Bitcoin (BTC) starts a new week still struggling with $26,000 as August becomes its worst month of 2023.

BTC price strength remains dubious after a snap crash ten days ago, with bulls unable to wrestle back control of the market to provide a relief bounce.

The outlook looks similarly uncertain — September is traditionally a poorly-performing month for Bitcoin, and with the August monthly close just days away, could another downside surprise lie in store?

Macro triggers are once again taking a back seat this week, with Personal Consumption Expenditures (PCE) Index data the highlight in what is otherwise a cool week for crypto contagion.

That said, traders and analysts are on their toes — with no hint of a rebound in sight, many are still braced for worse to come.

Cointelegraph takes a look at the main BTC price performance talking points for the week ahead.

BTC price sags with monthly close in sight

There are no prizes for guessing how Bitcoin ended its latest weekly candle — especially with prior knowledge of previous closes.

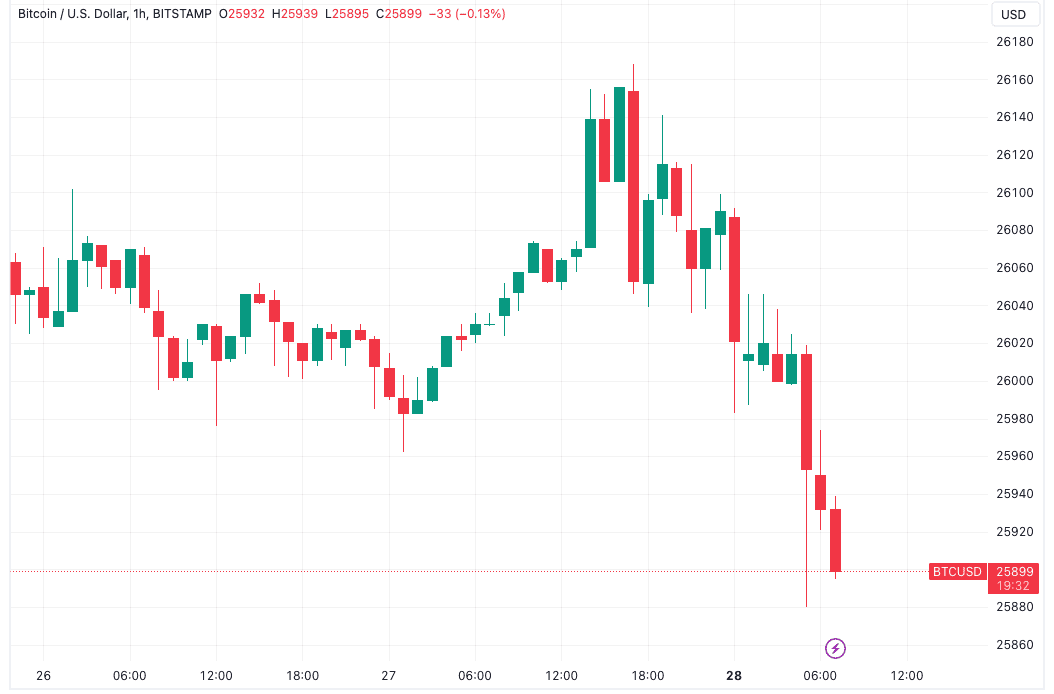

Despite holding $26,000 into the close, BTC/USD immediately went downhill thereafter, wicking to $25,880 before consolidating slightly higher, data from Cointelegraph Markets Pro and TradingView shows.

That marked multi-day lows, part of what popular trader Skew forecast could be pressure from shorters into the new week.

“Shorts continue to stack into the weekend, expecting some kind of move around US Futures open and into Monday EU session,” part of X analysis read.

Skew additionally described weekend BTC behavior as “max pain price action.”

The monthly close was a key topic for market participants, with volatility on the cards after August produced 11% losses.

