Bitcoin dropped below a key support level Thursday after US Treasury Secretary Scott Bessent said the government had no plans to make additional purchases of Bitcoin for its strategic reserve and separate digital asset stockpile.

Bitcoin (BTC) fell below the $120,000 psychological support level and traded at $118,730 at the time of writing, hours after hitting an all-time high of $124,457 earlier on Thursday, Cointelegraph data showed.

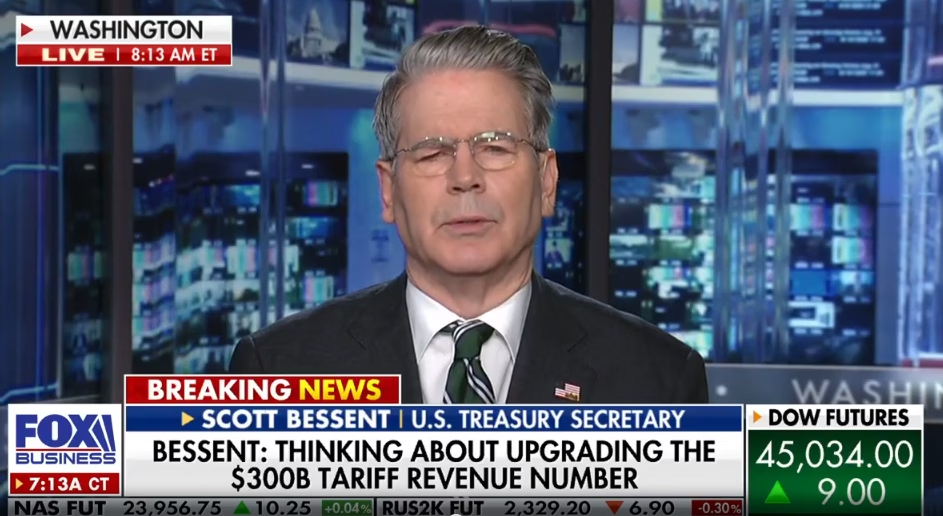

The decline followed Bessent’s comments in an interview with Fox Business, where he confirmed the government would not buy more Bitcoin.

“We’ve also started to get into the 21st century, a Bitcoin reserve. We’re not going to be buying that, but we are going to use confiscated assets and continue to build that up,” Bessent said.

US President Donald Trump signed an executive order on March 6 establishing both a strategic Bitcoin reserve and a separate digital asset stockpile, both of which would initially use cryptocurrency forfeited in government criminal cases. Trump’s order opened the door for additional Bitcoin purchases by the US Treasury via “budget neutral” strategies that “do not impose incremental costs on United States taxpayers.”

In March, Bessent advocated for a strategic shift in the US approach to its Bitcoin reserve, telling CNBC and signaling at the White House Crypto Summit that the government should stop selling seized Bitcoin and “bring it onshore” using established regulatory frameworks.

He said that after victims of financial misconduct are compensated, any remaining seized coins would be added to a national Bitcoin reserve, putting the US in a position to lead in global crypto.

In April, Bo Hines, who at the time was a part of the Presidential Council of Advisers for Digital Assets, said the administration was exploring funding options for Bitcoin acquisitions, including tariff revenue and a reevaluation of the Treasury’s gold certificates.

Thursday’s drop came just hours after Bitcoin briefly overtook Google’s $2.4 trillion market capitalization to become the fifth-largest global asset, before optimism faded on the Treasury’s stance.

Related: Bitcoin’s corporate boom raises ‘Fort Knox’ nationalization concerns

“We’re going to stop selling” Bitcoin: Bessent

In a silver lining to the sentiment-dampening statement, the Bessent did confirm that the US does not plan to sell any of…

Click Here to Read the Full Original Article at Cointelegraph.com News…