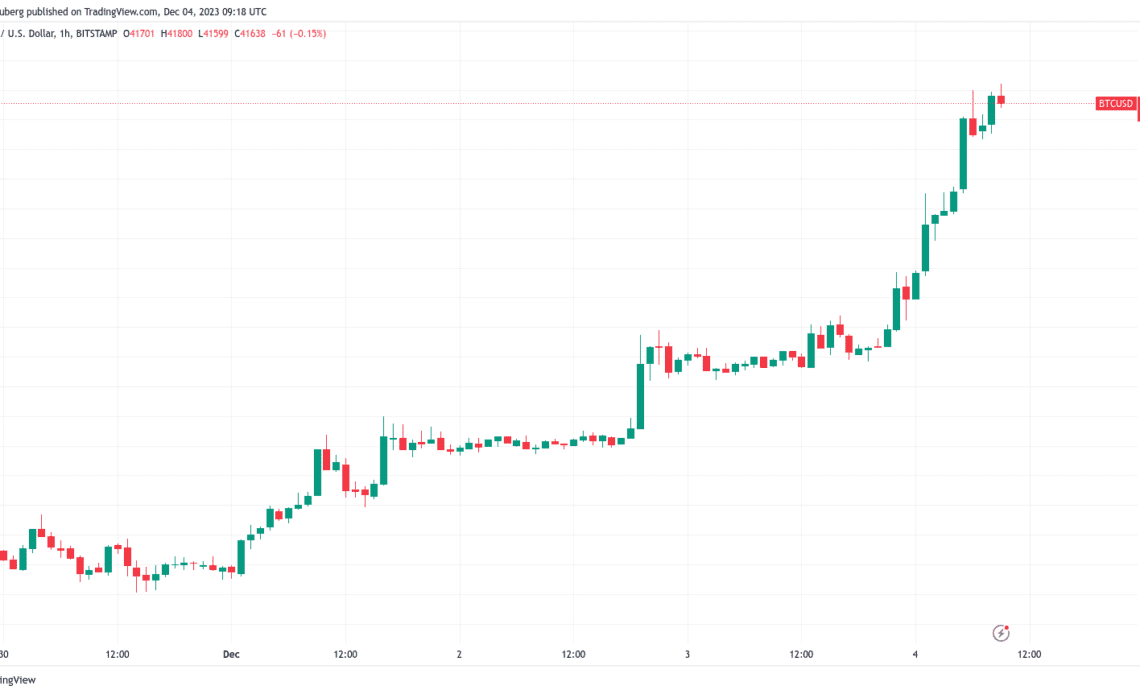

Bitcoin (BTC) starts the first week of December looking better than it has since early 2022 — at over $40,000.

BTC price action is delighting bulls already as the month begins, with the weekly close providing the first trip above the $40,000 mark since April last year.

Shorts are getting wiped and liquidity taken as the bull run sees its latest boost on the back of macroeconomic changes and anticipation of the United States’ first spot price exchange-traded fund (ETF).

Despite misgivings and some predicting a major price retracement, Bitcoin continues to offer little respite for sellers, who continually miss out on profits or are left waiting on the sidelines for an entry price which never comes.

The party mood is not just reflected on markets — Bitcoin miners are busy preparing for the halving, and with hash rate already at all-time highs of its own, the trend is set to continue this week.

Is there more upside left or is Bitcoin getting ahead of itself?

This is the question that longtime market participants will be asking in the coming days as legacy markets open and adjust to a post-$40,000 BTC price.

Cointelegraph takes a closer look at the state of Bitcoin this week and examines the potential volatility catalysts lying in store for hodlers.

Bitcoin surges past $40,000 — but serious correction remains on watchlist

Bitcoin is firmly reminding investors of “Uptober” as the month gets underway — by liquidating shorts and beating out key resistance levels.

The fun began into the weekly close, when $40,000 came into view for the first time since April last year.

Bulls did not slow down there, however, and BTC/USD continued rising to current local highs of $41,800, data from Cointelegraph Markets Pro and TradingView confirms.

In doing so, Bitcoin has wiped short positions to the tune of over $50 million on Dec. 4 alone, per statistics from CoinGlass — already the largest single-day tally since Nov. 15.

Perhaps understandably, many traders are calling for upside continuation toward $50,000, with leveraged short liquidity slowly disappearing as BTC price performance edges higher.

#bitcoin continuing to work through the 3x, 5x, 10x short liquidity. pic.twitter.com/aRwvJil3c6

— Decentrader (@decentrader) December 4, 2023

“Someone still aggressively chasing price here,” popular trader Skew wrote during coverage of live market moves.

“More importantly if said…

Click Here to Read the Full Original Article at Cointelegraph.com News…