The Ether (ETH) price has struggled to sustain the $1,850 support since April 21, the same level it held before the rally toward $2,100 initiated on April 13. Investors have reason to question whether there are buyers, considering the 13.5% price correction in six days and the $548 million in leveraged futures longs liquidated between April 19 and April 21.

Firstly, the regulatory environment seems to have gotten stricter for centralized exchanges. Dubai-based Bybit, for instance, announced that all users must complete Know Your Customer (KYC) identity verification for order execution and withdrawals. Before the May 8 update, non-KYC users had a monthly withdrawal limit of 100,000 USD Tether (USDT).

United States-based crypto exchange Gemini announced on April 21 the upcoming launch of a derivatives platform outside the U.S. The uncertain regulatory environment forced the company to seek alternative regions, though only clients from selected regions can access the new service. The list excludes the U.S., Canada, and most European countries except Switzerland.

Ethereum network is navigating in troubled waters

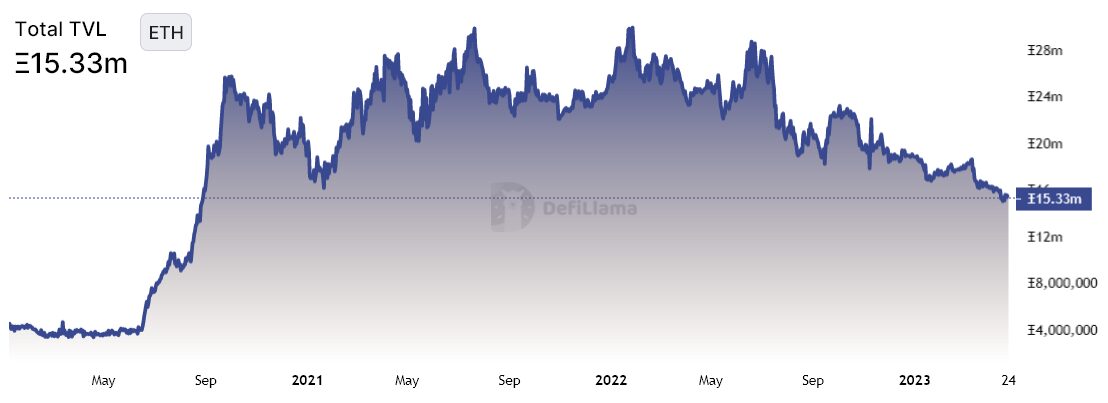

Given its lower use in decentralized applications (Dapps), the Ethereum network is probably experiencing its own problems. For starters, total deposits on Ethereum’s smart contracts in ETH terms plunged to their lowest levels since August 2020. Such an analysis already excludes the effects of native Ethereum staking, which recently started to allow withdrawals.

According to DefiLlama data, Ethereum Dapps reached 15.3 million ETH in total value locked (TVL) on April 24. That compares with 22.0 million ETH six months prior, a 30% decline. As a comparison, TVL on BNB Smart Chain in BNB terms declined by 20%, and Polygon network’s MATIC deposits decreased by 11%.

Furthermore, Ethereum network dominance on stablecoin deposits reached its lowest level in more than 12 months at 54%, down from 64% in December 2022. On the other hand, the Tron network was the biggest winner in stablecoins due to its low transaction fee. As a comparison, the Ethereum network’s average transaction fee has been above $4 since February 2023.

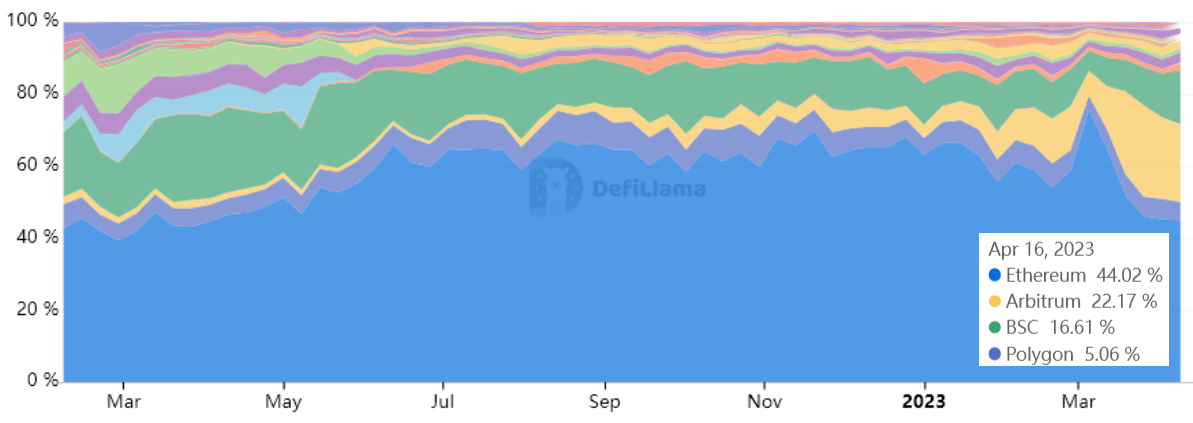

Ethereum market share by volume on decentralized exchanges (DEX) peaked at 75% in the week ending March 5 but has steadily declined to 44% in the week ending April 16.

Gainers on DEX trading volumes were Arbitrum, increasing to…

Click Here to Read the Full Original Article at Cointelegraph.com News…