Key takeaways:

-

Ether derivatives data shows weak demand for leveraged bullish positions.

-

Corporations and TradFi favor independent layer-1 chains, challenging Ethereum’s dominance in decentralized finance.

Ether (ETH) surged to $4,518 on Tuesday as traders showed a higher risk appetite following a modest 0.1% rise in US consumer inflation. Yet, beneath the surface, derivatives data suggests the rally’s strength may be overstated, particularly as some major companies are pursuing their own layer-1 strategies instead of building on Ethereum’s layer-2 ecosystem.

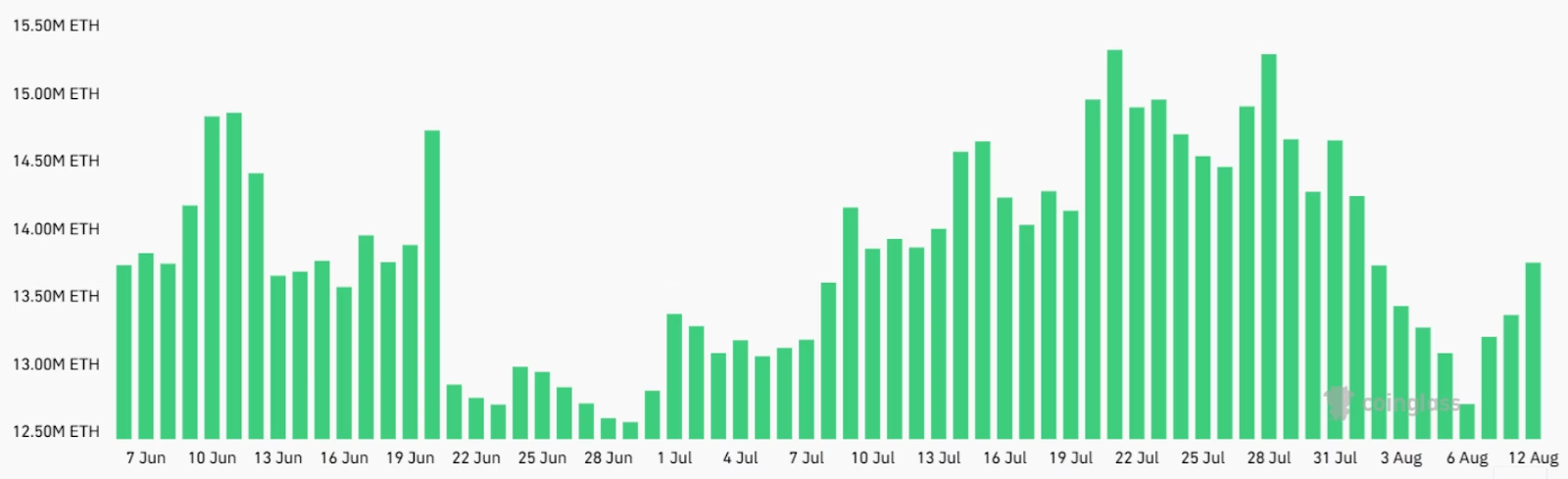

The ETH futures aggregate open interest rose to $60.8 billion, up from $47 billion a week earlier. However, the increase stems mainly from ETH’s price appreciation, as open interest in Ether terms remains 11% below the July 27 peak of 15.5 million ETH.

ETH derivatives signal weak demand for leveraged bullish positions

Derivatives metrics show reduced demand for leveraged bullish exposure despite strong spot market gains.

