USDT profitability — Tether profit 2024

In the first half of 2024, Tether quietly posted one of the biggest profit hauls in crypto history, pulling in a staggering $5.2 billion across just two quarters.

That’s not a typo: $4.52 billion in Q1, followed by another $1.3 billion in Q2.

Contrary to popular belief, this windfall didn’t come from trading fees or printing more USDt (USDT). It came almost entirely from interest income on Tether’s reserve assets — mainly US Treasuries.

By mid-2024, Tether had accumulated $97.6 billion worth of US government debt, quietly becoming one of the world’s largest holders of Treasurys, outpacing the reserves of many sovereign nations.

This all reveals a key part of the stablecoin business model: Users deposit fiat (like USD), and in return, Tether mints USDT while investing those dollars into low-risk, yield-generating assets.

So, if you’ve ever wondered how stablecoins make money, this is it: Fiat-backed stablecoins like Tether’s USDT act as financial intermediaries. With global interest rates still elevated, that passive income engine is now more powerful than ever.

Did you know? The world’s first stablecoin was BitUSD, launched in July 2014. Created by blockchain pioneers Charles Hoskinson and Dan Larimer on the BitShares platform, BitUSD attempted to maintain its peg by locking BTS tokens into smart contracts as collateral.

How Tether makes money

Stablecoin issuers don’t lend money like traditional banks, but they often earn just as much.

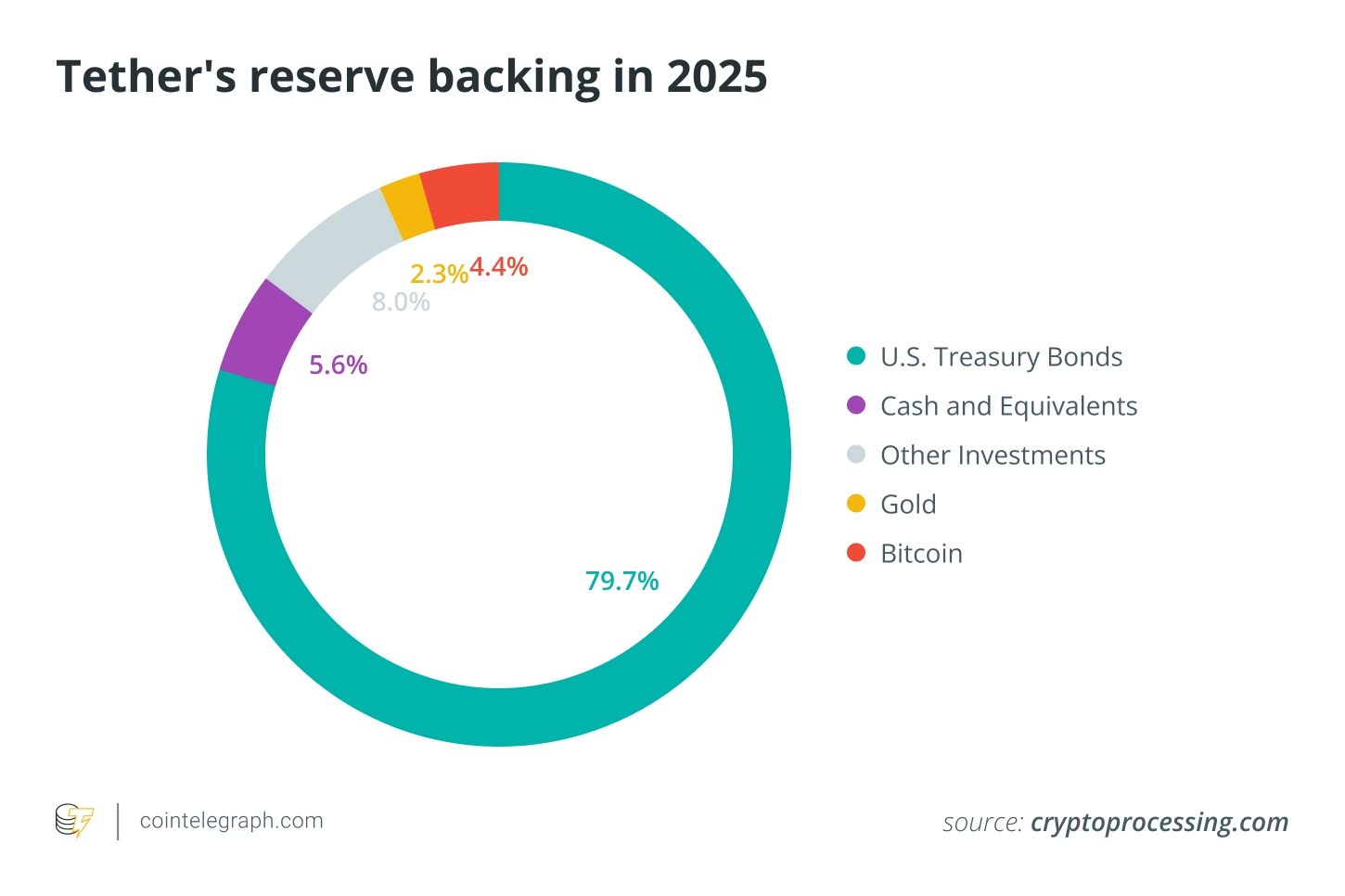

As of March 2025, Tether’s total exposure to US Treasurys — spanning direct holdings, reverse repos and money market funds — approached $120 billion. That makes it one of the top 20 Treasury holders worldwide, with exposure larger than many governments.

But Treasurys are just one piece of the puzzle. Tether’s diversified reserve strategy includes gold, Bitcoin (BTC) and secured loans, offering both yield and protection against volatility. In Q1 2025, for example, gold positions helped buffer swings in crypto markets, showcasing how crypto pegging mechanisms can rely on a mix of hard assets, not just dollars.

Meanwhile, Tether’s ongoing issuance of collateralized loans (backed by its reserves) adds another revenue layer. Though less publicized, these loans have historically brought in hundreds of millions annually.

Click Here to Read the Full Original Article at Cointelegraph.com News…