OpenSea, the world’s largest nonfungible token (NFT) marketplace, has witnessed a substantial drop in daily volumes as fears about a potential market bubble grow.

OpenSea volume plummets to yearly lows

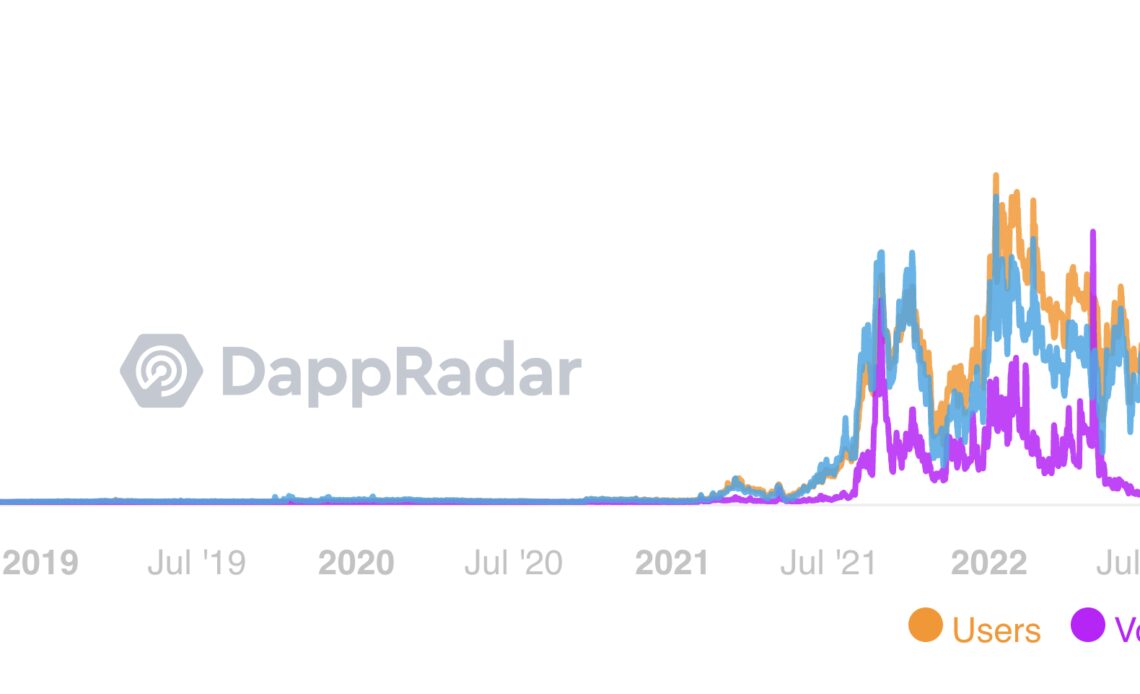

Notably, the marketplace processed nearly $5 million worth of NFT transactions on Aug. 28 — approximately 99% lower than its record high of $405.75 million on May 1, according to DappRadar.

The massive declines in daily volumes coincided with equally drastic drops in OpenSea users and their transactions, suggesting that the value and interest in the blockchain-based collectibles have diminished in the recent months.

That is further visible in the falling floor prices — the minimum amount one is ready to pay for an NFT — of leading digital collectible projects.

For instance, the floor price of the Bored Ape Yacht Club has dropped by 53% to 72.5 ETH on Aug. 28 versus a high of 153.7 ETH on May 1.

Similarly, the floor price of CryptoPunks, another top NFT collection, dropped almost 20% from its July high of 83.72 ETH.

NFT bubble is bursting

NFT prices are quoted in the native currency of the blockchain on which they are launched. So a digital collectible created on Ethereum will be purchased using Ether (ETH), which also means that NFT’s prices will fall if ETH’s market valuation plummets.

A bearish ETH market appears to be one of the primary drivers behind the poor NFT statistics. Notably, the price of one Ether has fallen from $4,950 in November 2021 to below $1,500 in August 2022.

BendDAO votes to improve NFT liquidity

Last week, BendDAO, a decentralized autonomous organization that enables NFT owners to collateralize their digital collectibles to take loans (in ETH) worth 30%-40% of the NFT’s floor price, voted to change its protocol’s code to make its NFT collateral more liquid.

The vote occurred after a rise in Ether price increased the value of ETH-denominated loans in dollar terms. Meanwhile, on the other hand, NFT prices plummeted, reducing the value of the collateral held by BendDAO.

As a result, BendDAO is now facing its own debt crisis moment, where borrowers cannot pay their dollar-denominated loans due to falling ETH prices, and lenders are finding it difficult to recover their loaned amount due to falling collateral valuations.

Related: Prosecutors want to claim NFTs as…

Click Here to Read the Full Original Article at Cointelegraph.com News…