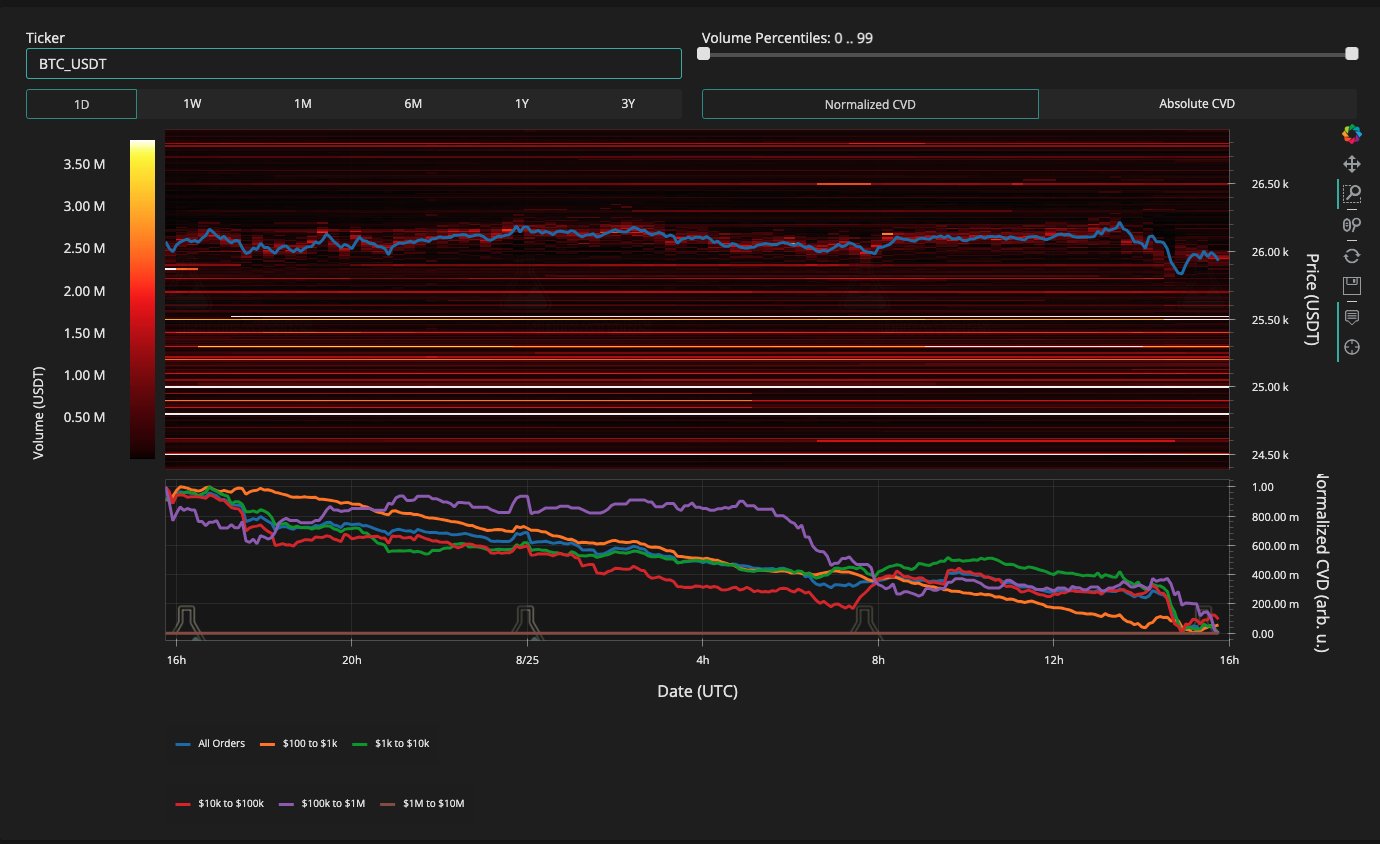

Keith Alan, co-founder of monitoring resource Material Indicators, predicted a trip to multi-month lows.

“Whales aren’t buying yet, and neither am I,” he commented alongside a chart of the Binance BTC/USD order book.

“Expecting volatility to continue through the monthly candle close. Patiently waiting to test the local low.”

In addition to low whale order volume, the accompanying order book chart showed a lack of bid liquidity overall, with $25,500 gaining only modest interest.

“I am looking for a trigger to enter where we drop to $25,000 lows, reclaim and pump,” popular trader Crypto Tony agreed.

“Or if we flip $26,700 into support. No entry before that on…

Click Here to Read the Full Original Article at Cointelegraph.com News…