Key points:

-

Bitcoin heads back below $113,000 at the Wall Street open as bulls fail to clinch support.

-

BTC price manipulation is one explanation for the downside, with exchange order-book bid liquidity in focus.

-

More crypto market volatility is expected from the Federal Reserve’s Jackson Hole event.

Bitcoin (BTC) sought new local lows at Wednesday’s Wall Street open as bulls struggled to halt a repeat US sell-off.

Bitcoin price pressure brings back “Spoofy the Whale”

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it sank below $113,000 after initially reclaiming it after the daily open.

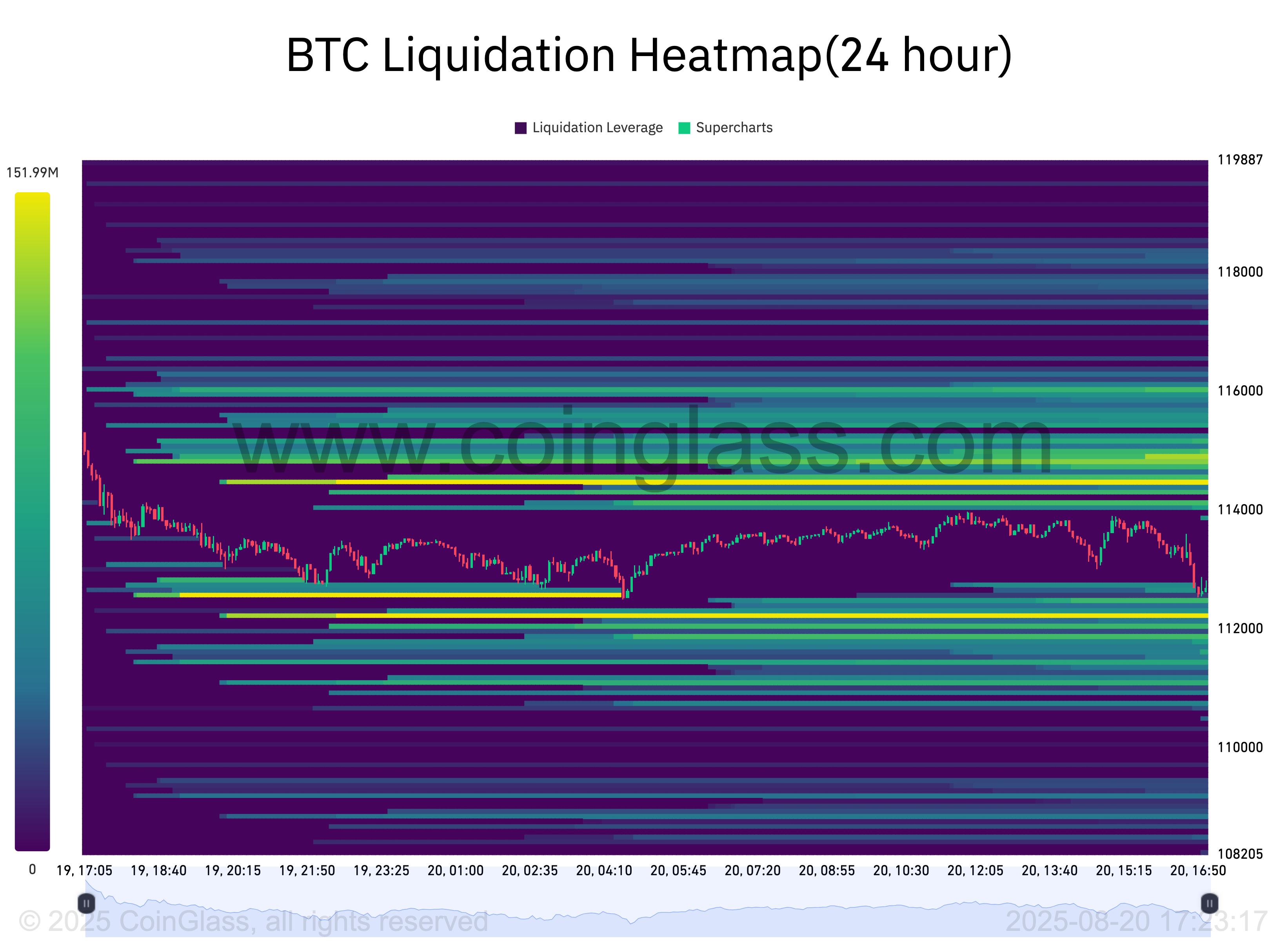

Bid liquidity was being taken on exchanges at the time of writing, with $112,300 now a level of interest, per data from CoinGlass.

“$BTC Took out a bunch of liquidity on both sides for the past 6 weeks, as it ranged around this same price region,” popular trader Daan Crypto Trades summarized on liquidity conditions in his latest post on X.

“The biggest cluster in close proximity now sits at around $120K and of course the local range low at $112K is still in play. Keep an eye out of those areas as they often act as local reversal zones and/or magnets when price gets close to them.”

Keith Alan, co-founder of trading resource Material Indicators, suggested that more bid liquidity appearing lower down the order book — including “plunge protection” at $105,000 — could be a form of price manipulation.

Alan referred to entities for whom he coined the phrases “Spoofy the Whale” and the “Notorious B.I.D.” — both apt to artificially influence price action in recent months.

“Too soon to make any assumptions, but the influence on price direction will be the same,” he concluded.

“Bids moving lower invites price to move lower.”

Continuing, popular commentator TheKingfisher warned that Bitcoin could “bleed” further, which would have significant consequences for altcoins.

“Altcoins currently show a balanced skew. We might see a minor retrace aimed at liquidating high-leverage shorts. Momentum remains steady,” part of an X post read on the day.

“Still, we could see a gradual bleed, cascading block by block. While majors remain stable, a 5% BTC move could trigger 10–30% drops in alts.”

Click Here to Read the Full Original Article at Cointelegraph.com News…