Key takeaways:

-

ETH rallied 41% in a month, but derivatives data shows traders remaining cautious, not bullish.

-

Institutional inflows and corporate Ether reserves suggest strong demand, yet recession risks cloud the outlook.

Ether (ETH) climbed to $4,349 on Monday, its highest price since December 2021. Despite outperforming the broader cryptocurrency market by more than 30% over the past 30 days, derivatives data shows ETH traders have yet to turn decisively bullish.

This has raised doubts about whether a rally to $5,000 is likely in the near term.

ETH has gained 41% in the past month, compared to a 9% increase in total crypto market capitalization. With such strong outperformance, demand for hedging naturally rises as traders lock in profits and rotate into other opportunities. The lack of appetite for leveraged bullish bets above $4,000 is therefore not unexpected.

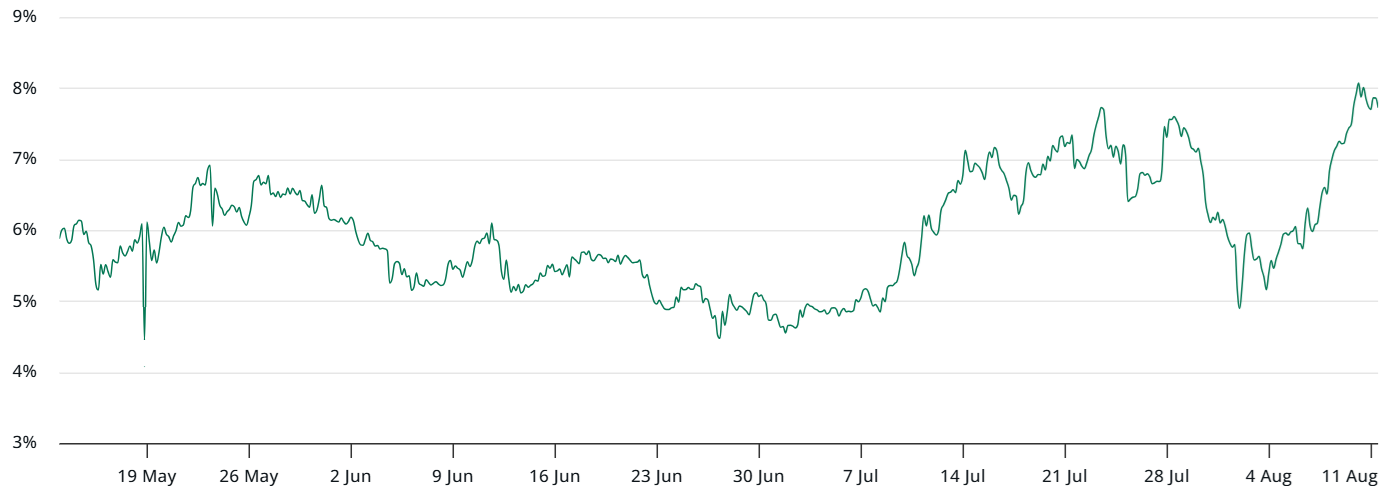

In neutral market conditions, monthly futures contracts typically trade at a 5% to 10% premium relative to spot markets to offset the longer settlement period. Yet despite ETH nearing six-month highs, this premium remains below a clear bullish threshold.

The lack of bullishness is somewhat concerning given that spot Ether exchange-traded funds attracted $683 million in net inflows between Thursday and Friday.

ETH options reflect neutral conditions despite rally

The ETH options market provides clues to gauge whether traders missed the rally and are waiting for a better entry or instead expect a price drop below $4,000.

In bearish setups, the options delta skew moves above the 6% neutral mark as put (sell) contracts command higher premiums. Conversely, excessive bullishness will drive the indicator below -6%.

Currently at -3%, the ETH options delta skew points to neutral sentiment. The metric has improved significantly since Aug. 2, when it briefly turned bearish after a 13% price drop.

Related: Ethereum’s Fusaka upgrade set for November – What you need to know

In short, professional traders are not aggressively bullish but are not expecting ETH to retest $4,000 either. Stronger institutional demand for ETH holdings helps explain this sentiment shift.

Publicly traded BitMine Immersion (BMNR) said Monday it added 317,126 ETH to its corporate reserves, valued at $1.35 billion at current prices….

Click Here to Read the Full Original Article at Cointelegraph.com News…