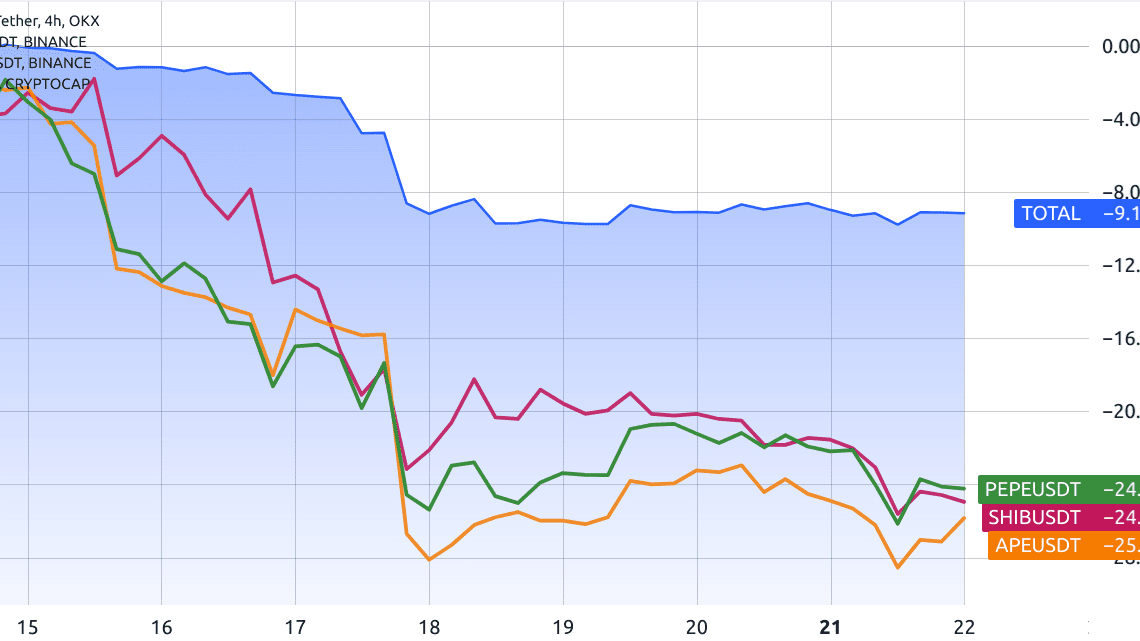

The recent crypto crash hit meme coins hard, culminating with a 9% drop in total market capitalization from Aug. 14 to Aug. 21. During the same period, Pepe (PEPE), Shiba Inu (SHIB), and ApeCoin (APE) saw a 25% decline. The big question is whether this trend will affect the wider market, signaling a broader bear market or simply reflects lagging performance of meme coins.

Meme coins, like Dogecoin (DOGE), burst onto the scene driven by viral memes and community enthusiasm. However, their appeal faded due to a mix of factors. These coins rely on media hype and online communities for attention, yet they lack value beyond their meme origins. Their speculative nature leads to rapid price changes and volatility.

Furthermore, the meme coin market has become saturated with copycats, drawing focus and resources to more traditional cryptocurrencies.

