In the past few months, Bitcoin (BTC) traders had grown used to less volatility, but historically, it’s not uncommon for the cryptocurrency to see price swings of 10% in just 2 or 3 days. The recent 11.4% correction from $29,340 to $25,980 between August 15 and August 18, took many by surprise and led to the largest liquidation since the FTX collapse in November 2022. But the question remains: was this correction significant in terms of the market structure?

Certain experts point to reduced liquidity as the reason for the recent spikes in volatility, but is this truly the case?

BTC surged 70%+ in 2023, yet the “Alameda gap” – liquidity dip post FTX and Alameda Research collapse – remains, supported by low volatility.

Read full analysis here: https://t.co/kVslgLQtpL pic.twitter.com/g8Ac7udBl7

— Kaiko (@KaikoData) August 17, 2023

As indicated by the Kaiko Data chart, the decline of 2% in the Bitcoin order book depth has mirrored the decrease in volatility. It’s possible that market makers adjusted their algorithms to align with the prevailing market conditions.

Hence, delving into the derivatives market to assess the impact of the drop to $26,000 seems reasonable. This examination aims to determine whether whales and market makers have become bearish or if they’re demanding higher premiums for protective hedge positions.

To begin, traders should identify similar instances in the recent past, and two events stand out:

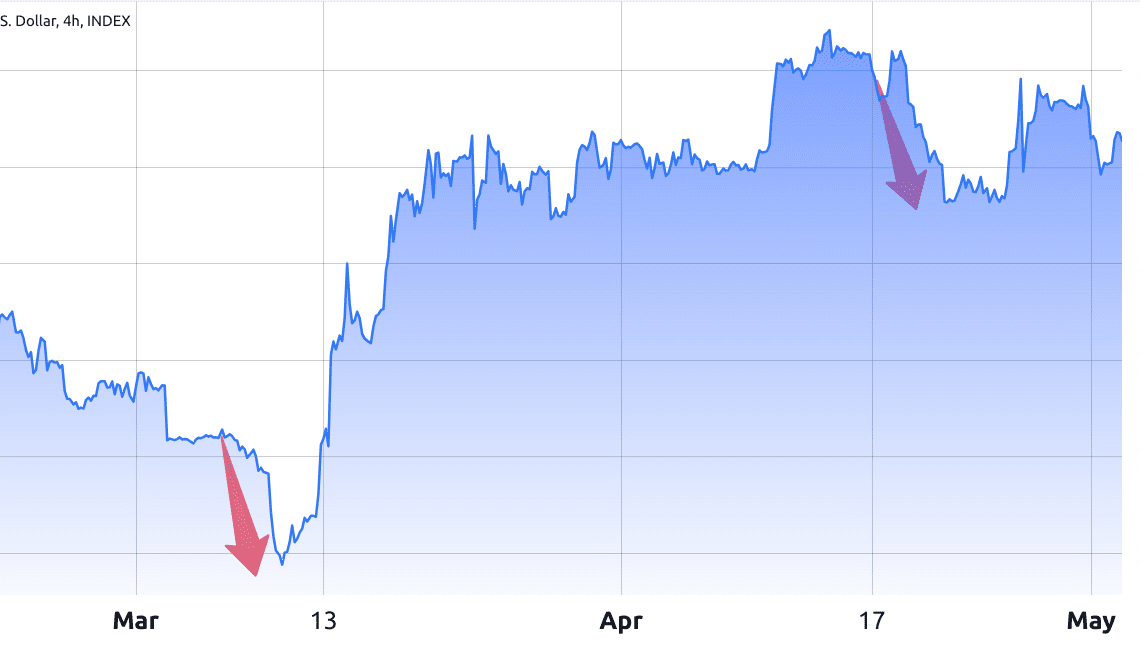

The first decline took place from March 8 to March 10, causing Bitcoin to plummet by 11.4% to $19,600, marking its lowest point in over 7 weeks. This correction followed the liquidation of Silvergate Bank, a crucial operational partner for multiple cryptocurrency firms.

The subsequent significant movement occurred between April 19 and April 21, resulting in a 10.4% drop in Bitcoin’s price. It revisited the $27,250 level for the first time in more than 3 weeks after Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), addressed the House Financial Services Committee. Gensler’s statements provided little reassurance that the agency’s enforcement-driven regulatory efforts would cease.

Not every 10% Bitcoin price crash is the same

Bitcoin quarterly futures generally tend to trade with a slight premium when compared to spot markets. This reflects sellers’ inclination to receive additional compensation in return for delaying the settlement. Healthy markets usually display BTC…

Click Here to Read the Full Original Article at Cointelegraph.com News…