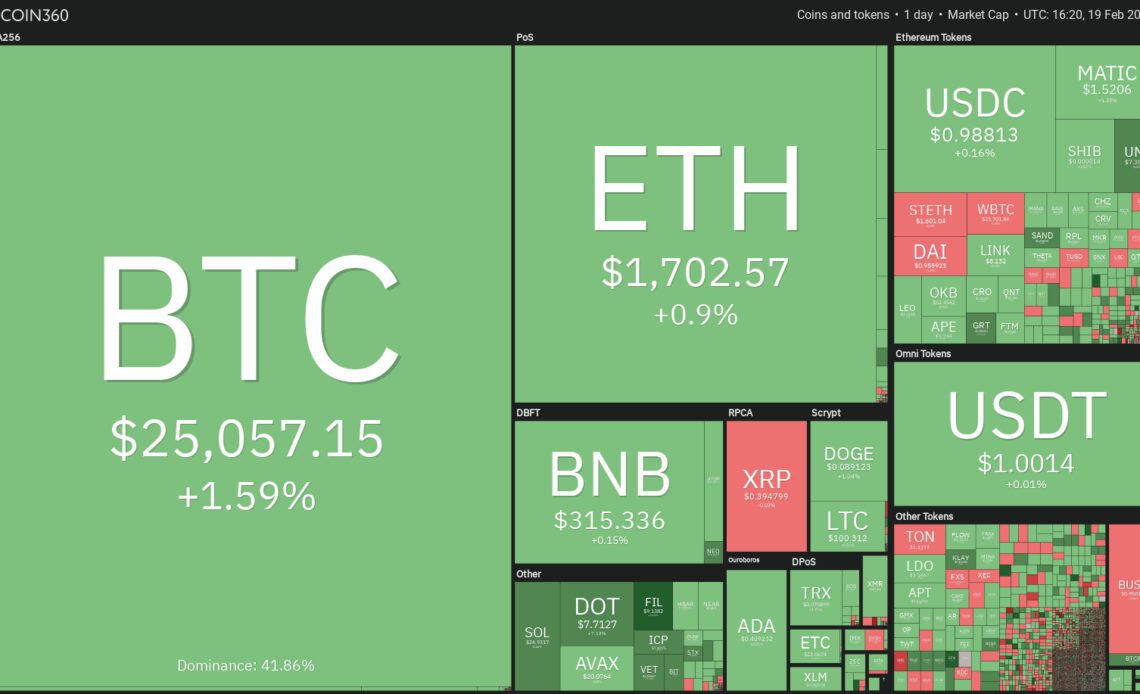

The Dow Jones Industrial Average fell for the third consecutive week but Bitcoin (BTC) price decoupled and is on track to close the week near the strong overhead resistance at $25,211. This suggests that the wider crypto market recovery is on a strong footing.

After Bitcoin’s sharp rally from the lows, analysts remain divided in their opinion about the next move. Some traders believe that the current Bitcoin rally will turn down once again, but others expect the momentum to continue, indicating the start of a new bull phase.

Chances are that Bitcoin and several other cryptocurrencies may continue to rally until a vast majority of the bears turn bullish. After that happens, a sizable dip is likely. That could shake out several weak hands and give an opportunity to the stronger hands to add to their positions. A higher low followed by a higher high may confirm the end of the bear phase and signal the start of the next bull market.

Meanwhile, select altcoins are looking strong and they may follow Bitcoin higher in the near term.

Let’s look at the charts to determine the critical levels to keep an eye on.

BTC/USDT

Bitcoin is trading near the stiff overhead resistance at $25,211. The small trading range days on Feb. 18 and Feb. 19 indicate that bulls are not hurrying to book profits and the bears are wary of shorting at the current levels.

The upsloping moving averages and the relative strength index (RSI) near the overbought territory indicate that bulls are firmly in command. A tight consolidation near a stiff overhead resistance usually resolves to the upside. If buyers catapult the price above $25,250, the BTC/USDT pair could accelerate to $31,000 as there is no major resistance in between.

Conversely, if the price dumps from the current level, it could find support at the 20-day exponential moving average ($23,115). The bears will have to pull the price below $22,800 to break the bullish momentum. The pair may then collapse to $21,480, which is likely to act as a strong support.

The bears aggressively sold the rally to $25,250 but they could not tug the price below the 20-EMA. This suggests that the sentiment remains strong and the bulls are viewing the dips as a buying opportunity.

Buyers are likely to have another go at the overhead resistance. If they manage to drive the price above $25,250, the next leg of the uptrend could…

Click Here to Read the Full Original Article at Cointelegraph.com News…