Staked Ether (ETH), liquid derivatives — it’s a whirlygig of smart contracts and big-brain blockchain jargon out there. Nonetheless, there are a few paths through the ETH staking wilderness.

But remember, anon, as the poet Antonio Machado said, “There is no path, paths are made by walking” — which is a fancy way of saying this isn’t financial advice and make sure you do your own research.

Let’s start with the first personality type and the type of ETH staking that might be appropriate.

The Ox: Slow and steady

The ox, archetypally, has a strong, dependable personality but can be stubborn and suspicious of new ideas. If that sounds like you, you may be interested in staking directly with Lido.

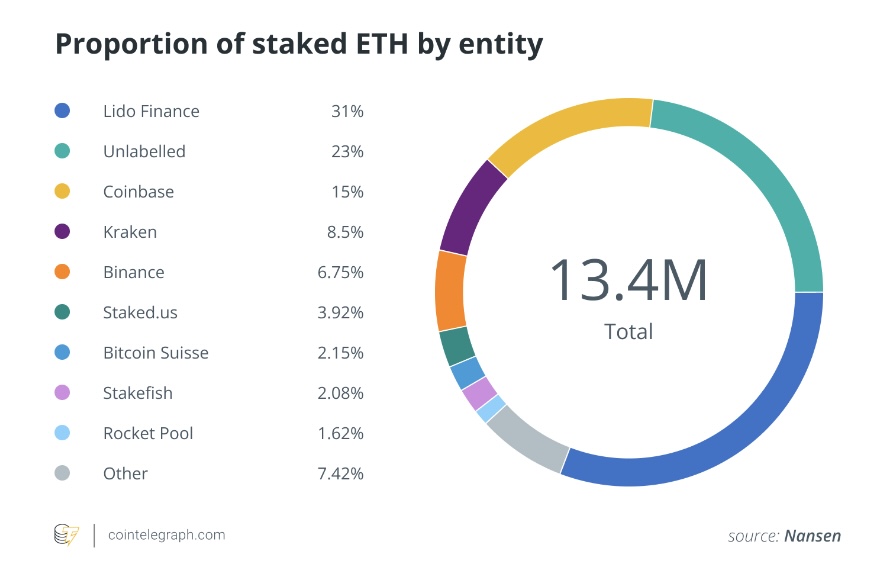

Lido Finance is not only the biggest liquid staking derivative (LSD) protocol but it’s now the biggest decentralized finance (DeFi) protocol in the market in terms of total value locked ($9.5 billion) and market capitalization. Lido takes your ETH and stakes it via a team of vetted validators, pooling the yield garnered and distributing it to the validators, the decentralized autonomous organization (DAO) and investors.

Related: 3 tips for trading Ethereum this year

In return for providing ETH to Lido, the DAO issues “staked ETH” (stETH) tokens, which are like receipts (or “liquid derivatives”) that can be redeemed for your original ETH plus the yield accrued. These tokens, along with those from other LSD protocols, such as Rocket Pool and StakeWise, can be traded on the open market.

The risks include the fact that the smart contracts holding your ETH might have an undiscovered bug, the DAO might get hacked, or one or more of Lido’s validators might get penalized by Ethereum and have some of their stake removed. All the following strategies contain these risks plus more.

The Dog: Honest, prudent and a little feisty

If that sounds like you, maybe look into auto-compounders. For example, adding liquidity to Curve Finance and then locking up the liquidity pool (LP )tokens.

When using Curve, I like to use Frax-based tokens, as the two protocols clearly have the hots for one another, and Frax pools often have the best rewards. I passed some of my ETH to Frax to stake and received their LSD called Frax ETH (frxETH).

It’s in Frax’s interest to maintain a highly liquid market for frxETH, so they run an LP on Curve, which offers up to 5.5% APY on top of the fact that your frxETH is also earning a similar yield. Nice.

Click Here to Read the Full Original Article at Cointelegraph.com News…