Key Takeaways

- Bitcoin dominance has risen above 50%, having started the year at 42%

- Traditionally, dominance falls while market prices are rising in the sector, marking the year 2023 out as unusual

- This hammers home how Bitcoin is still finding its feet, and why prudence needs to be taken when extrapolating past performance to the future

- Bitcoin was only launched in 2009 and had minimal liquidity for the first few years, meaning our sample space of data is too short to make assumptions solely based on the past

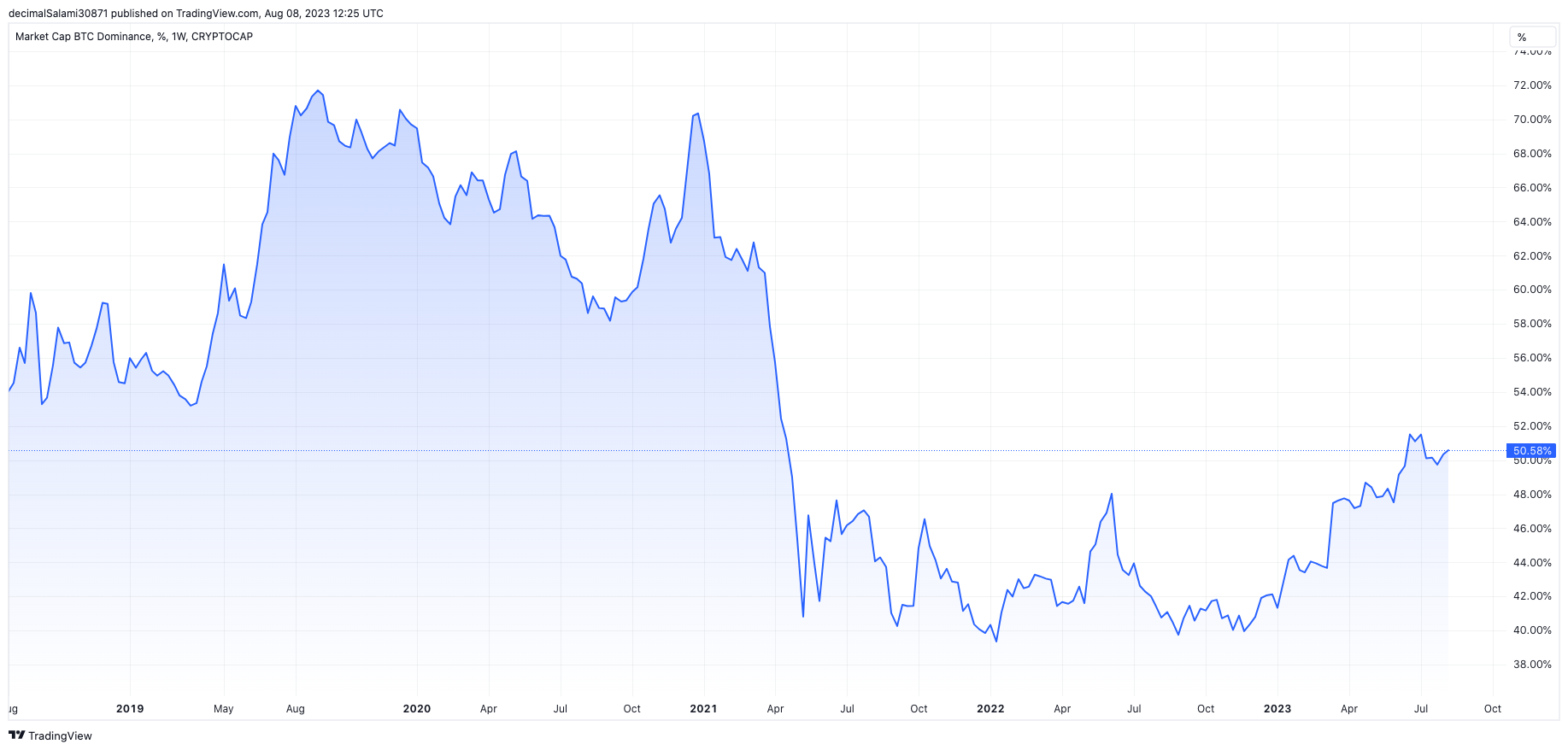

Bitcoin dominance, which measures the ratio of the Bitcoin market cap to the entire cryptocurrency market cap, has clambered back above 50%. With the period of relative serenity in the crypto markets recently, it has been rangebound for the last two months, although dipped to 49% last week.

However, the dominance of the world’s biggest crypto has surged since the start of this year, having been in the low 40’s as the book was closed on the year 2022.

The increase is the biggest prolonged expansion in Bitcoin dominance since 2019, when it rose from 53% to 72% in a five-month period beginning that April.

Notably, the rise of Bitcoin’s dominance this time around contrasts with what we have seen in the past regard the timing of cycles. Despite its extreme volatility when comparing to other major asset classes, Bitcoin can generally be viewed as the lowest-beta option within digital assets.

Notably, the rise of Bitcoin’s dominance this time around contrasts with what we have seen in the past regard the timing of cycles. Despite its extreme volatility when comparing to other major asset classes, Bitcoin can generally be viewed as the lowest-beta option within digital assets.

In previous cycles, the dominance has hence tended to fall in bull markets as altcoins outpace Bitcoin’s gains. The pattern has tended to be as follows:

- Bear market

- Bitcoin rises, dominance jumps

- Altcoins rise more, dominance falls

This time around, the altcoins have not fulfilled their end of the bargain.

Crypto market is changing fundamentally

There are a few theories which spring to mind to explain these occurences. The first is that Bitcoin is separating itself from the rest of the crypto market. Regulation is one factor here – Bitcoin has proven to be more immune than many other coins in the space, many of whom have been weighed down by the crackdown in the US around securities laws.

The SEC explicitly named many tokens as securities, including SOL (Solana), MATIC (Polygon) and ADA (Cardano). While Ripple won a landmark case (at least partially) against the SEC last month, providing hope for the future legal path of…

Click Here to Read the Full Original Article at CoinJournal: Latest Bitcoin, Ethereum & Crypto News…