Bitcoin (BTC) starts a new week in an exciting place as price action knocks on new all-time highs.

-

Bitcoin surges to $122,000, the latest sign that price discovery is around the corner.

-

Dip discussions focus on the weekend’s CME gap, which offers $117,000 as a retracement target.

-

CPI and PPI are due this week as markets cement bets that the Federal Reserve will cut interest rates next month.

-

USDT transactions from whales suggest a lack of interest in profit-booking.

-

A red Coinbase Premium spells potential problems for Bitcoin during upcoming US trading sessions.

Bitcoin traders assess $122,000 weekend surge

Bitcoin price action wasted no time boosting the bulls after the weekly close.

A swift surge took BTC/USD beyond $122,000, and local highs of $122,312 on Bitstamp came before a retracement began, per data from Cointelegraph Markets Pro and TradingView.

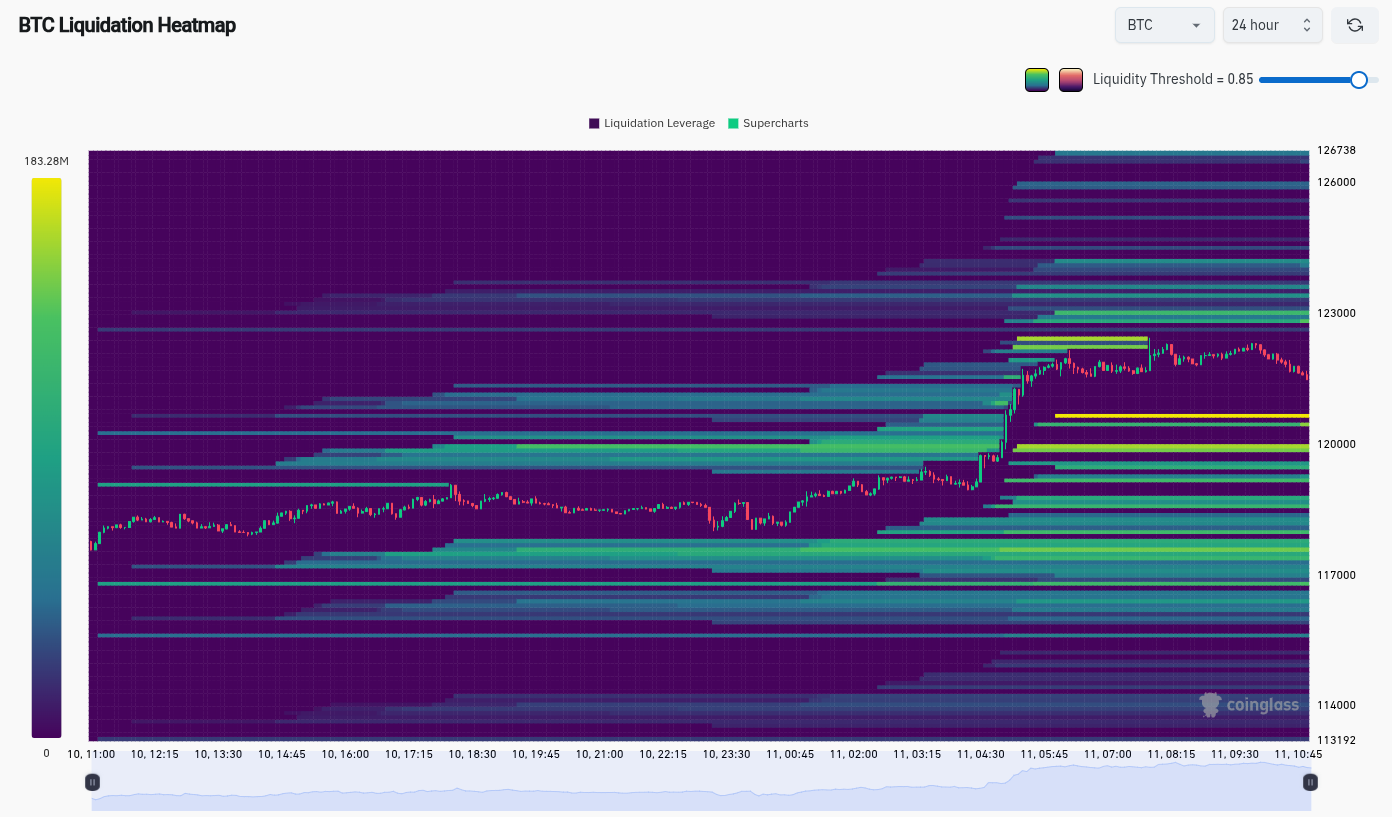

In doing so, Bitcoin liquidated over $100 million in short positions as it took out a wall of liquidity just below all-time highs.