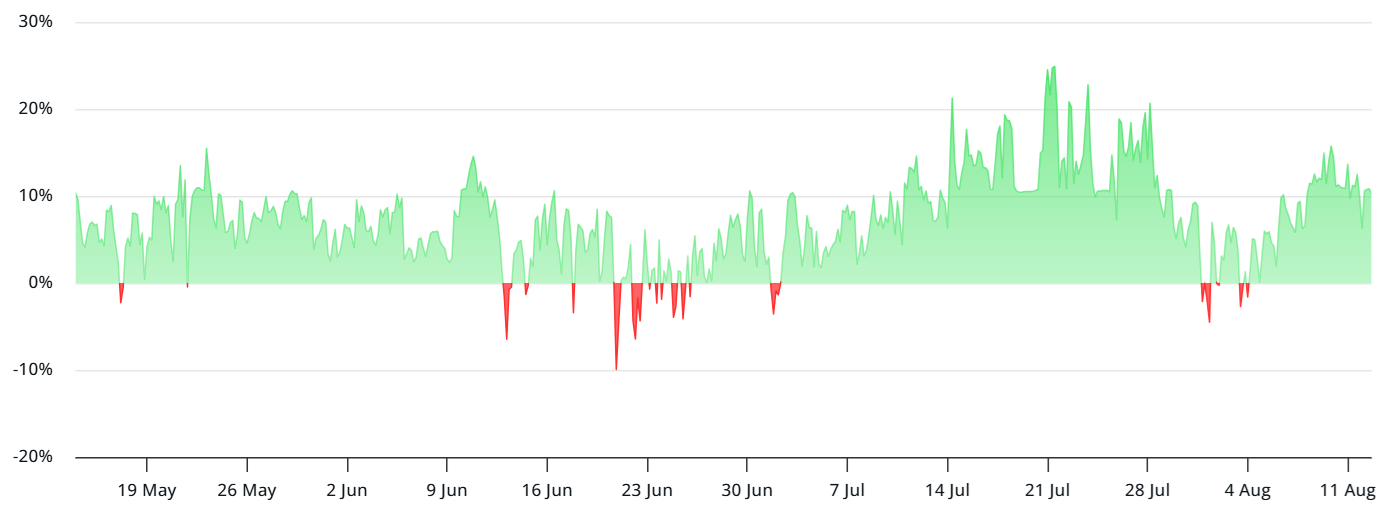

The ETH perpetual futures annualized premium is now 11%, considered neutral. Readings above 13% indicate excessive demand for leveraged long positions, last observed on Saturday. This lack of momentum from aggressive traders is notable given the magnitude of the recent price rally.

One should assess monthly ETH futures to gain an additional perspective, given that perpetual contracts are retail traders’ preferred instrument. These contracts with a set expiry date typically trade at a 5% to 10% annualized premium to spot prices, reflecting the extended settlement period.

After reaching 11% on Monday, the premium fell back to 8% on Tuesday. Despite a 32% increase in ETH price over the past 10 days, leveraged long interest has not returned to levels seen in previous bullish cycles, suggesting unease about Ethereum’s fundamentals and onchain activity trends.

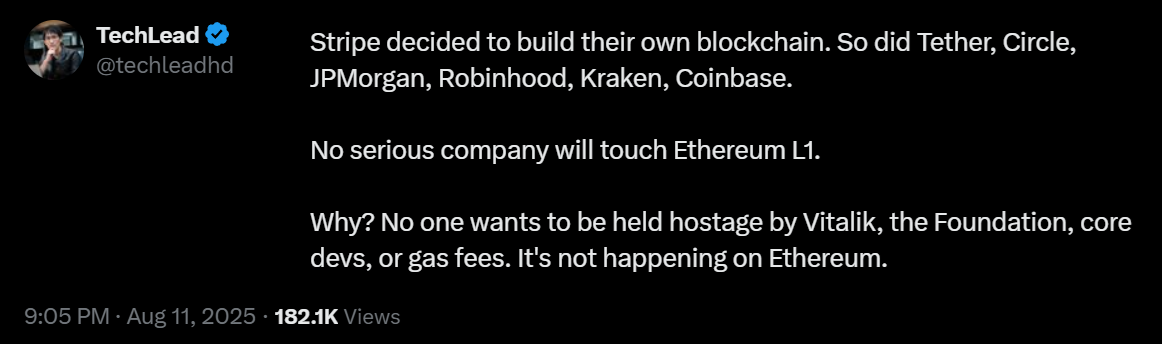

X user techleadhd noted that Stripe, Circle, Tether, and JPMorgan have launched their own chains rather than adopting Ethereum layer-2 solutions. While this view incorrectly assesses Coinbase and Robinhood, which remain anchored to Ethereum’s base layer, it illustrates that some enterprises prefer layer-1 control and tailored infrastructure.

Tokenized assets, including stablecoins backed by traditional reserves,…

Click Here to Read the Full Original Article at Cointelegraph.com News…