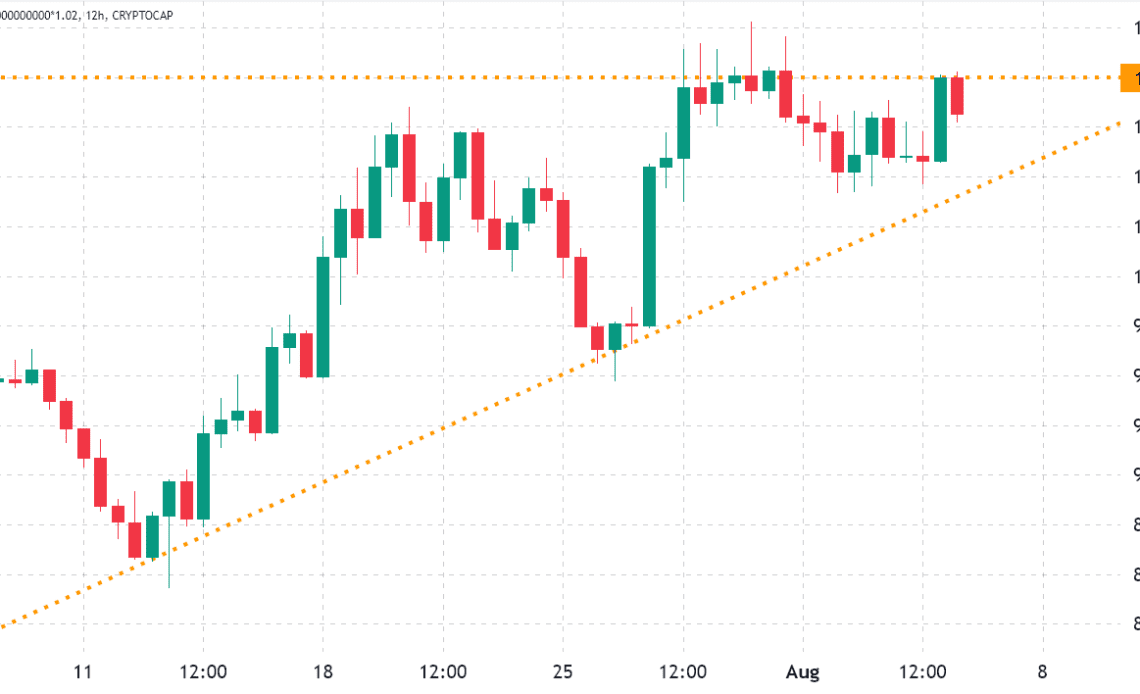

Cryptocurrencies have failed to break the $1.1 trillion market capitalization resistance, which has been holding strong for the past 54 days. The two leading coins held back the market as Bitcoin (BTC) lost 2.5% and Ether (ETH) retraced 1% over the past seven days, but a handful of altcoins presented a robust rally.

Crypto markets’ aggregate capitalization declined 1% to $1.07 trillion between July 29 and Aug. 5. The market was negatively impacted by reports on Aug. 4 that the U.S. Securities and Exchange Commission (SEC) is investigating every U.S. crypto exchange after the regulator charged a former Coinbase employee with insider trading.

While the two leading cryptoassets were unable to print weekly gains, traders’ appetite for altcoins was not affected. Investors were positively impacted by the Coinbase exchange partnership with BlackRock, the world’s largest financial asset manager, responsible for $10 trillion worth of investments.

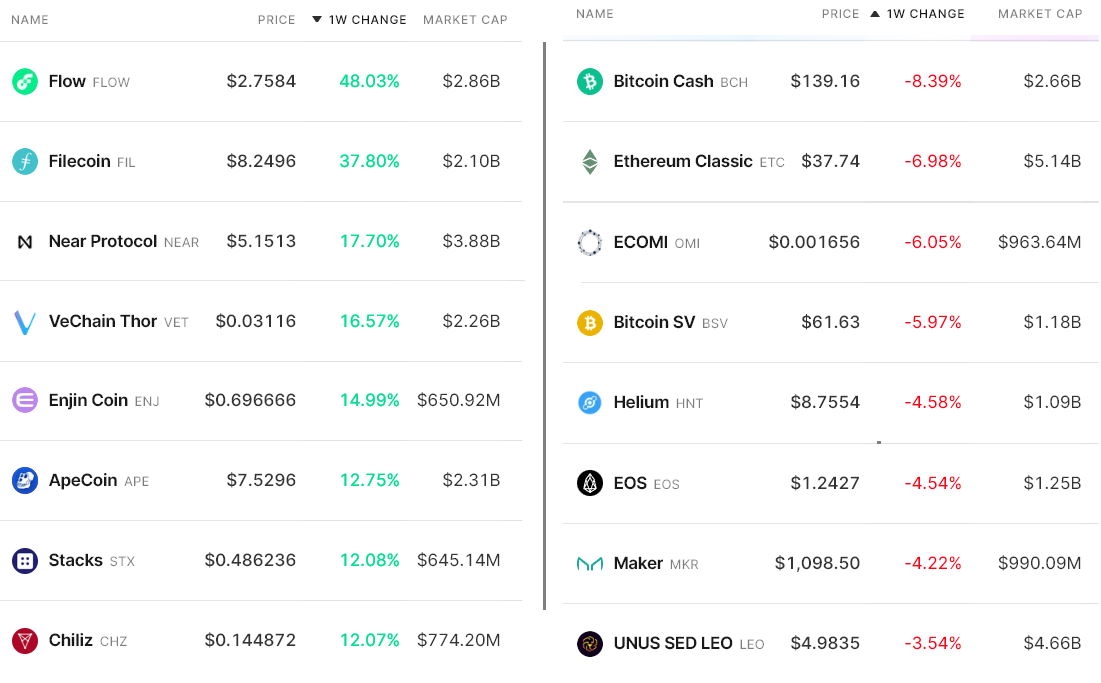

Coinbase Prime, the service offered to BlackRock’s clients, is an institutional trading solution that provides trading, custody, financing and staking on over 300 digital assets. Consequently, comparing the winners and losers among the top-80 coins provides skewed results, as 10 of those rallied 12% or more over the past seven days:

FLOW rallied 48% after Instagram announced support for the Flow blockchain via Dapper Wallet. The social network controlled by Meta (formerly Facebook) is expanding nonfungible token integration.

Filecoin (FIL) gained 38% following the v16 Skyr upgrade on Aug. 2, which hardened the protocol to avoid vulnerabilities.

VeChain (VET) gained 16.5% after some news sources incorrectly announced an Amazon Web Services (AWS) partnership. VeChain Foundation explained that the AWS reference was first cited in a May 9 case study.

Tether premium deteriorated slightly

The OKX Tether (USDT) premium is a good gauge of China-based crypto retail trader demand. It measures the difference between China-based peer-to-peer trades and the United States dollar.

Excessive buying demand tends to pressure the indicator above fair value at 100%, and during bearish markets, Tether’s market offer is flooded, causing a 4% or higher discount.

Currently, the Tether premium stands at 98.4%, its lowest level since June 10. While distant from retail panic…

Click Here to Read the Full Original Article at Cointelegraph.com News…