Cryptocurrency markets experienced a relatively calm month in February as the total market capitalization gained 4% in the period. However, the fear of regulatory pressure appears to be having an impact on volatility in March.

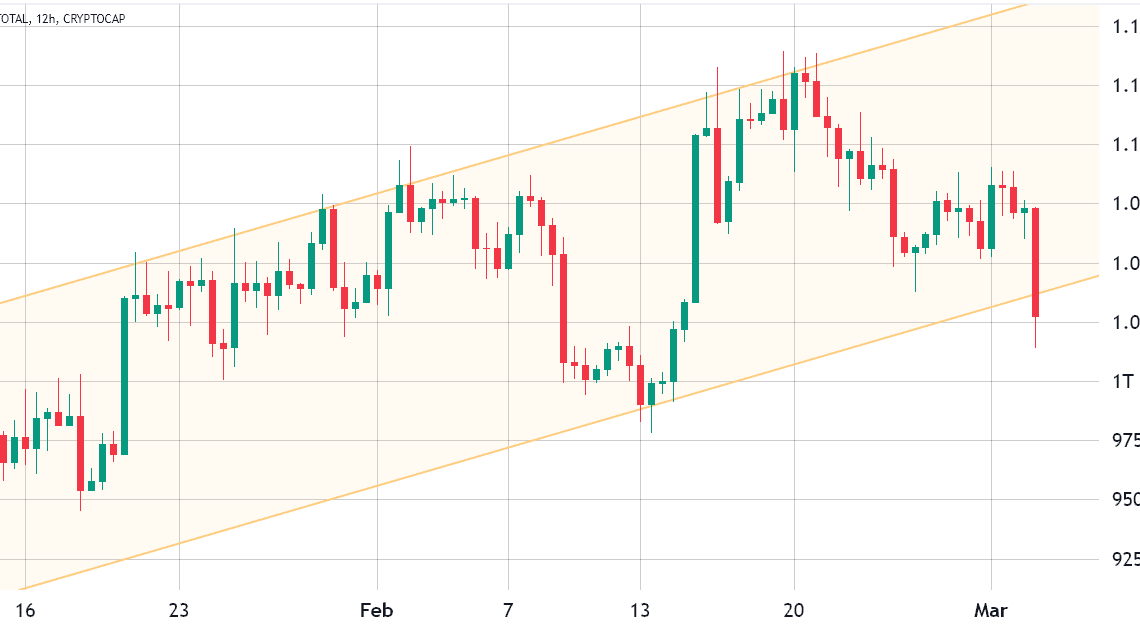

Bulls will undoubtedly miss the technical pattern that has been guiding the total crypto market capitalization upward for the past 48 days. Unfortunately, not all trends last forever, and the 6.3% price correction on March 2 was enough to break below the ascending channel support level.

As displayed above, the ascending channel initiated in mid-January saw its $1.025-trillion market cap floor ruptured after Silvergate Bank, a major player in crypto on- and off-ramping, saw its stock plunge by 57.7% at the New York Stock Exchange on March 2. Silvergate announced “additional losses” and suboptimal capitalization, potentially triggering a bank run that could lead to the situation spiraling out of control.

Silvergate provides financial infrastructure services to some of the world’s largest cryptocurrency exchanges, institutional investors and mining companies. Consequently, clients were incentivized to seek alternative solutions or sell their positions to reduce exposure in the crypto sector.

On March 2, the bankrupt cryptocurrency exchange FTX revealed a “massive shortfall” in its digital asset and fiat currency holdings, contrary to the previous estimate that $5 billion could be recovered in cash and liquid crypto positions. On Feb. 28, former FTX engineering director Nishad Singh pleaded guilty to charges of wire fraud along with wire and commodities fraud conspiracy.

With billions worth of customer funds missing from the exchange and its United States-based arm, FTX US, there is less than $700 million in liquid assets. In total, FTX recorded an $8.6 billion deficit across all wallets and accounts, while FTX US recorded a deficit of $116 million.

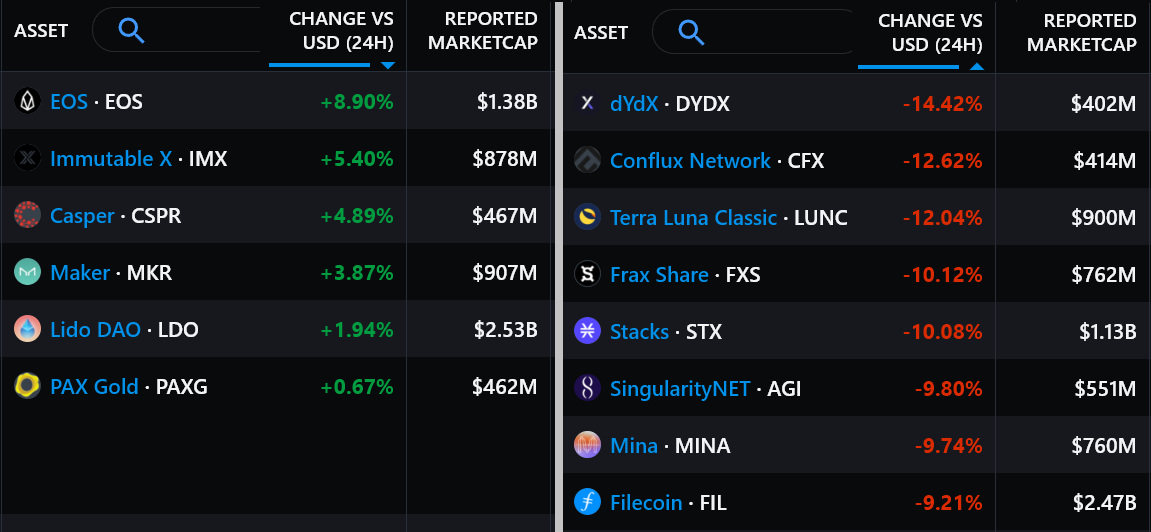

The 4% weekly decline in total market capitalization since Feb. 24 was driven by the 4.5% loss from Bitcoin (BTC) and Ether’s (ETH) 4.8% price decline. As expected, there were merely six out of the top 80 cryptocurrencies with positive performances in the past seven days.

EOS gained 9% after the EOS Network Foundation announced the final testnet for the Ethereum Virtual Machine launch on March 27.

Immutable X (IMX) traded up 5% as the project became a…

Click Here to Read the Full Original Article at Cointelegraph.com News…