Bitcoin (BTC) may enjoy a familiar tailwind in the coming weeks and even beyond if new macro forces continue to play out.

In a post on X (formerly Twitter) on Dec. 14, popular trader Crypto Ed, founder of trading group CryptoTA, eyed multi-month lows in U.S. dollar strength.

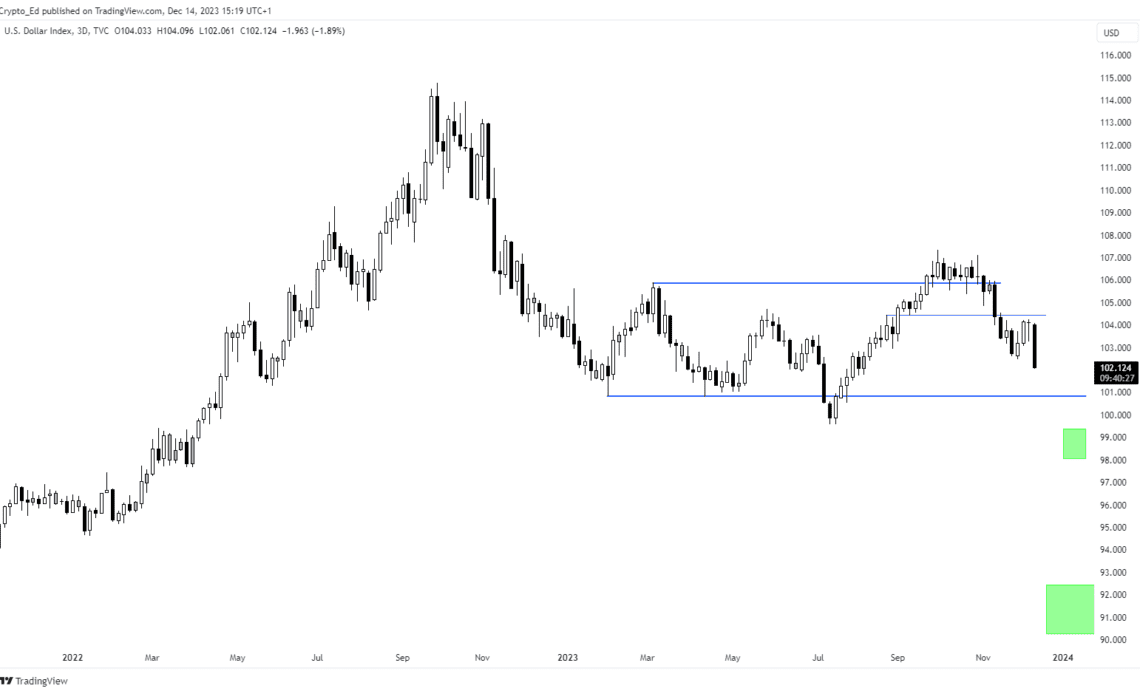

Bitcoin trader targets sub-100 DXY dive

Bitcoin and dollar strength have in the past exhibited inverse correlation. While this has decreased in recent times, changes to U.S. macro policy are now broadly seen to boost Bitcoin but pressure the greenback going forward.

As Cointelegraph reported, the week’s macro data prints, combined with encouraging signals from the Federal Reserve, have analysts pointing the way to further crypto market upside next year.

This is thanks to declining inflation potentially allowing for the Fed to “pivot” on interest rate hikes, increasing liquidity — to the benefit of risk assets.

An asset not set to enjoy the aftermath of the switch is the dollar, which has declined precipitously this week as macro figures showed the impact of monetary tightening on inflation.

The U.S. dollar index (DXY) is down more than 2% since the start of the week, currently below $102 — its lowest levels since mid-August.

Commenting, Crypto Ed joined those who are optimistic on Bitcoin while predicting further downside pressure on DXY.

“Long Term Outlook for DXY what will help BTC to teleport to new ATH’s,” he wrote, referring to new all-time highs for BTC/USD.

“DXY to $92.”

An accompanying chart earmarked key levels to look for on DXY on 3-day timeframes.

Fed balance sheet creeps higher

On the topic of liquidity, economist Lyn Alden nonetheless argued that conditions were not yet ideal in terms of supporting a broad risk-asset renaissance.

Related: Bitcoin bulls eye BTC price comeback as cash inflows echo late 2020

“Global liquidity indicators started to stall a bit after their recent rise, and reverse repos haven’t drained in the first half of December, but today’s dovish Fed and drop in DXY potentially kickstarted a bit more liquidity,” she told X subscribers on Dec. 14.

Days later, Alden nonetheless noted a “pretty remarkable repricing” by markets looking at how the Fed might lower rates in 2024.

DXY down again today so far, and crude oil and other commodities getting a bit of a corresponding bounce.

The past 24 hours has seen a pretty remarkable repricing by the market of forward rate expectations.

Click Here to Read the Full Original Article at Cointelegraph.com News…