Bitcoin’s price (BTC) fell below a four-day narrow trading range near $22,400 on March 7 following comments by U.S. Federal Reserve Chair Jerome Powell as he sat before a Senate banking committee. During the congressional appearance, the Fed chairman warned that the bank is prepared to tame inflation by pushing for more significant interest rate increases.

Fed Chair Powell added that “the ultimate level of interest rates is likely to be higher than previously anticipated,” and that recent economic data was “stronger than expected.” These remarks significantly increased investors’ expectations of a 50 basis point interest rate hike on March 22, putting pressure on risk assets such as stocks, commodities, and Bitcoin.

That movement could explain why the $565 million Bitcoin weekly options expiry on March 10 will almost certainly favor bears. Nonetheless, additional negative crypto market events might have also played a significant role.

Bitcoin from the Silk Road and Mt. Gox are on the move

The movement of multiple wallets linked to U.S. law enforcement seizures on March 8 added to the price pressure on Bitcoin investors. Over 50,000 Bitcoin worth $1.1 billion were transferred, according to data shared by on-chain analytics firm PeckShield.

Furthermore, 9,860 BTC were sent to Coinbase, raising concerns about the coins being sold on the open market. These wallets are directly linked to the former Silk Road darknet marketplace and were seized by law enforcement in November 2021.

Mt. Gox creditors have until March 10 to register and choose a method of compensation repayment. The movement is part of the 2018 rehabilitation plan, and creditors must choose between “early lump sum payment” and “final payment.”

According to Cointelegraph, it is unclear when creditors can expect to be paid in cryptocurrency or fiat currency, but estimates indicate that the final settlement could take several years.

As a result, Bitcoin’s price drop to $22,000 on March 8 effectively confirmed bears’ advantage on the March 10 options expiry.

Bulls placed far more bets, but most will be worthless

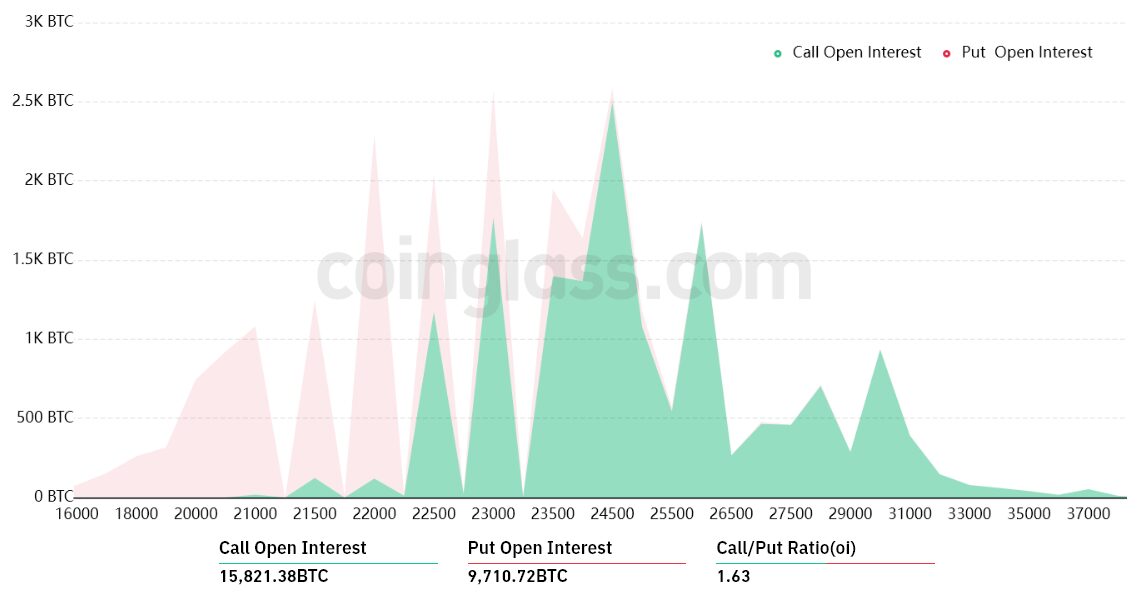

The March 10 options expiry has $565 million in open interest, but the actual figure will be lower because bulls have concentrated their bets on Bitcoin trading above $23,000.

The 1.63 call-to-put ratio reflects the disparity in open interest between the $350 million call (buy) options and the $215 million put (sell) options….

Click Here to Read the Full Original Article at Cointelegraph.com News…