Capital rotates as investors shift their attention to new trends

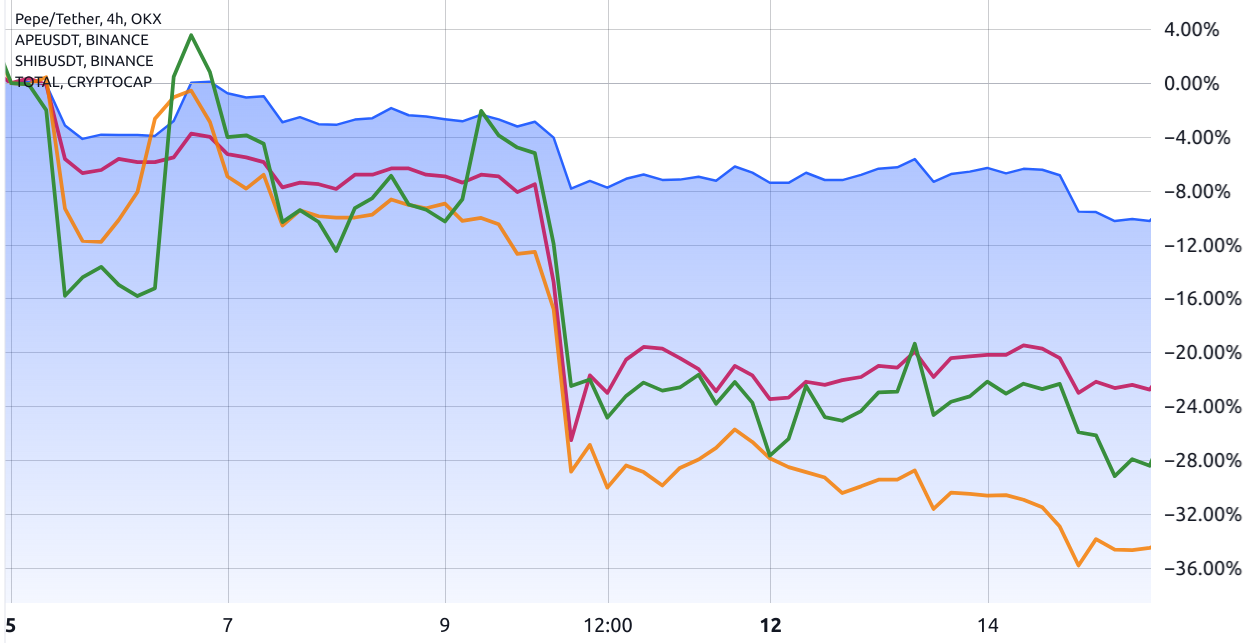

For traders, the mid-August crypto market crash was a stark reminder of meme coin volatility. Many of these coins emerged in the last six months, like PEPE, HarryPotterObamaSonic10Inu (BITCOIN) , and Milady Meme Coin (LADYS). This might push new entrants away and create a negative sentiment, potentially extending a bear market to the broader crypto landscape.

However, this underperformance is typical for meme coins, as seen in the past, like when APE), SHIB, and PEPE lagged the total crypto market by 18% between June 5 and June 15.

These two instances don’t necessarily mean meme coins will always perform worse than the broader crypto market. They reflect a higher beta in the sector, where meme coins tend to exaggerate market movements. Despite this, it’s uncertain if excessive price drops are a backward-looking phenomenon or signal a market reversion.

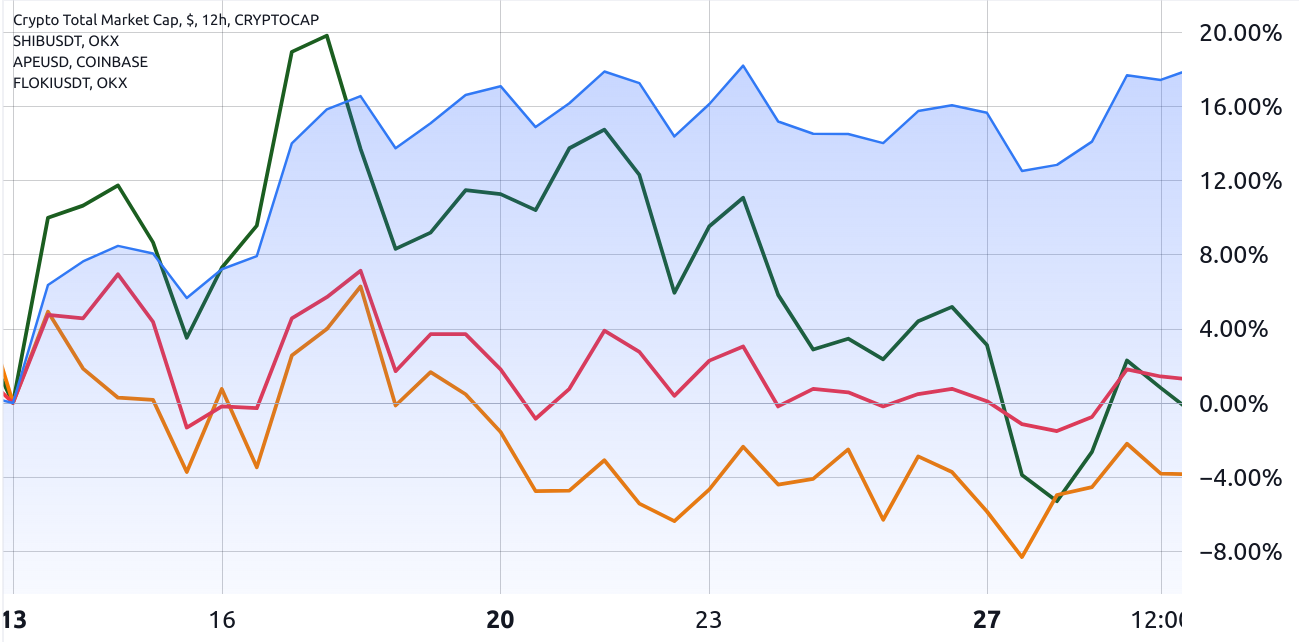

Contrary to expectations, meme coins can also lag during bull markets. For instance, between March 13 and March 30, meme coins fell while the total crypto cap gained 17.5%.

After looking at the two most recent instances of meme coin underperformance, it’s crucial to examine their aftermath. This entails determining whether the price drop hinted at a possible…

Click Here to Read the Full Original Article at Cointelegraph.com News…