Ethereum’s native token, Ether (ETH) could grow by 35% versus Bitcoin (BTC) this year to hit 0.1 BTC for the first time since 2018 as it forms a classic bullish continuation pattern.

Ethereum price must first break key resistance

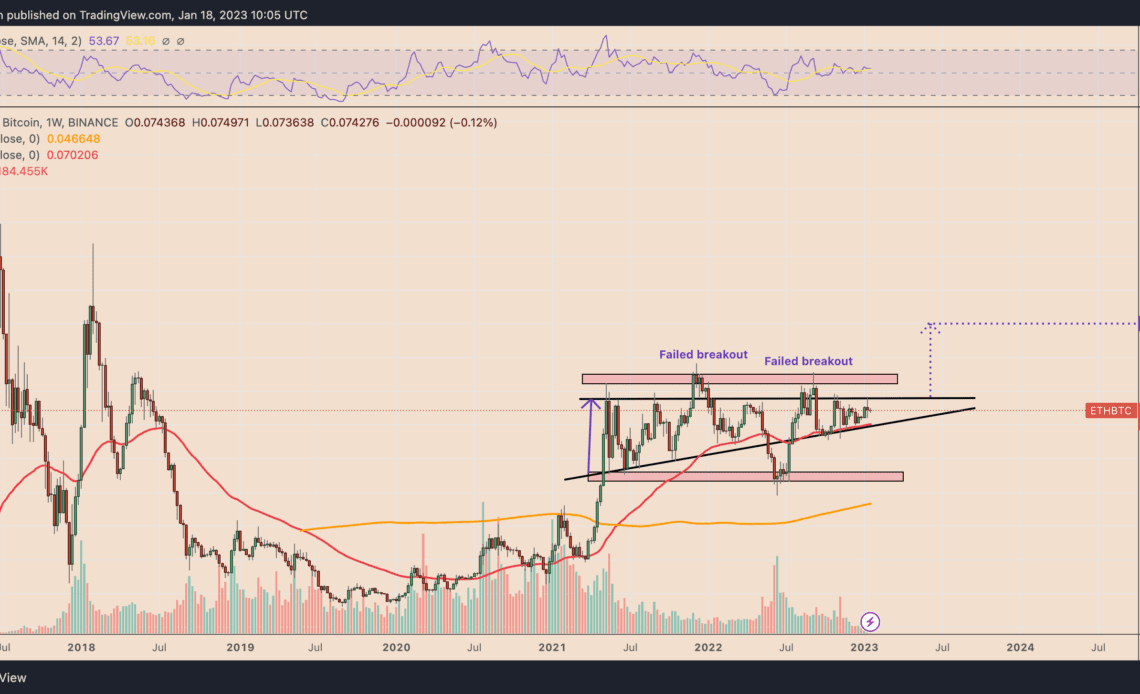

Dubbed ascending triangle, the pattern forms when the price fluctuates inside a range defined by a rising trendline support and horizontal trendline resistance. It typically resolves after the price breaks out in the direction of its previous trend.

On a weekly chart, the ETH/BTC pair has been painting an ascending pattern since May 2021. The Ethereum token eyes a breakout above the pattern’s horizontal trendline resistance near 0.0776 BTC. Breaking this level could then see the price rally by as much as the triangle’s maximum height.

In other words, the ETH/BTC pair could reach the next big resistance level at 0.1 BTC in 2023, or 35% from the current price levels.

Nonetheless, it is important to mention that ETH/BTC has attempted to break above the triangle’s resistance trendline eight times since May 2021. The attempts included two major breakouts in November 2021 and September 2022, which saw the pair rallying 14% and 9%, respectively.

Both rallies fizzled out inside the 0.082-0.085 BTC area, followed by extreme price corrections that took ETH/BTC back inside the triangle range. Given this multi-year hurdle, the pair could face stiff resistance inside the 0.082-0.085 BTC range, even if it breaks above the triangle’.

Such a move would risk crashing Ether toward the triangle support, which coincides with its 50-week exponential moving average (50-week EMA; the red wave in the chart above) near 0.070 BTC, down nearly 6% from the current price levels.

ETH “deflation” narrative

Ethereum’s bullish setup versus Bitcoin appears as Ether’s dominance has doubled versus other crypto assets in the past few years.

Notably, ETH’s market capitalization has risen to nearly 20.5% of the entire crypto market valuation in January 2023 from about 10% in December 2020, the month when the Ethereum network started its transition from proof-of-work (PoW) to proof-of-stake (PoS) with the launch of a dedicated staking smart contract.

The process of becoming a PoS network has brought two key changes to Ethereum’s economy. First, users temporarily lock away a portion of their Ether holdings into Ethereum’s PoS smart contract to earn yield. And second, the…

Click Here to Read the Full Original Article at Cointelegraph.com News…