What percentage of Bitcoin is owned by BlackRock?

BlackRock’s entry into the Bitcoin market through the iShares Bitcoin Trust (IBIT) has marked a new era in institutional Bitcoin accumulation.

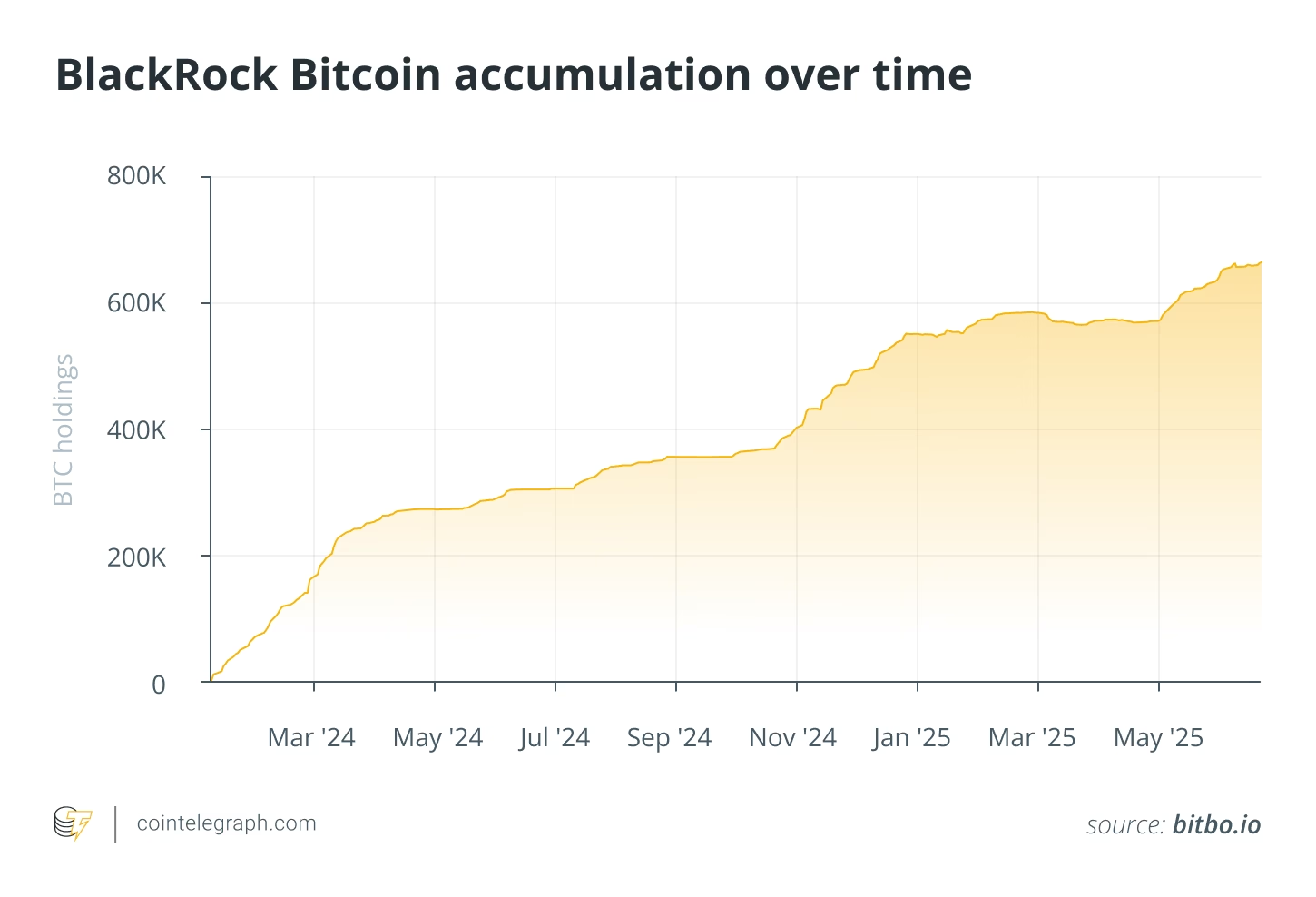

Since its launch on Jan. 11, 2024, IBIT has grown at a pace that few expected, and no other ETF has matched. As of June 10, 2025, BlackRock holds over 662,500 BTC, accounting for more than 3% of Bitcoin’s total supply. At today’s prices, that’s $72.4 billion in Bitcoin exposure, a staggering figure by any measure.

For comparison, it took SPDR Gold Shares (GLD) over 1,600 trading days to reach $70 billion in assets under management. IBIT did it in just 341 days, making it the fastest-growing ETF in history. In addition to being a milestone for BlackRock itself, this fact also shows us how deeply institutional interest in Bitcoin has matured.

BlackRock’s Bitcoin holdings now eclipse those of many centralized exchanges and even major corporate holders like Strategy. In terms of raw Bitcoin ownership, only Satoshi Nakamoto’s estimated 1.1 million BTC outnumbers IBIT, and that lead is narrowing.

If inflows continue at the current pace, IBIT may eventually become the single largest holder of Bitcoin, a major change for Bitcoin supply distribution and ownership concentration.

BlackRock Bitcoin accumulation over time

Did you know? Coinbase Custody, not BlackRock, holds the private keys for the BTC in IBIT, safely storing client assets offline and backed by commercial insurance.

Why is BlackRock betting big on Bitcoin in 2025?

Behind BlackRock’s massive allocation is a strategic shift in how it views Bitcoin: as a legitimate component of long-term, diversified portfolios.

The BlackRock Bitcoin strategy

BlackRock’s internal thesis embraces Bitcoin’s volatility as a tradeoff for its potential upside. With IBIT, they’re betting that broader adoption will stabilize the asset over time, improving price discovery, increasing liquidity and narrowing spreads.

In this view, Bitcoin is a long-term play on monetary evolution and digital asset infrastructure.

This philosophy (coming from the world’s largest asset manager) sends a strong signal to peers. It reframes the conversation around institutional adoption of Bitcoin, shifting it from “whether” to “how much” exposure is appropriate.

The investment case for institutional…

Click Here to Read the Full Original Article at Cointelegraph.com News…