Key points:

-

Monetary stimulus in China and Europe increases investors’ focus on Bitcoin price.

-

The US Federal Reserve is under political pressure to cut rates, as the DXY weakens.

-

Bitcoin’s decoupling from traditional markets continues to gain attention.

Bitcoin (BTC) traders are somewhat puzzled by BTC price jumping to $85,000, especially since the S&P 500 index has dropped 5.7% in April, and this move came after the cryptocurrency managed a 14% rebound off its trade-war induced crash to $74,400. Investors are cautiously optimistic, but multiple events and data points to further gains above $90,000.

Several metrics and events support a “decoupling,” meaning Bitcoin’s price is not closely following traditional financial instruments. However, some skepticism emerges as BTC has not matched gold’s performance. Gold reached an all-time high of $3,358 on April 16, leading to speculation that governments and central banks are increasing their gold reserves.

Global stimulus rises as US economy shows early weakness

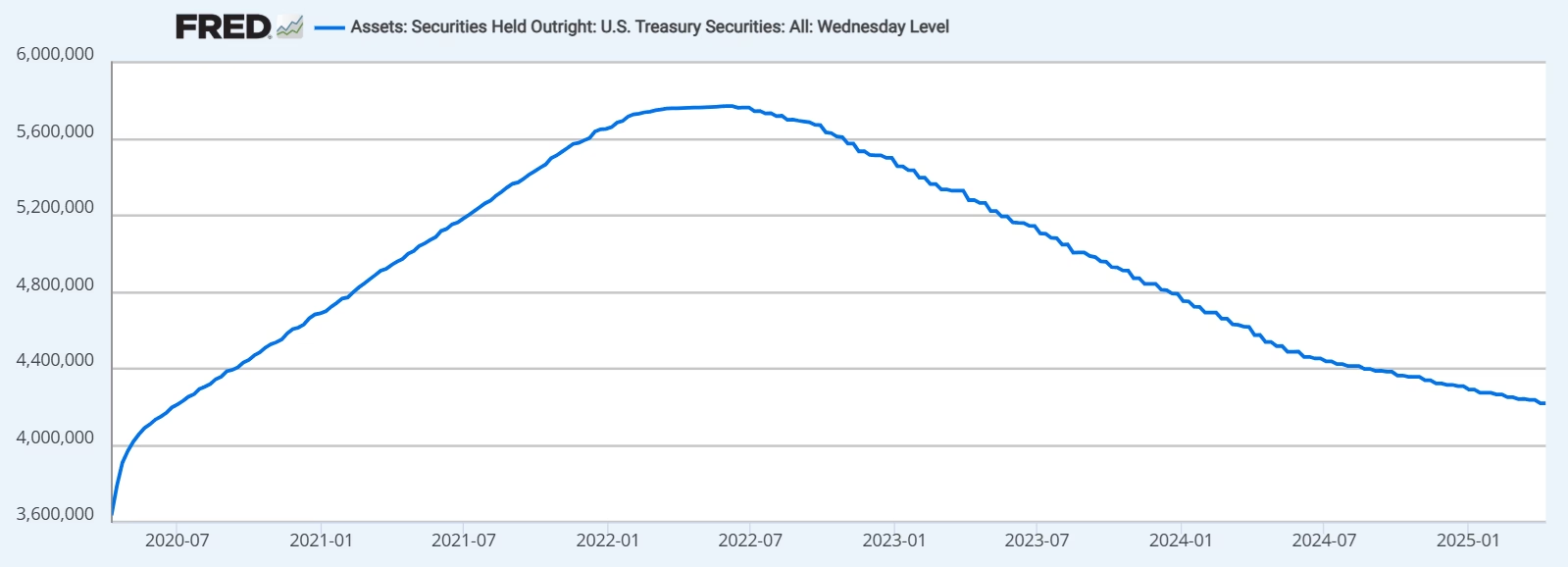

As central banks respond to the threat of an economic recession, the chances of an increase in monetary supply are rising. While the US Federal Reserve (Fed) has held off on lowering interest rates or expanding its balance sheet, other nations have already taken such steps. This puts more pressure on the US economy, which is starting to show signs of weakness.

In China, new bank loans in March rebounded more than expected to $500 billion, over 20% higher than analysts had predicted and a strong recovery from the previous month’s decline. According to Reuters, the PBOC has promised to increase stimulus measures to reduce the impact of the trade war with the United States.

On April 17, the European Central Bank cut interest rates for the seventh time in a year to support the eurozone economy. The ECB has lowered the cost of capital to its lowest level since late 2022. Several investment banks have also reduced their inflation forecasts for the region, as the tariff war could reduce the region’s gross domestic product by 0.5%, according to Reuters.

Weaker US dollar and Bitcoin miners’ long-term commitment

Further adding pressure on the US Federal Reserve to end its restrictive monetary policy is the weakening of the US dollar compared to major global currencies, as the DXY Index has dropped to its lowest level in three years. A weaker dollar usually helps exports, which can be…

Click Here to Read the Full Original Article at Cointelegraph.com News…