The long-awaited recession and resulting resumption of the 2022 bear market that many have been expecting has failed to materialize so far in 2023. In fact, most assets have caught a bid, with the NASDAQ hitting a 52-week high on July 12.

How can this be, and will the rally continue?

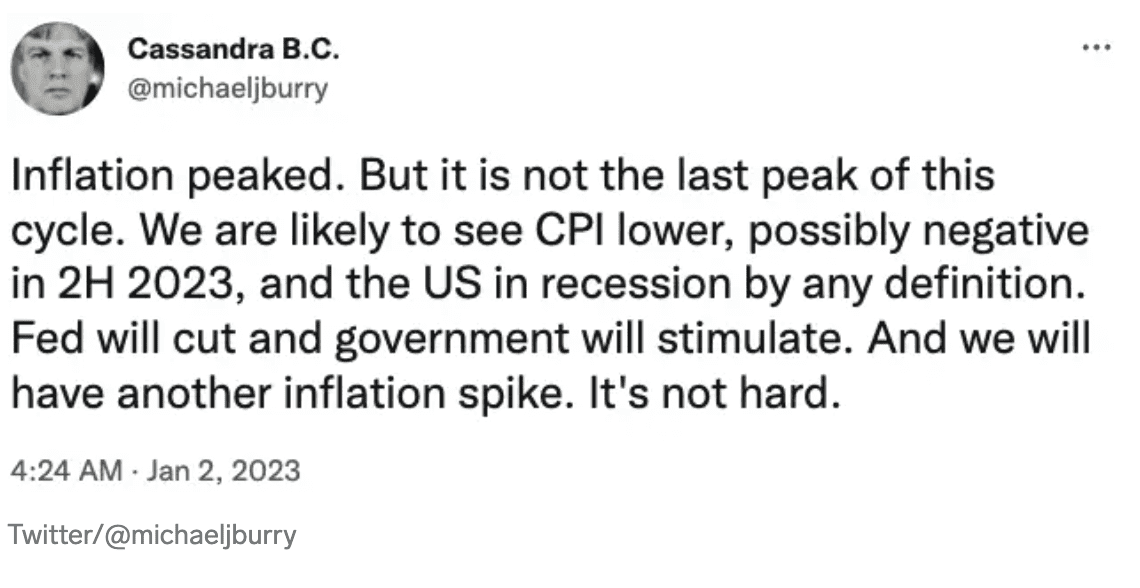

Michael Burry of Big Short fame declared in January that the US could be in recession by late 2023, with CPI lower and the Fed cutting rates (note that today’s CPI print came in much lower than expected, further fueling the recent rally). This would lead to another inflation spike in his view.

Recently independent macro and crypto analyst Lyn Alden explored the topic in a newsletter published this month.

In the report, Alden examines today’s inflationary environment by contrasting it to two similar but different periods: the 1940s and the 1970s. From this, she concludes that the US economy will likely enter stall speed or experience a mild recession while experiencing some level of persistent inflation. This could mean that markets continue trending upward until an official recession hits.

My July 2023 newsletter is out:https://t.co/gTH0nUyrU8

The topic focus on fiscal dominance, and how large debts and deficits can mute the impact of higher interest rates as a policy tool. pic.twitter.com/qmuzInyYjK

— Lyn Alden (@LynAldenContact) July 2, 2023

The Fed’s inflation fight continues

The important difference between the two periods involves rapid bank lending and large monetized fiscal deficits, which Alden suggests are the underlying factors driving inflation. The former occurred in the 1970s as baby boomers began buying houses, while the latter occurred during World War II as a result of funding the war effort.

The 2020s are more like the 1940s than the 1970s, yet the Fed is running the 1970s monetary policy playbook. This could turn out to be quite counterproductive. As Alden explains:

“So as the Federal Reserve raises rates, federal interest expense increases, and the federal deficit widens ironically at a time when deficits were the primary cause of inflation in the first place. It risks being akin to trying to put out a kitchen grease fire with water, which makes intuitive sense but doesn’t work as expected.”

In other words, today’s inflation has been primarily driven by the creation of new federal debt, or what some may call government money printing.

Raising interest rates to calm inflation can work, but it’s meant for inflation that has its roots in an expansion…

Click Here to Read the Full Original Article at Cointelegraph.com News…