The listing of ETHPOW (ETHW) across multiple crypto exchanges has been followed by a huge drop in price despite some initial success.

ETHPOW drops 80%

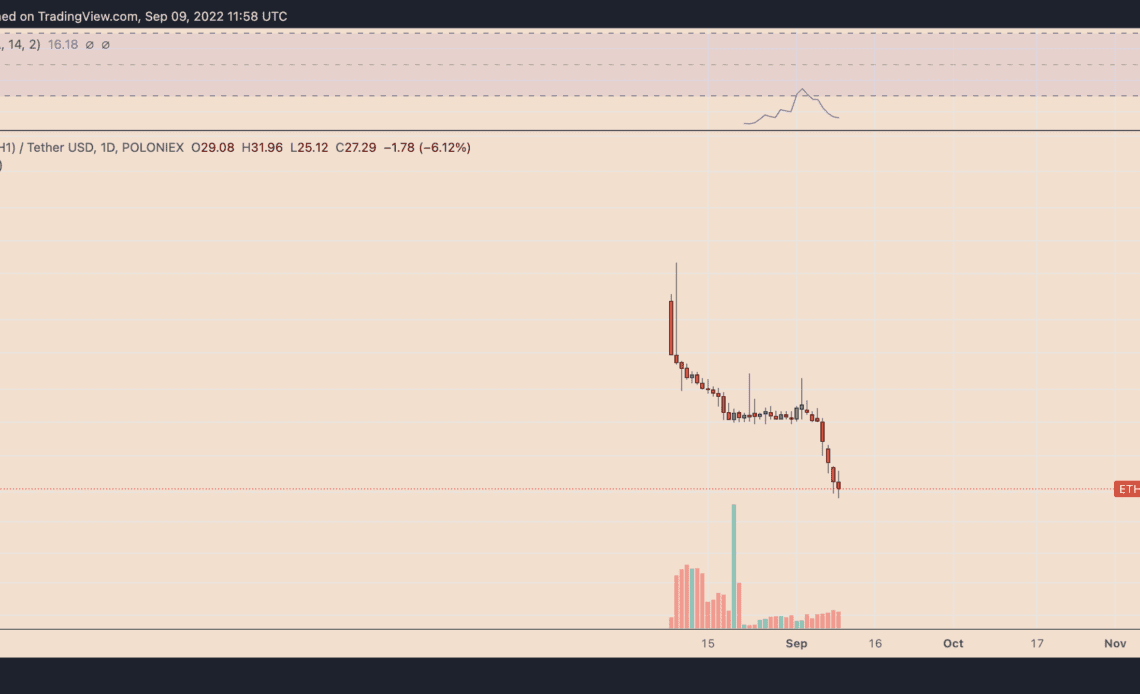

On the daily chart, ETHW’s price dropped by more than 80% to $25 on Sept. 10, over a month after its market debut.

For starters, ETHPOW only exists as a futures ticker, for now, conceived in anticipation that an upcoming network update on Ethereum could result in a chain split.

Ethereum will undergo a major protocol change called the Merge by mid-September, switching its existing consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS).

Therefore, Ethereum will obsolete its army of miners, replacing them with “validators,” which are nodes that would perform the same tasks by merely staking a certain amount of tokens with the network.

As a result, current Ethereum miners will be forced to migrate to other PoW chains or shut down. Ethereum Classic (ETC), which carries the original Ethereum PoW code, has benefited the most by becoming a haven for such miners.

For instance, the chart below shows Ethereum Classic’s hashrate rising and Ethereum’s hash rate dropping in the days leading up to the Merge.

But Ethereum Classic may not be the only option for ETH miners.

Chandler Guo, one of the most prominent crypto miners, has proposed that miners continue to validate and add blocks to the current PoW Ethereum chain post-Merge. This so-called contentious hard fork would keep the current Ethereum PoW chain alive, which Guo and supporters have termed ETHPOW.

And just as the Ethereum blockchain has its native coin in Ether (ETH), the new ETHPOW chain will have its asset called ETHW. Anybody holding ETH ahead of the Merge will receive an equal amount of ETHW after the potential chain split.

Related: Ethereum Merge can trigger high volatility, BitMEX CEO warns

However, given the significant downside risk of ETHPOW, traders appear to be more comfortable holding ETH, enabling them to receive ETHW as well should a chain split occur.

History would suggest $ETH PoW forks are best sold. ETHW IOUs are now $30-33 (-67% from 1 month ago). I wouldn’t sell the forks — in case it doesn’t happen — and your $ETH is locked into the contract.

So if you’re fast, think of this as a free 1.7% dividend on your $ETH. https://t.co/RRCc7kmV24

— Mira Christanto (@asiahodl) September 9, 2022

In addition, decreasing ETHW price may…

Click Here to Read the Full Original Article at Cointelegraph.com News…