Despite the risks and the failures associated with central bank digital currencies (CBDCs), global policymakers are pushing forward to make them a reality.

In November alone, officials from the International Monetary Fund (IMF), Bretton Woods Committee, and Bank for International Settlements (BIS) issued rallying calls for governments to push forward on CBDCs with courage and determination. But rather than double down on a bad idea and waste further resources in this pursuit, policymakers should let this idea go and focus on more fundamental reforms that would create a freer financial system.

The November CBDC campaign began when IMF managing director Kristalina Georgieva told policymakers, “If anything… we need to pick up speed [with CBDC development].” Bretton Woods Committee chair Bill Dudley likewise called not only for the United States to develop a CBDC, but for the BIS to establish an international standard for CBDCs. And BIS Innovation Hub head Cecilia Skingsley told an audience that CBDCs should not be dismissed as a “solution in search of a problem” because they might be useful one day.

Related: Milei vowed to close Argentina’s central bank — But will he do it?

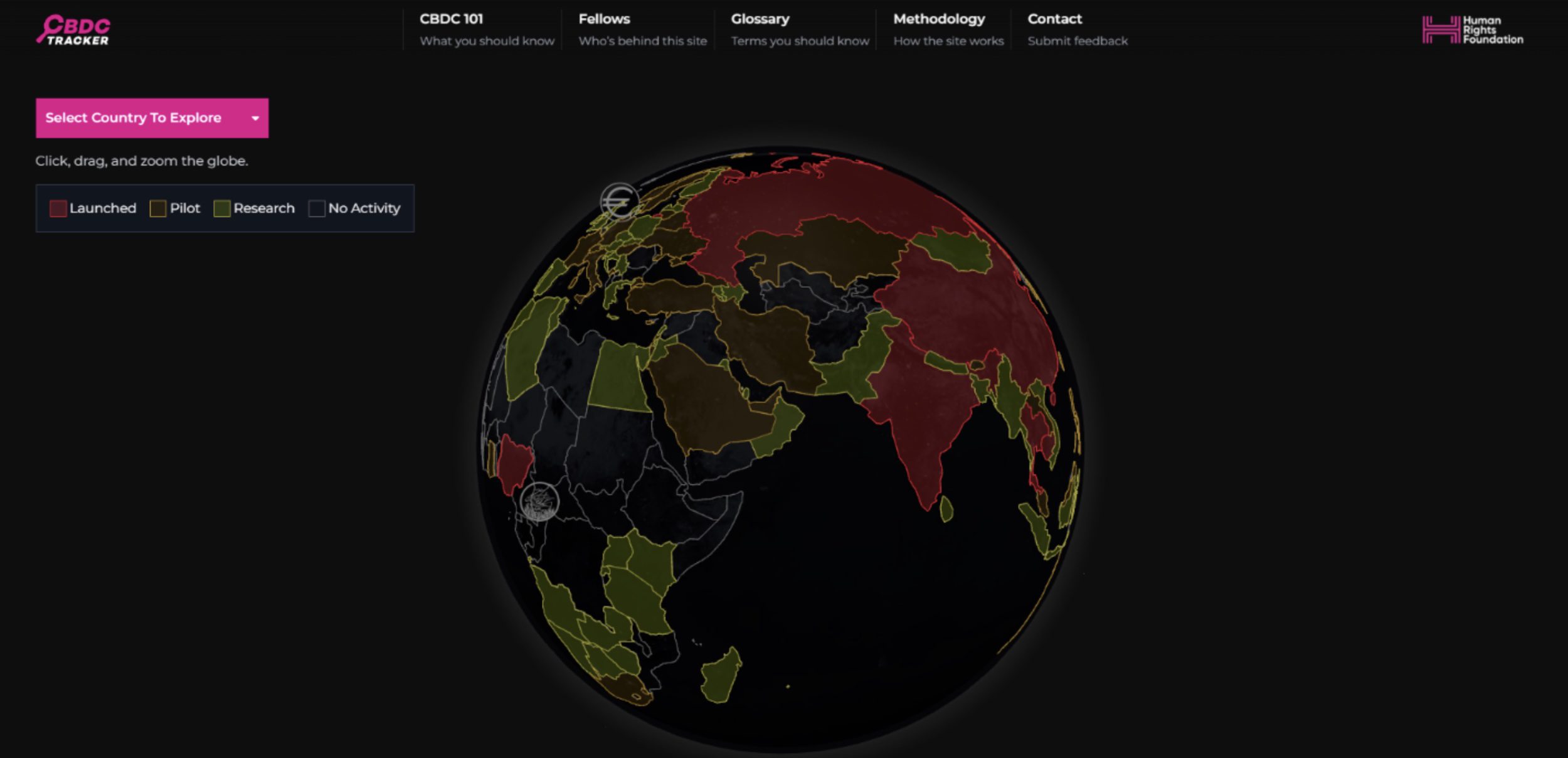

These calls come at a strange time. As the Human Rights Foundation’s CBDC Tracker indicates, nine countries and the eight islands that compose the Eastern Caribbean Currency Union have launched CBDCs; 38 countries and Hong Kong have CBDC pilot programs; and 68 countries and 2 currency unions are researching CBDCs. Yet, none of these projects have proven worthwhile.

Yet, some governments may not even have the money to give away. In Thailand, plans to give citizens 10,000 baht ($288) through a CBDC were delayed partly because the government had not identified where the 548 billion baht ($15.8 billion) needed to cover the handout would come from. Worse yet, others warned that the handout may not even be legal. It wasn’t until later that the prime minister announced that it would be funded by government loans.

Elsewhere, the CBDC experience has been much worse. Nigeria’s CBDC struggled to gain adoption so much that the Nigerian government started pulling cash off the streets. Within weeks, it created a cash shortage so severe that it led to protests outside of banks and riots in the streets. Still, CBDC adoption only increased from 0.5 percent to 6 percent.

So at best, the CBDC experience seems to be one of…

Click Here to Read the Full Original Article at Cointelegraph.com News…