Key takeaways:

-

Record global money supply growth is a big tailwind for Bitcoin.

-

Spot Bitcoin ETFs could soon surpass gold holdings, boosting BTC’s reserve-asset status.

-

Retail inflows remain limited but could ignite a strong rally if mainstream interest returns.

Bitcoin (BTC) last traded at $120,000 on July 23, prompting traders to question whether a new all-time high is still possible this year.

Global economic uncertainty and the sustainability of the artificial intelligence sector remain the biggest risks.

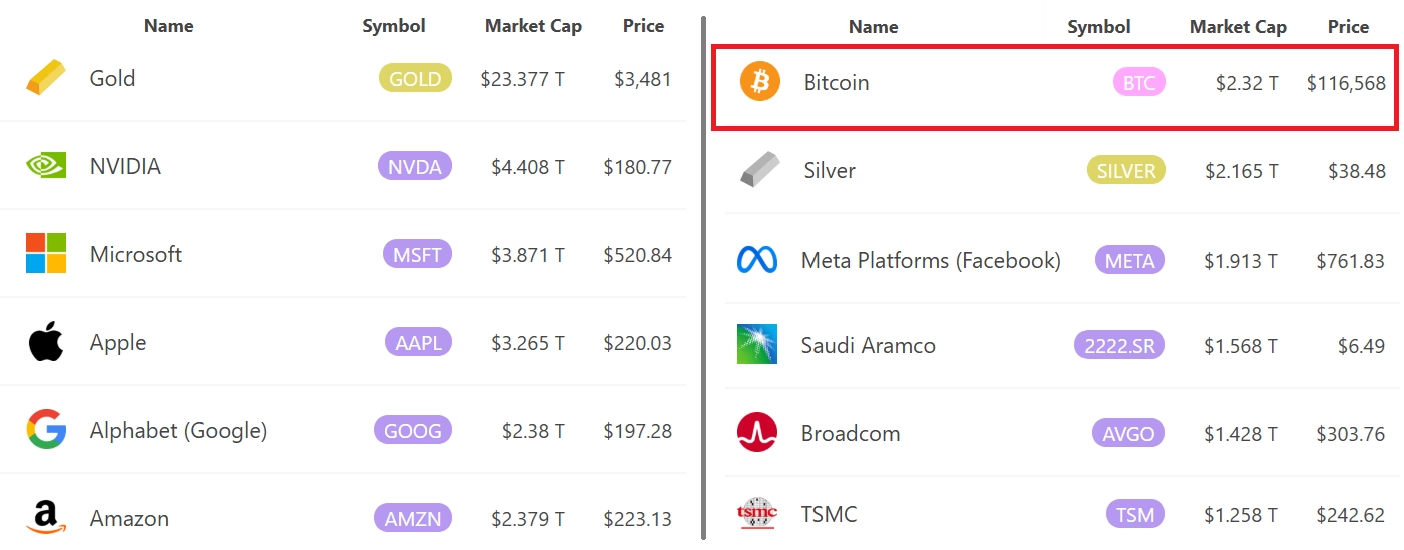

Still, three major near-to-medium-term drivers could set Bitcoin on a path well above its current $2.3 trillion market capitalization.

Some analysts expect Bitcoin to surpass gold’s $23 trillion valuation, while others argue that a full decoupling from tech stocks will take much longer as adoption remains in its early stages.

Even if investor perception does not shift, the expansion of the global monetary supply is laying the groundwork for a new paradigm, and Nvidia (NVDA) may be signaling that change.

Bitcoin trades like Nvidia, Strategy and Metaplanet

Nvidia’s valuation surged to $4.4 trillion from $2.3 trillion in March, despite its latest quarterly net income being flat compared to six months earlier.

Traders may be betting on much higher future earnings, or valuation metrics may be losing relevance as governments are expected to accelerate monetary expansion due to mounting fiscal debt.

The M2 global money supply across the 21 largest central banks reached a record $55.5 trillion in July, while the United States federal budget deficit totaled $1.3 trillion in just nine months.

Such conditions support the case for Bitcoin bulls, even if BTC’s relatively strong correlation with tech stocks continues.

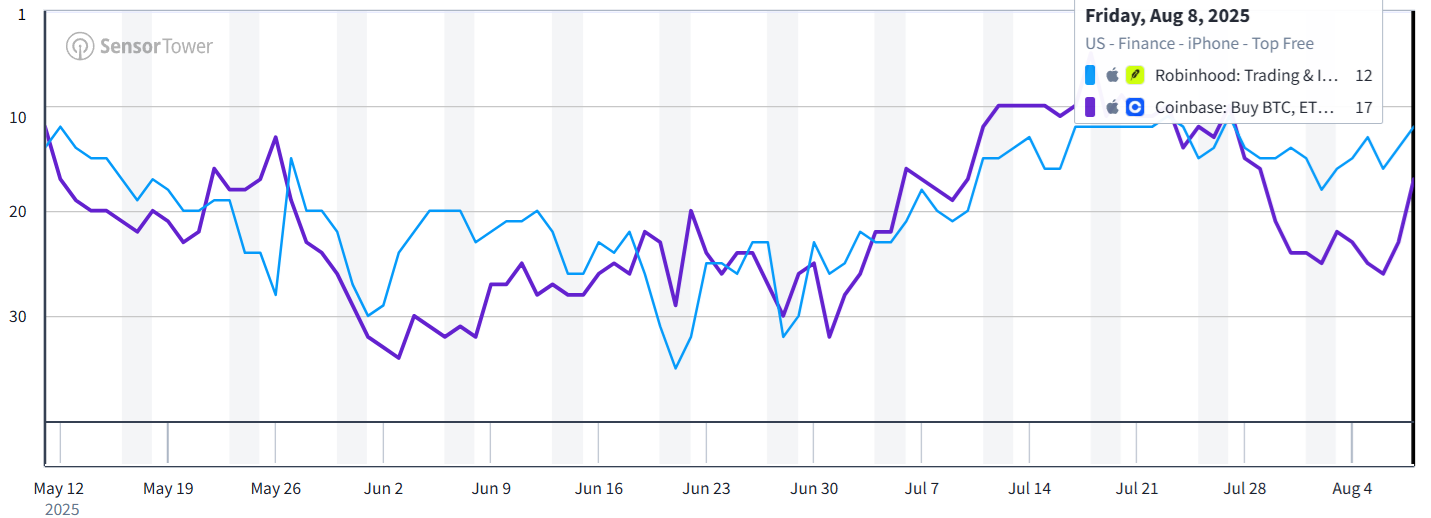

However, retail inflows are still largely absent despite Bitcoin’s 116% gains over the past year, but that is expected to change.

The gap compared to the S&P 500’s 22% annual return acts as a magnet for new capital, particularly as the cryptocurrency gains traction in mainstream media with companies like Strategy (MSTR) and MetaPlanet (MTPLF) grabbing headlines.

Related: Bitcoin company Metaplanet kicks off August with first big buy

Currently, crypto apps such as Coinbase and Robinhood show little sign of retail investor…

Click Here to Read the Full Original Article at Cointelegraph.com News…