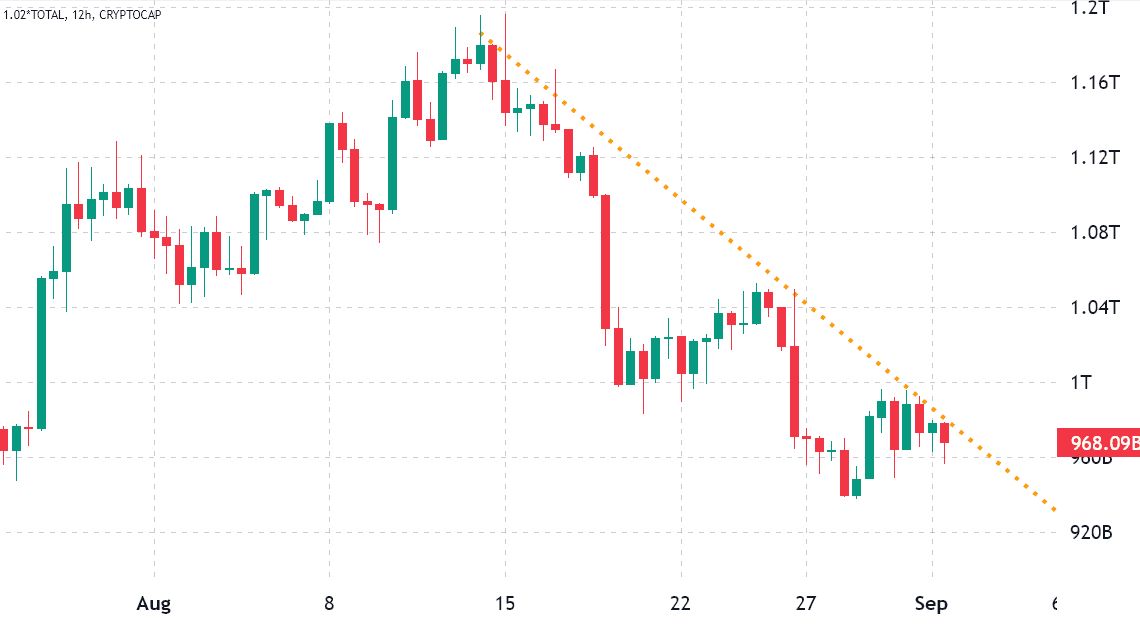

From a bearish perspective, there’s a fair probability that the crypto market entered a descending channel (or wedge) on Aug. 15 after it failed to break above the $1.2 trillion total market capitalization resistance. Even if the pattern isn’t yet clearly distinguishable, the last couple of weeks have not been positive.

For example, the $940 billion total market cap seen on Aug. 29 was the lowest in 43 days. The worsening conditions have been accompanied by a steep correction in traditional markets, and the tech-heavy Nasdaq Composite Index has declined by 12% since Aug. 15 and even WTI oil prices plummeted 11% from Aug. 29 to Sept. 1.

Investors sought shelter in the dollar and U.S. Treasuries after Federal Reserve Chair Jerome Powell reiterated the bank’s commitment to contain inflation by tightening the economy. As a result, investors took profits on riskier assets, causing the U.S. Dollar Index (DXY) to reach its highest level in over two decades at 109.6 on Sept 1. The index measures the dollar’s strength against a basket of top foreign currencies.

More importantly, the regulatory newsflow remains largely unfavorable, especially after U.S. federal prosecutors requested internal records from Binance crypto exchange to look deeper into possible money laundering and recruitment of U.S. customers. Since late 2020, authorities have been investigating whether Binance violated the Bank Secrecy Act, according to Reuters.

Crypto investor sentiment re-enters the bearish zone

The risk-off attitude caused by Federal Reserve tightening led investors to expect a broader market correction and is negatively impacting growth stocks, commodities and cryptocurrencies.

