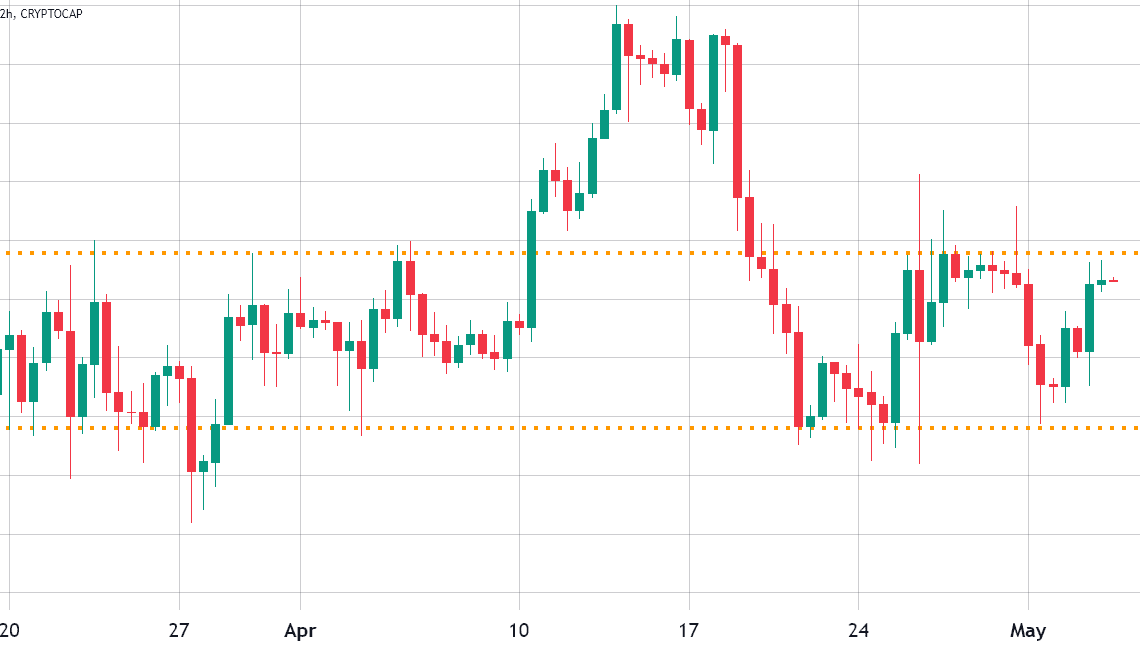

For the past 14 days, cryptocurrency markets have been trading within an unusually tight 7.1% range. In other words, investors are unwilling to place new bets until there’s additional regulatory clarity, especially in the United States.

The total crypto market capitalization fell by 1% to $1.2 trillion over the seven days ending May 4, primarily as a result of Bitcoin’s (BTC) 1.1% price decline, Ether’s (BTC) 0.2% loss, and BNB trading down 1.4%.

Notice that the exact same $1.16 trillion to $1.22 trillion total market cap range previously stood for twelve days between March 29 and April 10. The conflicting forces: regulatory uncertainty weighing it down and the banking crisis pushing prices upward are likely the reason for the lack of risk-appetite on both sides.

SEC’s crypto crackdown could backfire

The Coinbase exchange, for instance, has been battling the U.S. Securities and Exchange Commission (SEC) regarding the need for clear rules for trading digital assets. The stakes were raised after the exchange was handed a Wells notice, a “legal threat” for “possible violations of securities laws”, on March 22.

However, the latest decision has been favorable to Coinbase, as the court has instructed the SEC to clarify the security rules for digital assets within ten days.

On the other hand, the banking crisis seems not to have faded after the lender PacWest Bancorp reportedly announced that it was considering a buyout. The regional financial institution held $40 billion in assets, although some 80% of the loan book is dedicated to the commercial real estate and residential mortgages — a sector that has been plagued by rising interest rates.

The recent crypto sideways trend suggests that investors are hesitant to place new bets until there’s more clarity on whether the U.S. Treasury will continue injecting liquidity to contain the banking crisis, which favors inflation and positive momentum for scarce assets.

BTC, ETH derivatives show muted demand from bears

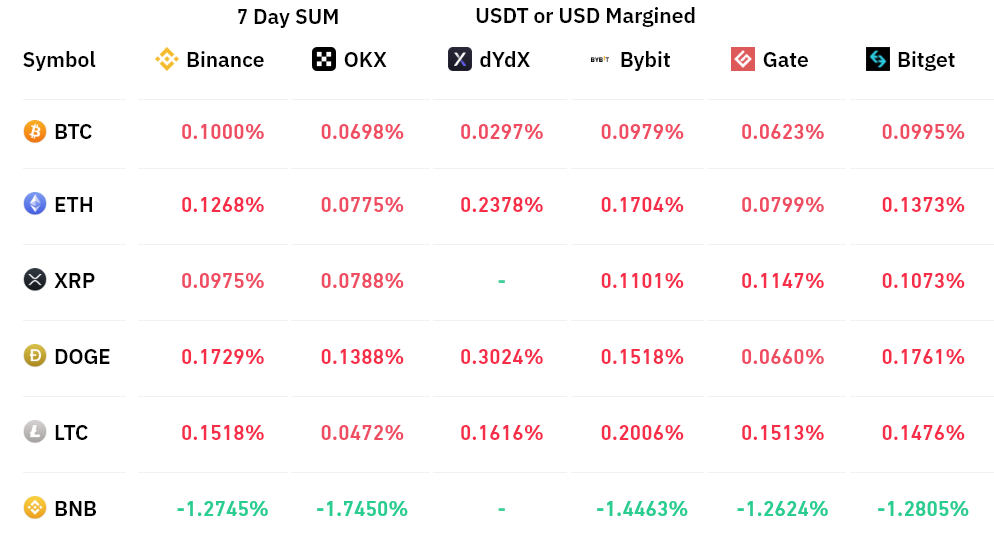

Perpetual contracts, also known as inverse swaps, have an embedded rate that is usually charged every eight hours. Exchanges use this fee to avoid exchange risk imbalances.

A positive funding rate indicates that longs (buyers) demand more leverage. However, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

Click Here to Read the Full Original Article at Cointelegraph.com News…