Bitcoin (BTC) stands to win big thanks to the BlackRock exchange-traded fund (ETF), investor and analyst Charles Edwards believes.

In his latest interview with Cointelegraph, Edwards, who is founder of quantitative Bitcoin and digital asset fund Capriole Investments, goes deep into the current state of BTC price action.

With his previous bullish statements continuing to stand the test of time, and after an eventful few months, Edwards does not see the need to alter the long-term perspective.

Bitcoin, he argues, may be less of a sure bet on shorter timeframes, but the overarching narrative of crypto becoming a recognized global asset class undoubtedly remains.

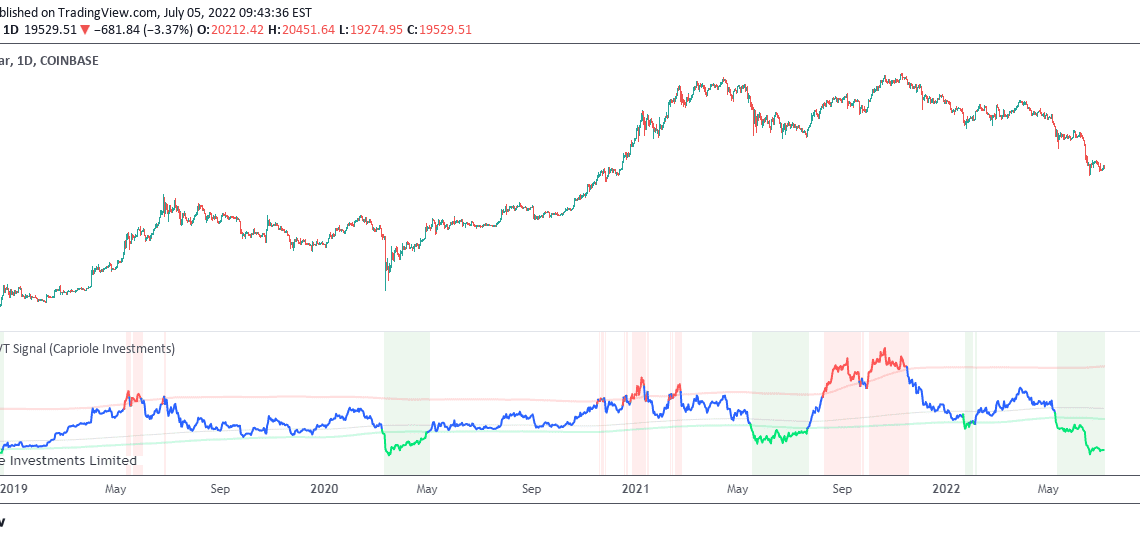

Cointelegraph (CT): When we last spoke in February, Bitcoin price was around $25,000. BTC is not only 20% higher today, but Bitcoin’s NVT ratio is also at its highest levels in a decade. Does this suggest more upside?

Charles Edwards (CE): NVT is currently trading at a normal level. At 202, it is trading in the middle of the dynamic range band, well below the 2021 highs. Given its normalized reading today, it doesn’t tell us much; just that Bitcoin is fairly valued according to this metric alone.

CT: At the time, you described Bitcoin as being in a “new regime” but forecast up to 12 months’ upward grind to come. How has your thinking evolved since?

CE: That thinking mostly remains today. Bitcoin has steadily grinded up about 30% since February. The difference today is that the relative value opportunity is slightly less as a result, and we are now trading into major price resistance at $32,000, which represents the bottom of the 2021 bull market range and confluence with major weekly and monthly order blocks.

My outlook today over the short term is mixed, with a bias towards cash until one of three things occurs:

- Price clears $32,000 on daily/weekly timeframes, or

- Price mean-reverts to the mid-$20,000s, or

- On-chain fundamentals return to a regime of growth.

CT: At $30,000, miners have begun to send BTC to exchanges en masse at levels rarely seen. Poolin, in particular, has moved a record amount in recent weeks. To what extent will miners’ purported selling impact price moving forward?

CE: It’s true that relative Bitcoin miner sell pressure has stepped up. We can see that in the two below on-chain metrics; Miner Sell Pressure and Hash Ribbons. Bitcoin’s hash rate is up 50% since January —…

Click Here to Read the Full Original Article at Cointelegraph.com News…