Ether (ETH) fell short of a bullish breakout based on technical and on-chain analysis, suggesting that the consolidation below the $2,000 price level could continue in the medium term. At the same time, a lack of sellers and strong fundamentals will likely protect Ether from steep declines.

Ethereum encounters resistance at long-term bullish reversal points

ETH/USD price increased by 42.80% since the start of 2023 thanks to a short squeeze in the altcoin market, negative investor sentiment and low liquidity conditions. Based on on-chain and technical levels, the rally has paused at a crucial bull-bear pivot.

Glassnode’s Relative Unrealized Loss metric measures the loss scale on Ether holders’ books. The orange line represents the bull-bear pivot line, where consolidation above this level signifies bear trends and vice versa. Usually, the market begins bullish trends after a breakout from previous all-time highs or consolidation over long periods, signified by a steep decline in the Unrealized Loss metric.

Similarly, from a technical perspective, Ether bulls failed to overcome the resistance at 0.082 BTC, bringing the price back to the parallel trading range between 0.053 BTC and 0.082 BTC.

Will time be different?

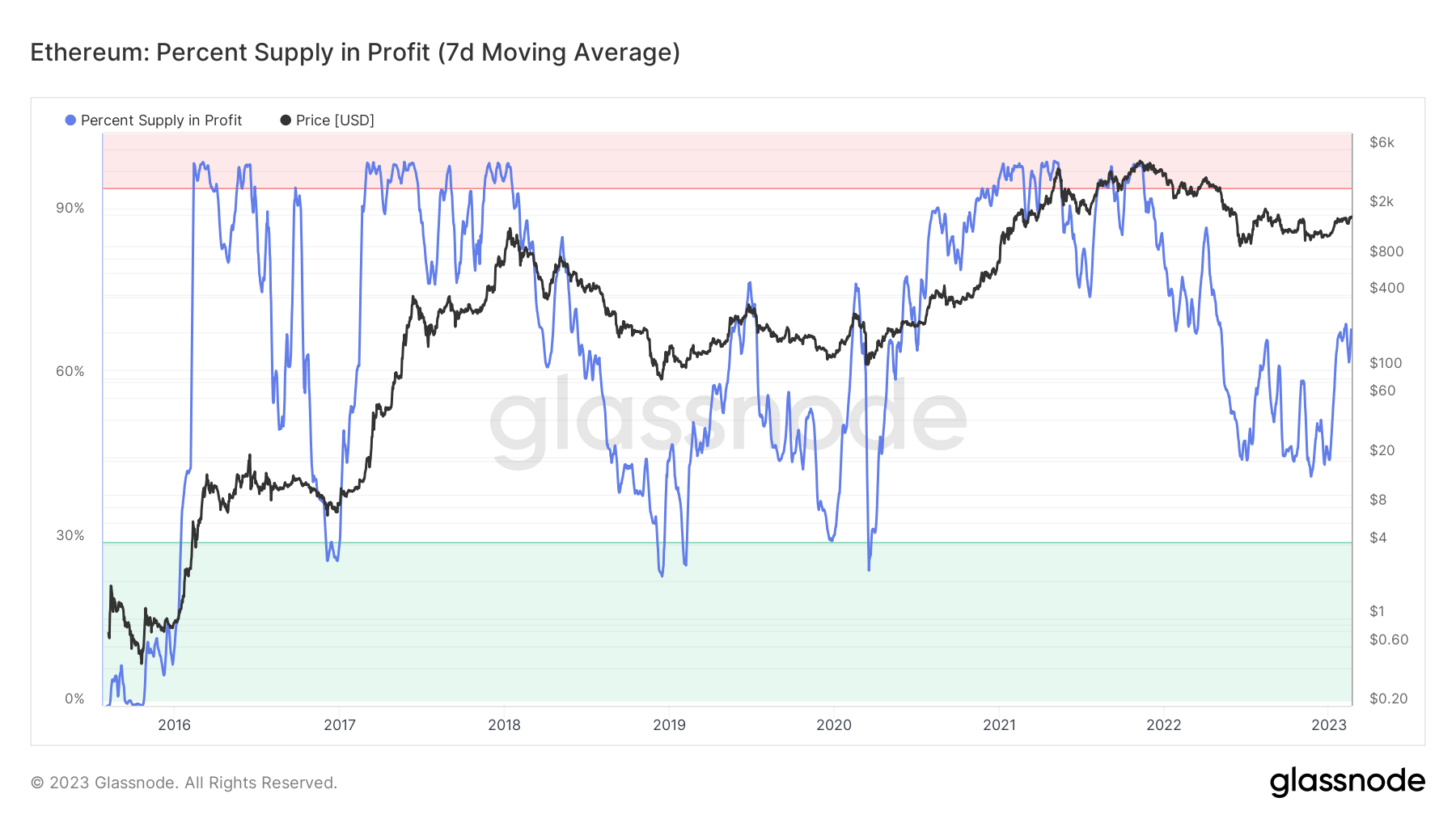

Based on historic levels, Ether missed the previous bottom levels by a huge margin, the minimum percentage of supply in profit extended to 42.1% compared to the 20-30% tapped during previous bear markets. It suggests the likelihood of more pain ahead for ETH holders. However, on-chain trends show robust activity and buying, reducing the downside risk significantly.

The net position change of Ether on exchanges shows a stark difference between the current and previous bear markets. Between 2018 and 2020, Ether inflows to exchanges were significantly higher than outflows, indicating that many holders moved their coins to exchanges to sell. However, during the negative period of 2022, although the price dropped, exchange outflows remained strong, suggesting that the selling pressure is weaker in the current bear market.

The percentage supply of Ether locked in smart contracts tells a similar story, with no significant declines in Ether locked in smart contracts. The uptrend that began in late 2020 held strong through the downturns of 2022,…

Click Here to Read the Full Original Article at Cointelegraph.com News…