Bitcoin (BTC) and altcoins are a no-brainer bet in the current macro climate, Arthur Hayes says.

In a post on X (formerly Twitter) on Dec. 14, the former CEO of exchange BitMEX said that investors have “no excuse” to short crypto.

$1 million Bitcoin still in play in 2024 “great pivot”

Going long crypto is the key to success as markets bet on the United States Federal Reserve lowering interest rates next year, Hayes argues.

On Dec. 13, at the latest meeting of the Federal Open Market Committee (FOMC), Fed policymakers voted to continue a freeze on interest rate hikes.

While broadly expected, a subsequent speech and press conference with Chair Jerome Powell sparked talk of impending rate cuts — an event known as a “pivot” in policy.

“While we believe that our policy rate is likely at or near its peak for this tightening cycle, the economy has surprised forecasters in many ways since the pandemic, and ongoing progress toward our 2 percent inflation objective is not assured,” Powell said.

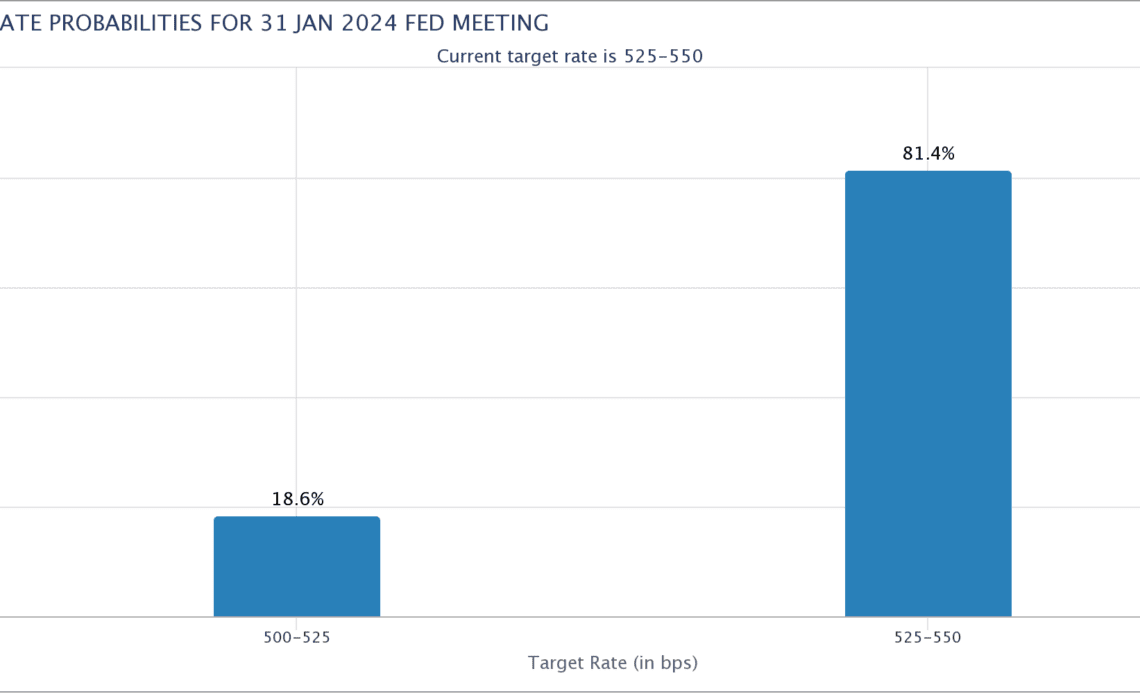

With that, market consensus over what might happen at the next FOMC meeting in January began to diverge. Per data from CME Group’s FedWatch Tool, the odds of a cut coming early in 2024 stood at 18.6% at the time of writing.

Fed decision day was followed by mainstream media attention focusing on the increasing optimism that U.S. monetary policy would begin to unwind after an unprecedented rate tightening cycle.

Reposting one such story, Hayes was in no two minds about what the knock-on effect for liquidity-sensitive crypto would be.

“At this point, there is no excuse not to be long crypto,” part of his post stated.

“How many more times must they tell you that the fiat in your pocket is a filthy piece of trash.”

Hayes further reiterated a longstanding $1 million BTC price prediction as a result of macro tides eroding the value of national currencies.

BTC price dips $1,500 on Ledger security woes

BTC/USD traded at around $42,500 at the time of writing, per data from Cointelegraph Markets Pro and TradingView, after flash volatility at the day’s Wall Street open.

Related: Bitcoin bulls eye BTC price comeback as cash inflows echo late 2020

This took away gains seen overnight, these constituting a rebound from a 7.5% dip earlier in the week — Bitcoin’s biggest single-day downtick of 2023 so far.

The move accompanied news of a security compromise affecting decentralized…

Click Here to Read the Full Original Article at Cointelegraph.com News…