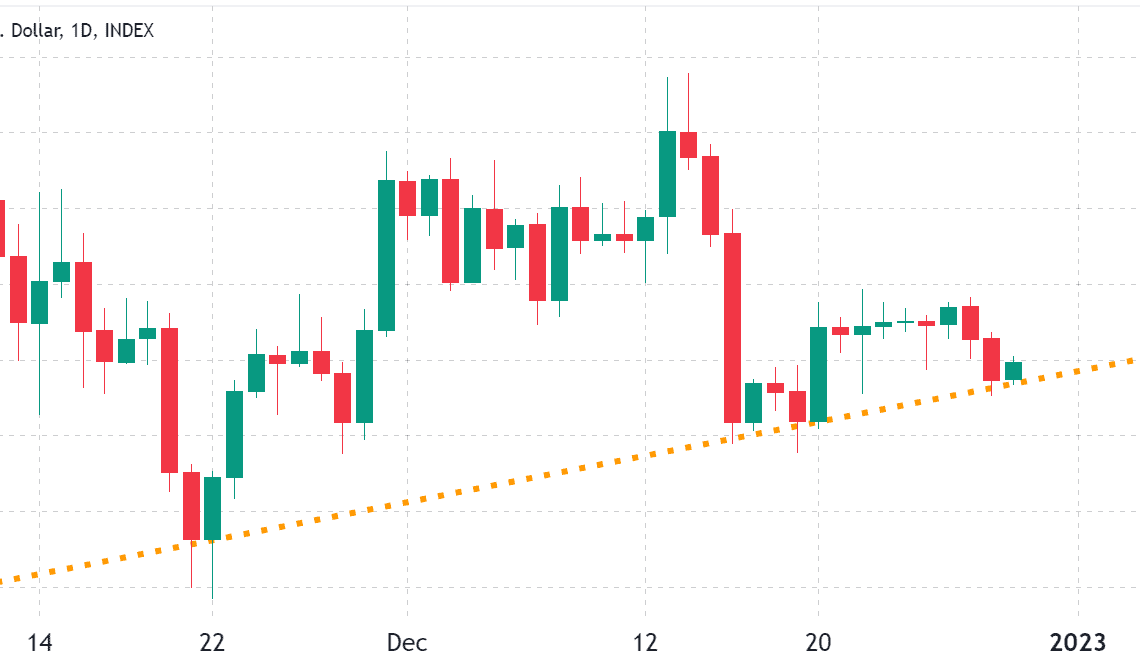

Ether (ETH) has been ranging near $1,200 since Dec. 17, but an ascending trend has been quietly gaining strength after 50 consecutive days.

The pattern points to $1,330 or higher by March 2023, making it essential for bulls to defend the current $1,180 support.

The anxiously awaited migration to a Proof of Stake in September 2022 paved the way for additional layer-2 integration and lower transaction costs overall. Layer-2 technologies such as Optimistic Rollups have the potential to improve Ethereum scalability by 100x and provide off-chain network storage.

Developers anticipate that the network upgrades scheduled for 2023 introducing large portable data bundles can boost the capacity of rollups by up to 100x. Moreover, in December 2021, Vitalik Buterin shared that the end game was for Ethereum to act as a base layer, with users “storing their assets in a ZK-rollup (zero knowledge) running a full Ethereum Virtual Machine.”

An unexpected move negatively affecting the competing smart chain platform Solana (SOL) has likely helped to fuel Ethereum investors’ expectations.

Related: Solana joins ranks of FTT, LUNA with SOL price down 97% from peak — Is a rebound possible?

Two noticeable non-fungible token projects announced on Dec. 25 an opt-in migration to Ethereum and Polygon chains, namely eGods and y00ts. The transition will also bridge the DUST token — used to buy, sell and mint NFTs on the DeGods ecosystem — via Ethereum and Polygon.

Still, investors believe that Ether could revisit sub-$1,000 levels as the U.S. Federal Reserve continues to push interest rates higher and drain market liquidity. For example, trader and investor Crypto Tony expects the next couple of months to be extremely bearish to ETH:

I am 90% confident in another drop down to below $1,000 and remain in my short from the range high while below $1,280

Now the path we take to get to sub $1,000 can take a few approaches, including a pump first. So be prepared and use strict risk management pic.twitter.com/Rc1nVQG5Ql

— Crypto Tony (@CryptoTony__) December 29, 2022

Let’s look at Ether derivatives data to understand if the bearish macroeconomic scenario has impacted investors’ sentiment.

Excessive demand for bearish bets using ETH futures

Retail traders usually avoid quarterly futures due to their price difference from spot markets. Meanwhile, professional traders prefer these instruments because they prevent the…

Click Here to Read the Full Original Article at Cointelegraph.com News…