Key takeaways:

Gold price rose 3% between May 29 and June 2, reaching its highest level in over three weeks, while Bitcoin (BTC) is holding above $105,000.

Weaker dollar forces investors elsewhere

Although this short-term underperformance might seem negative at first glance, several macroeconomic indicators suggest Bitcoin could break out sooner than expected.

The US Dollar Index (DXY) has dropped to its lowest level in six weeks, signaling that investors are reducing their exposure to the US currency. Typically, this trend reflects declining confidence in the Federal Reserve’s monetary policy and/or growing concerns about the sustainability of US government debt.

US Treasury Secretary Scott Bessent told CBS on May 1 that the country “is never going to default,” adding that “we are on the warning track.”

These remarks came after JPMorgan Chase CEO Jamie Dimon raised alarms following a House of Representatives bill proposing an additional $4 trillion increase to the debt ceiling.

A weaker DXY Index encourages holders of the $31.2 trillion in outstanding US federal debt to seek returns elsewhere. While fixed-income investments offer predictable returns, the value of the US dollar remains volatile. If foreign currency-based investments deliver better yields, capital is likely to shift away from the dollar.

US has incentives to diversify gold reserves

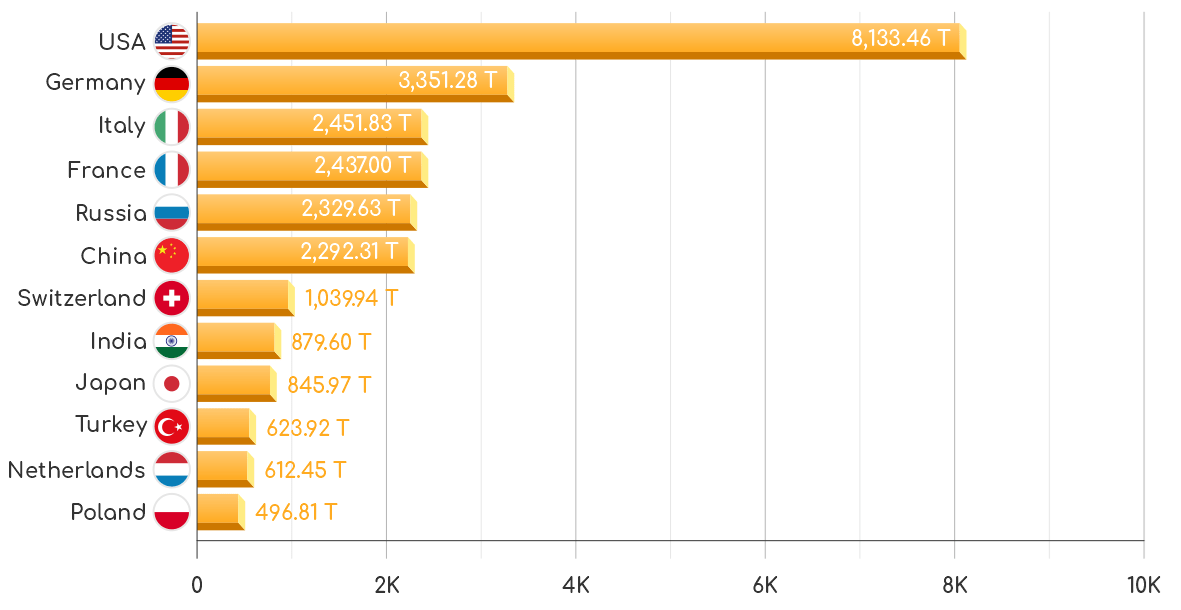

Despite gold’s appeal, there are a few factors that could limit investor demand. The US government is the largest holder of the precious metal, meaning the Treasury could sell part of its reserves to strengthen its fiscal position. Repurchasing some of its debt, especially long-term bonds, would likely boost the US dollar.

Even if the US were to divest 17% of its gold reserves, equivalent to $171.8 billion at current prices, it would still lead global rankings by a wide margin of over 100%. However, while substantial, that amount would only cover around three weeks of the federal deficit, making the effort relatively ineffective.

Related: Blockchain Group adds $68M in Bitcoin to corporate treasury

In contrast, a $171.8 billion investment in Bitcoin would firmly establish US dominance in the asset, easily surpassing China’s estimated holdings of 190,000 BTC. More importantly, this scenario is already plausible following the signing of the Strategic…

Click Here to Read the Full Original Article at Cointelegraph.com News…