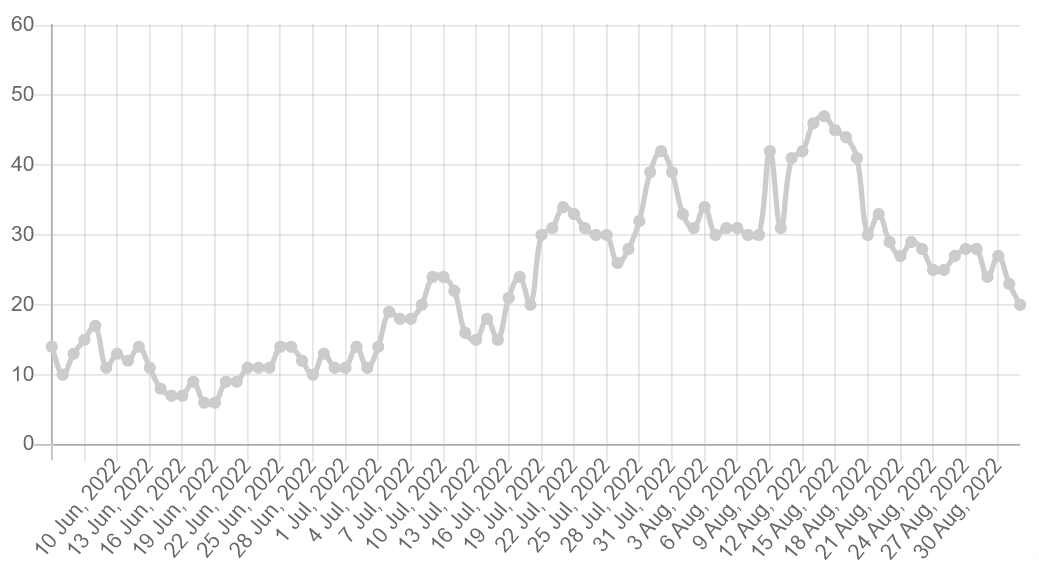

The data-driven sentiment Fear and Greed Index peaked on Aug. 14 as the indicator hit a neutral 47/100 reading, which did not sound very promising either. On Sept. 1 the metric hit 20/100, the lowest reading in 46, and typically deemed a bearish level.

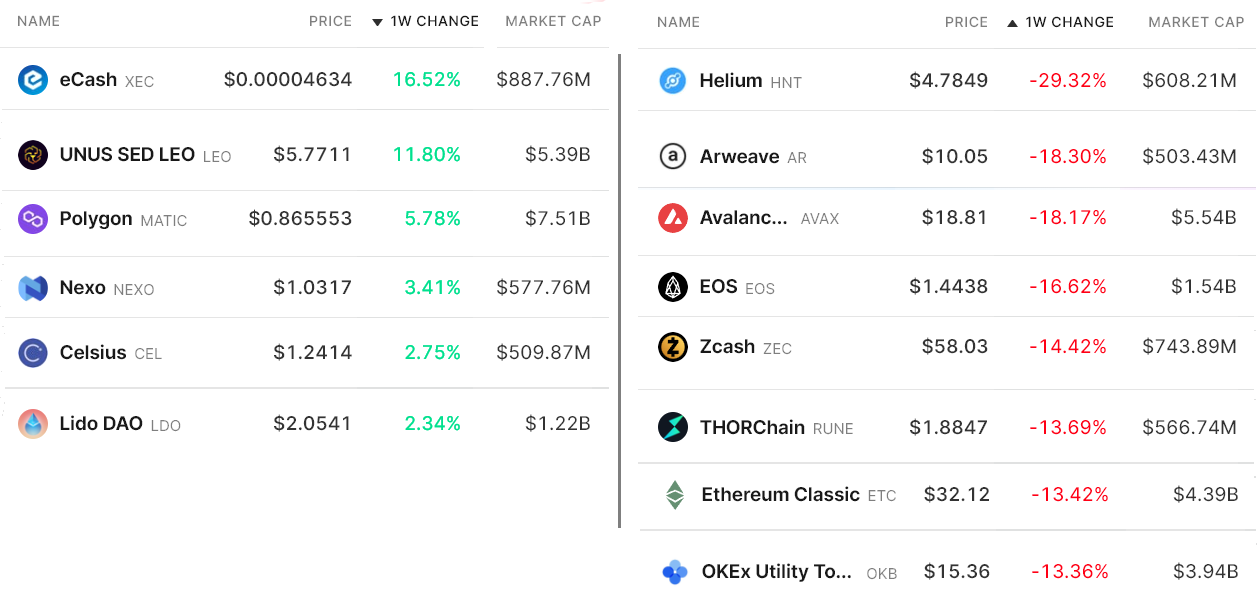

Below are the winners and losers from the past seven days as the total crypto capitalization declined 6.9% to $970 billion. While Bitcoin (BTC) and Ether (ETH) presented a 7% to 8% decline, a handful of mid-capitalization altcoins dropped 13% or more in the period.

eCash (XEC) jumped 16.5% after lead developer Amaury Séchet announced the Avalanche post-consensus launch on eCash Mainnet,…

Click Here to Read the Full Original Article at Cointelegraph.com News…