The current crypto bear market has induced panic, fear and uncertainty in investors. The dire situation started when the global crypto market capitalization dropped below the $2 trillion mark in January 2022. Since then, the price of Bitcoin (BTC) has decreased by over 70% from its all time-high of $69,044.77 it reached on November 10, 2021. Similarly, the values of other major cryptocurrencies such as Ethereum (ETH), Solana (SOL), Avalanche (AVAX), and Dogecoin (DOGE) have decreased by around 90%.

So does history tell us anything about when the bear market will end? Let’s start by examining the causes of the 2022 bear market.

Catalysts of the 2022 bear market

There are several factors that caused the current bear run.

First off, the build up to the bear market started in 2021. During this period many regulatory authorities threatened to introduce stringent laws governing cryptocurrencies. This created fear and uncertainty in the market. For example, the U.S. Securities and Exchange Commission (SEC) issued a lawsuit against Ripple. China banned bitcoin mining resulting in most BTC miners to relocate to other countries.

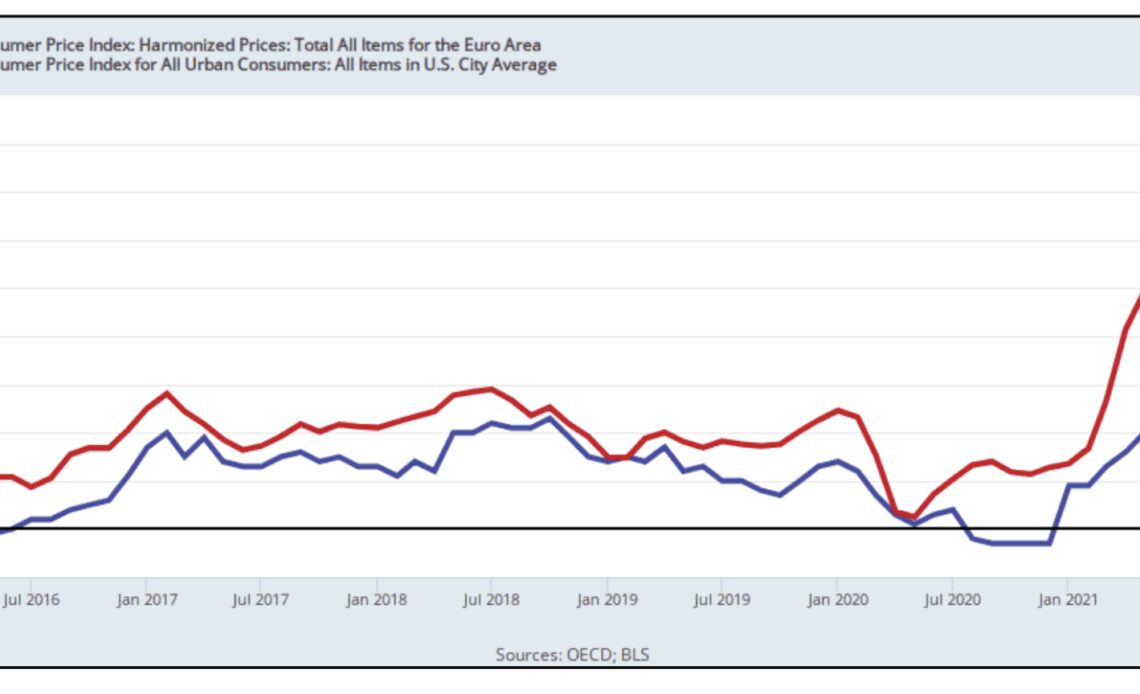

A global increase in inflation and rising interest rates instilled fear and uncertainty in the market resulting in lower crypto investment than expected. Although there is much publicity pertaining to the United States inflation and interest rate, other countries such as India have experienced similar challenges.

Notably, earlier this year the Federal Reserve announced that it was taking stringent measures to “accelerate tapering of monthly bond purchases. In other words, the United States planned to introduce measures that slow down its economy to control the ever rising inflation in the country. The following graph shows the inflation trend from 2016 to 2022.

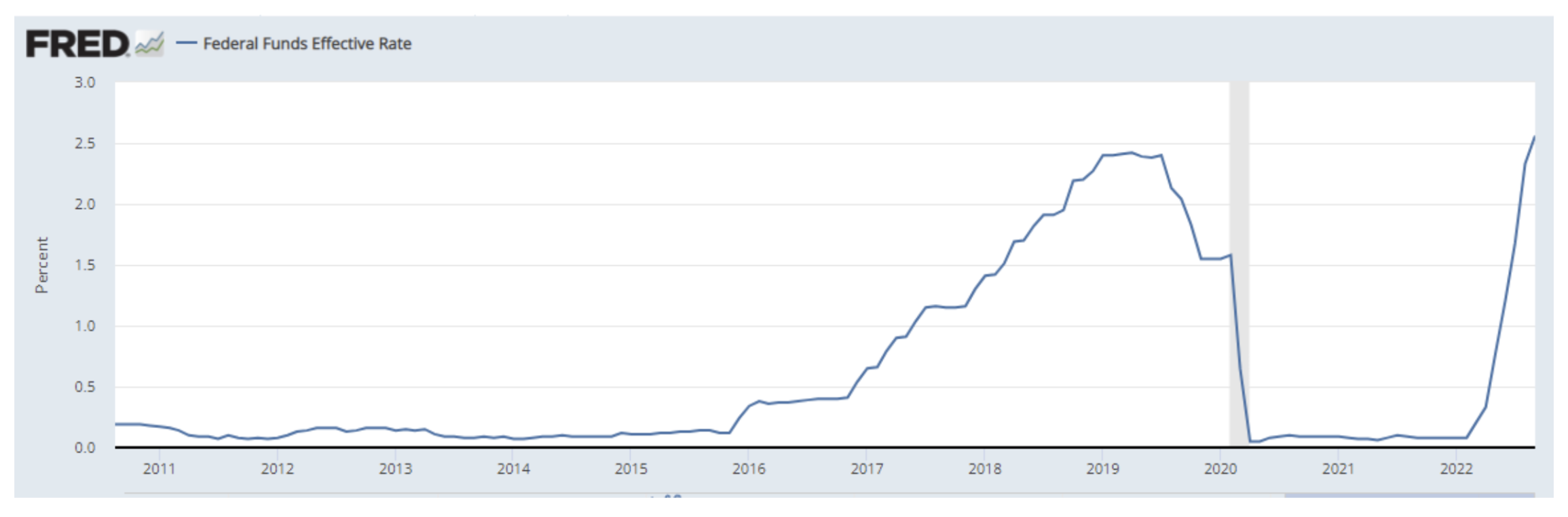

In effect, to reduce the rate of inflation, the Federal Reserve increased the Federal Funds rate two times during the year. This reduced the disposable income of U.S. residents, thereby dampening investment effort in risk assets like cryptocurrencies.

Crypto analysts believe that leverage was another primary cause of the current bear market. Leverage entails pledging a small amount of money as collateral to borrow a large amount for investing. In this case, investors borrow from exchanges to finance their investments in the market.

The downside of leverage is that once the price of…

Click Here to Read the Full Original Article at Cointelegraph.com News…