Data from monitoring resource CoinGlass now shows resistance being added at $123,000 and above.

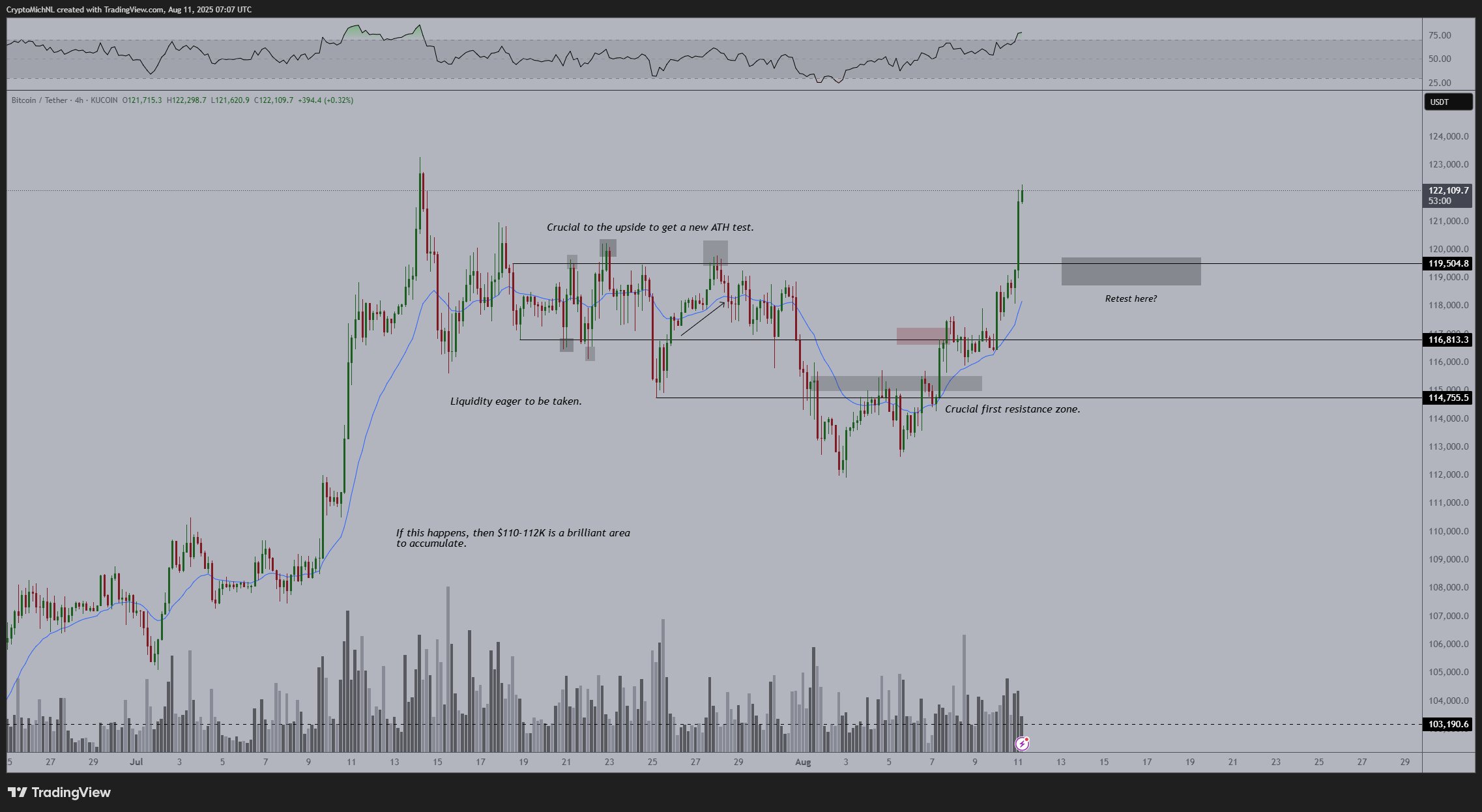

Reacting, market participants were relieved but cautious. BTC/USD, they argued, could well trend back down to consolidate gains before attacking all-time highs.

