Ether (ETH) price is up 60% since May 3, outperforming leading cryptocurrency Bitcoin (BTC) by 32% over that span. However, evidence suggests the current $1,600 support lacks strength as network use and smart contract deposit metrics weakened. Moreover, ETH derivatives show increasing sell pressure from margin traders.

The positive price move was primarily driven by growing certainty of the Merge, which is Ethereum’s transition to a proof-of-stake (PoS) consensus network. During the Ethereum core developers conference call on July 14, developer Tim Beiko proposed Sept. 19 as the tentative target date for the Merge. In addition, analysts expect the new supply of ETH to be reduced by up to 90% after the network’s monetary policy change, thus creating a bullish catalyst.

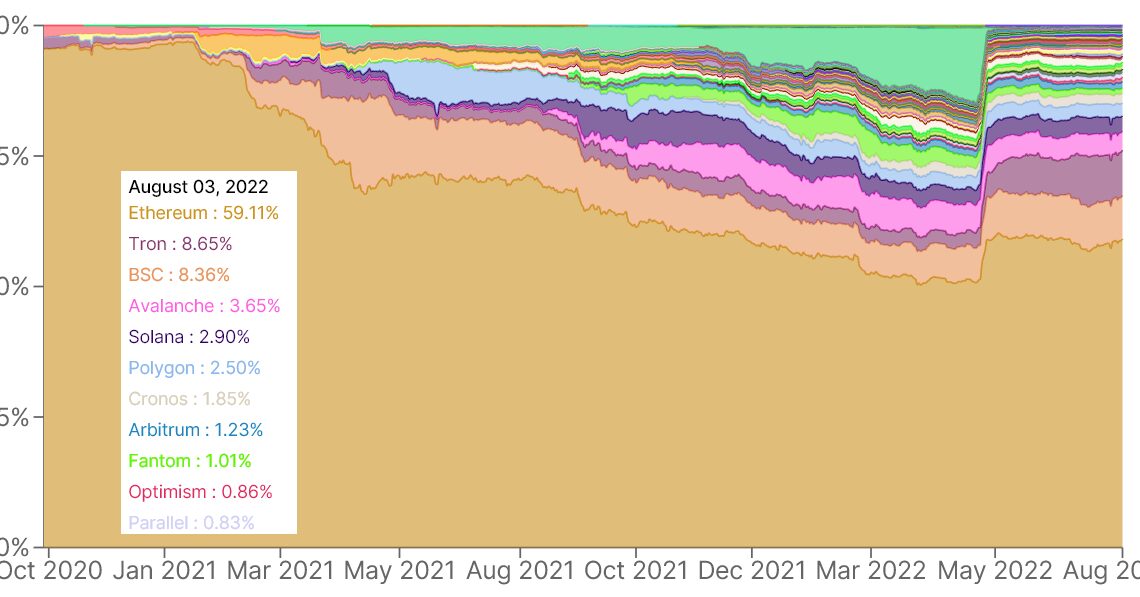

Ethereum’s total value locked (TVL) has vastly benefited from Terra’s ecosystem collapse in mid-May. Investors shifted their decentralized finance (DeFi) deposits to the Ethereum network thanks to its robust security and battle-tested applications, including MakerDAO (MKR) — the project behind the DAI stablecoin.

Currently, the Ethereum network holds a 59% market share of TVL, up from 51% on May 3, according to data from Defi Llama. Despite gaining share, Ethereum’s current $40 billion deposits on smart contracts seem small compared to the $100 billion seen in December 2021.

Demand for decentralized application (DApp) use on Ethereum seems to have weakened, considering the median transfer fees, or gas costs, which currently stand at $0.90. That’s a sharp drop from May 3, when the network transaction costs surpassed $7.50 on average. Still, one might argue that higher use of layer-two solutions such as Polygon and Arbitrum are responsible for the lower gas fees.

Options traders are neutral, exiting the “fear” zone

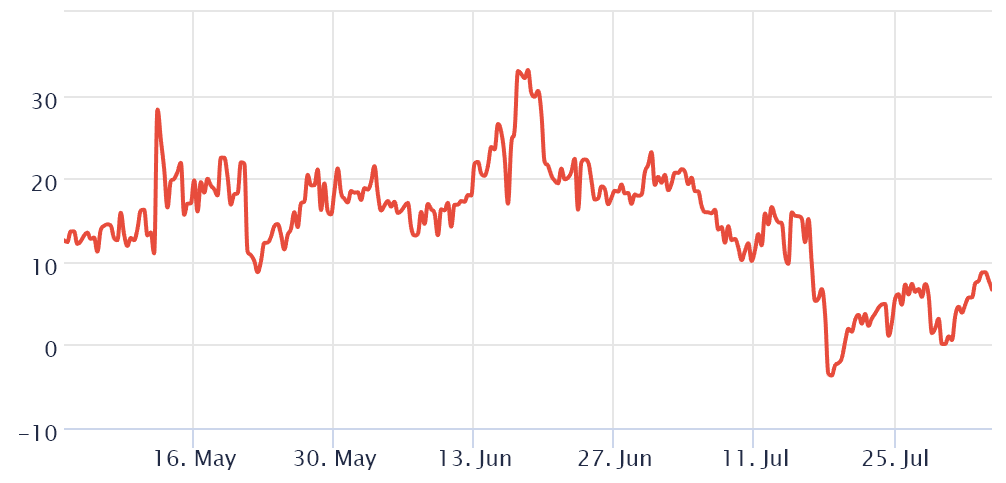

To understand how whales and market makers are positioned, traders should look at Ether’s derivatives market data. In that sense, the 25% delta skew is a telling sign whenever professional traders overcharge for upside or downside protection.

If investors expect Ether’s price to rally, the skew indicator moves to -12% or lower, reflecting generalized excitement. On the other hand, a skew above 12% shows reluctance to take bullish strategies, typical of bear markets.

For reference, the higher the index, the less inclined traders are to price downside risk. As displayed…

Click Here to Read the Full Original Article at Cointelegraph.com News…