Bitcoin (BTC) led the cryptocurrency markets higher on Aug. 29 following Grayscale’s victory in the lawsuit against the United States Securities and Exchange Commission. However, the rally could not be sustained as analysts cautioned that the victory did not guarantee the approval of a spot Bitcoin exchange-traded fund.

Still, the victory may prove to be bullish for Grayscale. Glassnode analysts said in a X (formerly Twitter) post on Aug. 30 that the Grayscale Bitcoin Trust (GBTC) could return to premium next year. It is important to note that GBTC has been trading at a discount to spot Bitcoin price for the past two-and-a-half years.

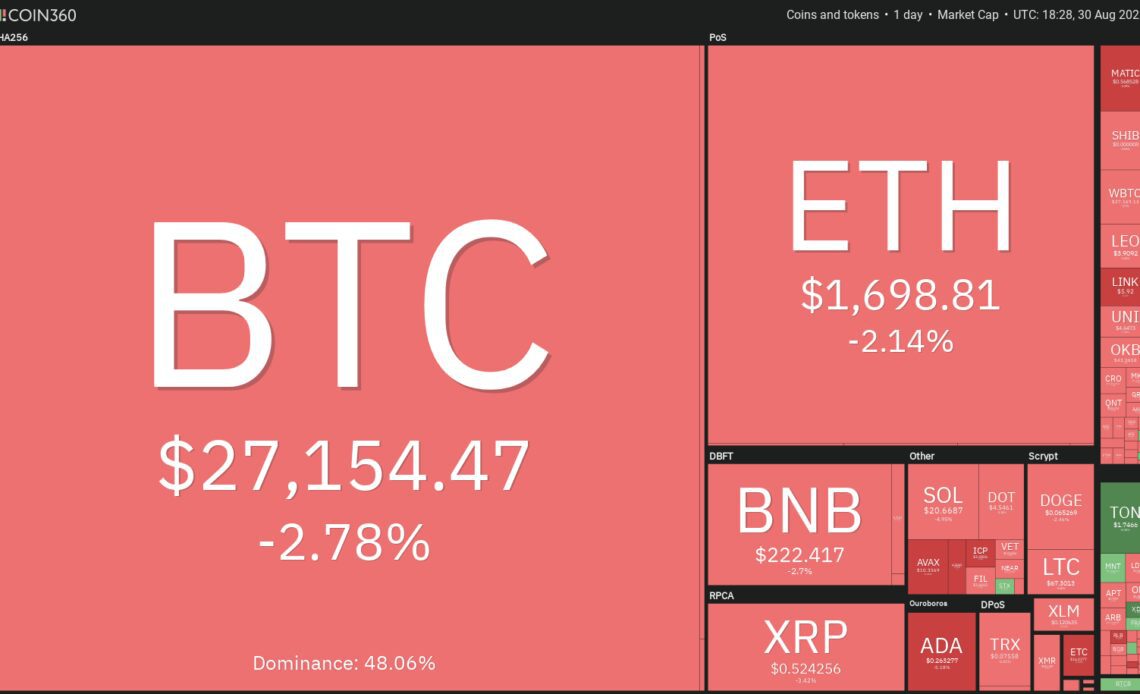

In the short term, even though the S&P 500 Index is on a path of recovery and the U.S. dollar index (DXY) has turned down in the near term, the crypto markets are not able to sustain the higher levels. This shows that traders have maintained their focus on crypto-specific news.

Could bulls defend the support levels in Bitcoin and altcoins? Will that lead to a stronger recovery soon? Let’s study the charts of the top-10 cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin’s range resolved to the upside with a sharp breakout on Aug. 29. This move indicates that the price is likely to oscillate inside the large range between $24,800 and $31,000 for a few days.

The 20-day exponential moving average ($27,168) is flattening out and the relative strength index (RSI) is just below the midpoint, indicating that the selling pressure is reducing.

Buyers will try to defend the breakout level of $26,833. If they succeed, it will signal that the bulls have flipped the level into support. The BTC/USDT pair may first rise to the 50-day simple moving average ($28,689) and thereafter attempt a rally to $31,000.

If bears want to trap the aggressive bulls, they will have to pull the price below $26,833. If they do that, it will indicate that the bears are selling on every recovery attempt. The pair could then retest the strong support at $24,800.

Ether price analysis

Ether (ETH) once again rebounded off the crucial support at $1,626 on Aug. 28, indicating that the bulls are buying the dips.

The momentum picked up on Aug. 29 and the bulls propelled the price above the 20-day EMA ($1,716). This suggests that the ETH/USDT pair could swing between $1,816 and $1,626 for some more time.

The price has turned…

Click Here to Read the Full Original Article at Cointelegraph.com News…