“Bitcoin looks great, almost a new all-time high. However, it’s a weekend move,” crypto trader, analyst and entrepreneur Michaël van de Poppe wrote in a post on X Monday.

“I would assume we’ll see some tests on lower levels before we’ll continue. Such a downwards test = violent move on Altcoins = buy the dip season.”

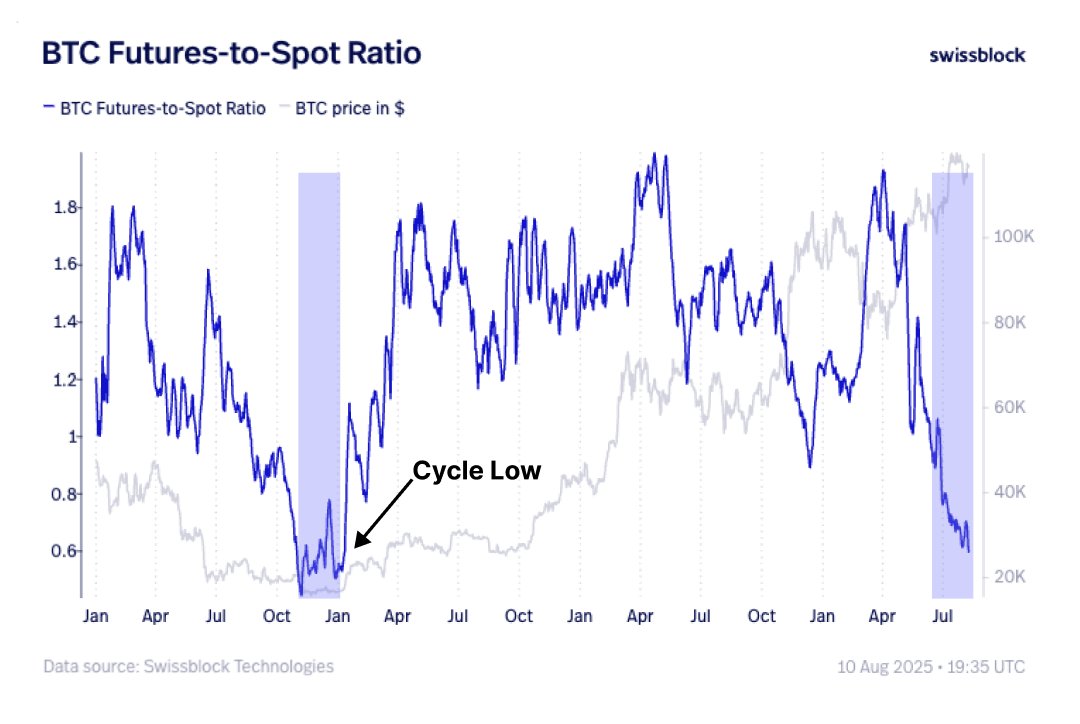

Eyeing overall leverage trends, meanwhile, popular trader BitBull had a bullish signal that should extend far beyond the current battle for price discovery.

The ratio of leveraged futures to spot buying is circling lows not seen since the pit of Bitcoin’s last bear market in late 2022.

“That’s a rare signal,” he summarized.

“It means this rally isn’t being propped up by leveraged longs that can get wiped out overnight. It’s being driven by spot demand, the kind that tends to hold through volatility.”

All eyes on the new Bitcoin CME gap

When it comes to a BTC price dip, market participants have one thing on their mind.

The weekend’s move up has created a new “gap”…

Click Here to Read the Full Original Article at Cointelegraph.com News…