Bitcoin (BTC) stayed near key support on March 5 as the weekly candle close brought fresh fears of a breakdown.

Analyst warns over fate of $20,000

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it continued to move in a tight range over the weekend.

The pair had remained practically stationary since its abrupt fall on March 3 triggered by a margin call amid uncertainty over Silvergate bank.

The streak has been broken pic.twitter.com/TY5w7NAKWw

— Daan Crypto Trades (@DaanCrypto) March 4, 2023

While avoiding further losses, analysis warned that Bitcoin could still easily fall much lower if a nearby support level failed to hold.

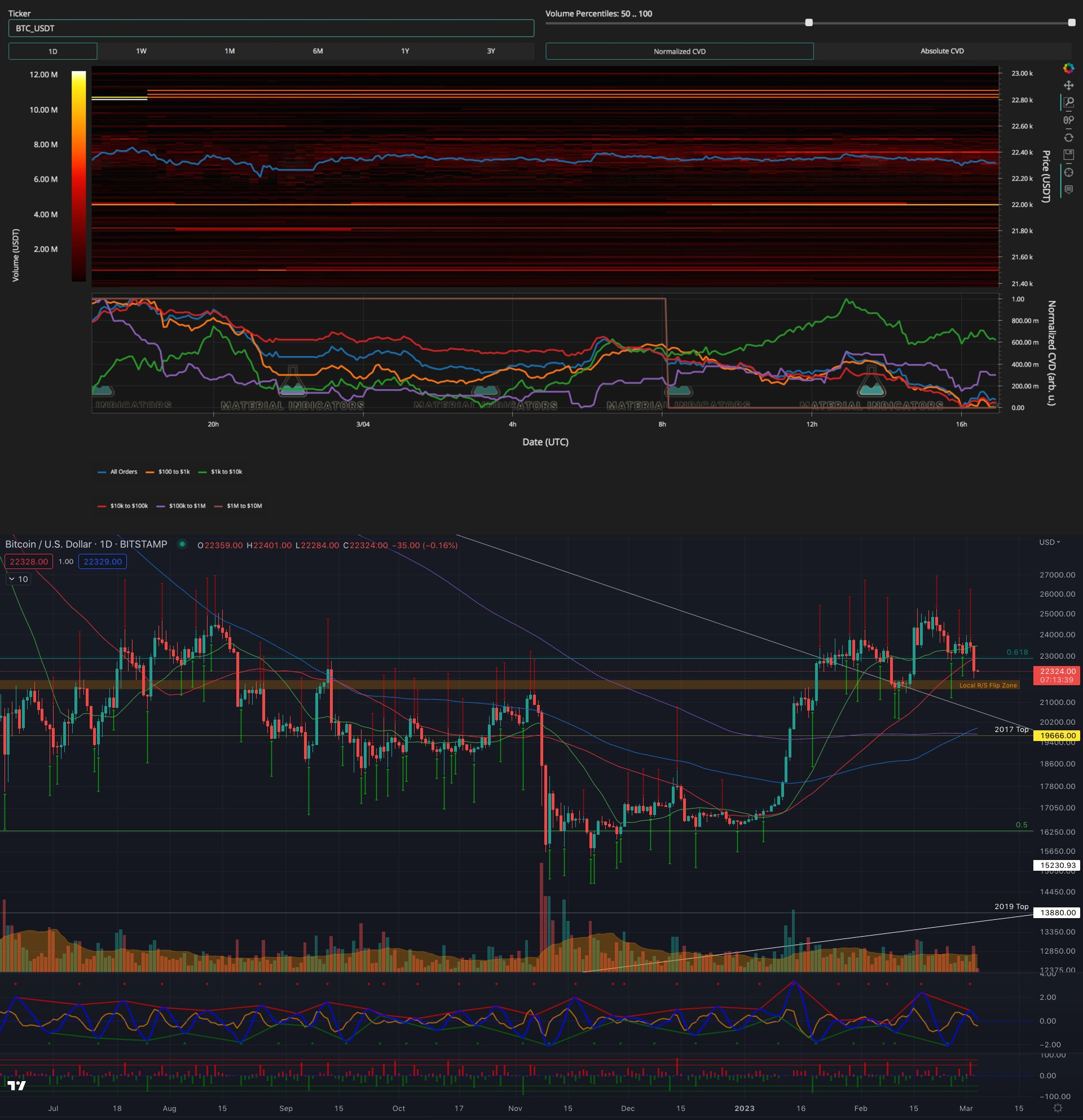

Monitoring resource Material Indicators explained that BTC price action had “lost key technical support” and that $22,000 — the sight of a recent resistance/support (R/S) flip — was now all that remained for bulls to hold onto.

“The local R/S Flip zone is the last stand between a retest at the trend line. Meanwhile, Trend Precognition is indicating a down trend,” it wrote in part of a Twitter update on the day.

“Will see if that changes after the W close.”

Accompanying charts showed both the trend line at stake and the BTC/USD order book on Binance with bid liquidity parked at $22,000.

Cointelegraph contributor Michaël van de Poppe, founder and CEO of trading firm Eight, warned that should $21,300 fail to hold as well, $20,000 may not help to stem the exodus.

“Crucial area for #Bitcoin is to hold the $21.3K area. Losing that, and we’ll see another sweep towards $19.5Kish and altcoins dropping 15-25%,” he predicted on March 4.

Van de Poppe nonetheless maintained a more optimistic view overall, suggesting that $40,000 could still appear “in a few months.”

“Moral of the story: Dollar-Cost Average and have balls to buy when you don’t feel confident,” he advised in part of a subsequent post.

“Overwhelmingly bearish sentiment”

With Silvergate’s potential bankruptcy still a hot topic, research firm Santiment queried why the market reaction had been so severe.

Related: Bitcoin price would retest $25K without Silvergate saga — analysis

In a dedicated post on the phenomenon, analysts revealed what they described as an “unusually high amount of negative commentary about the markets.”

“It’s particularly interesting that #cryptocrash has been a key of-and-on trending hashtag on the platform, even though Bitcoin’s…

Click Here to Read the Full Original Article at Cointelegraph.com News…