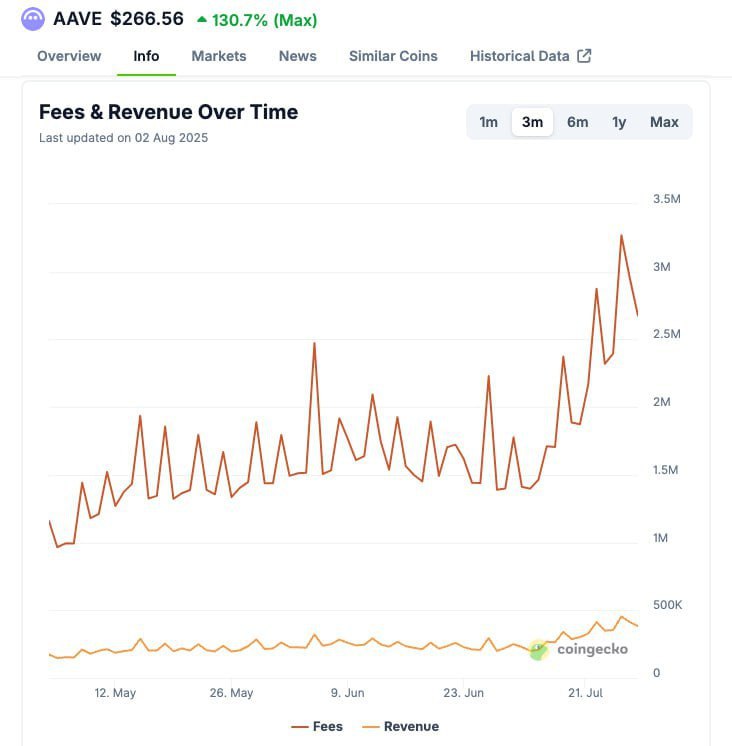

- Aave’s daily fees increased by around 200% within the last three months.

- They hit multi-month peaks of over $3 million per day, indicating intensified borrowing.

- The surge reflects reinvigorated DeFi lending interest.

Aave continues to dominate the DeFi lending market, this time attracting attention with serious figures.

CoinGecko data shows daily fees on the blockchain have increased by more than 200% since May.

That signals amplified on-chain activity and soaring demand for decentralised liquidity.

Most importantly, the statistics signal DeFi borrowing resurgences.

The chart shows AAVE’s 24-hour fees were below $1.2 million in early May.

It had surpassed 43 million as of the end of July, printing multi-month highs.

Revenue saw a modest gain (still below $500K) compared to collected fees, but the increase reflected enriched platform profitability.

Furthermore, the chart reflects significant dips and spikes in fee activity, which indicates healthy volatility.

Such fluctuations suggest an active lending market with healthy utilisation, and not instability.

Meanwhile, daily fees are the revenue engine for Aave.

The prevailing trend signals emerging resurgences for the protocol that saw flattened activity early in the year.

What’s driving Aave fees?

Borrowing demand is at the centre of the surging daily fees in the ecosystem.

Individuals pay interest whenever they borrow on Aave, and these payments account for the highest portion of the daily fees.

Fee income increases when more users take loans, possibly to chase price actions or leverage yield opportunities.

Also, the latest integrations have propelled fees.

For instance, users have deployed more than $60 million into yield-generating opportunities via MetaMask’s Aave-powered Stablecoin Earn feature.

In just one week, over $60M is generating yield through @MetaMask‘s new Stablecoin Earn product.

Powered by Aave. pic.twitter.com/mYcaQnkgyZ

— Aave (@aave) August 4, 2025

Such streamlined plug-ins make it smooth for retailers to access lending markets, enriching demand for AAVE’s liquidity pools.

Moreover, the latest stable Ethereum price actions have encouraged users to (directly) interact with dApps again.