Until Bitcoin (BTC) breaks its long-established $25-30k trading range, the crypto market is arguably in what some analysts have called a “crab market”. It is likely that a decisive macroeconomic or crypto-specific catalyst will be necessary to break out of it. This failed to occur in the month of September.

BTC price briefly tested the lower end of the established trading range and touched $25,200. In the second half of the month, however, the price recovered to $26,900 and posted a monthly close of +3.92%. This both bucked the historical trend of negative closes in September and went against traditional markets. The S&P 500 was down 5.4% over the same time frame.

However, Bitcoin’s relative resilience did not stabilize the industry as a whole. Crypto stocks were hit with an even bigger correction than the S&P, and altcoins continued their month-long losing streak against BTC. As every month, the Cointelegraph Research Monthly Trends report provides an overview of industry-wide developments. It is an invaluable resource, especially in bear market conditions when many of the less mature sectors of the industry drop out of the news headlines.

The report is available for Pro subscribers on the Cointelegraph Research Terminal.

Major mining companies down 30%

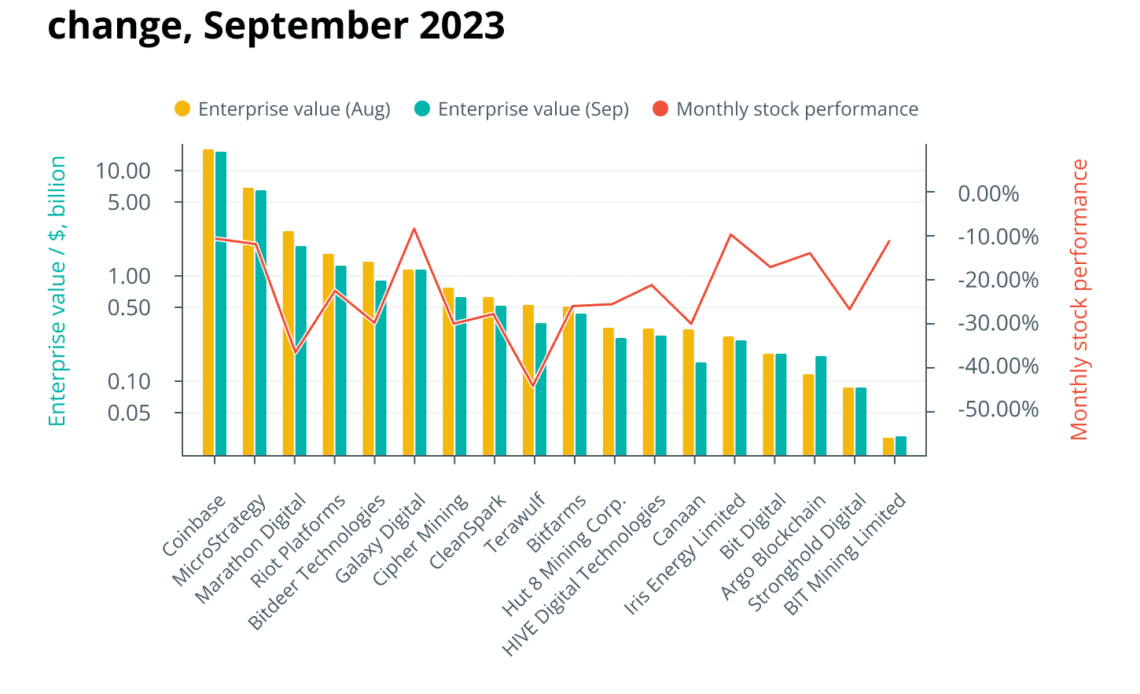

Most publicly traded crypto companies faced a challenging month in September and their stocks underperformed. In many cases, share prices dropped by 10%–40% and the sector averaged a decline of 22.4%. Especially the crypto mining stocks were hit hard.

TeraWulf, Marathon Digital and Iris Energy Limited all lost almost one-third of their valuation. The miners affected by these large corrections had rallied massively in the first half of the year, sometimes gaining +300%. However, share prices started to decline in July and have now mostly erased these previous gains. Some of the reasons for this correction are specific to the mining sector and are unlikely to affect crypto more widely.

Bitmain releases new Antminer iteration

The large corrections in the stocks of the mining stocks can, among other things, be attributed to a tightening of mining economics. In April of next year, the next Bitcoin halving event will occur, which will slash rewards for validating votes in half overnight. Despite this outlook, network hashrate and difficulty show no signs of slowing down and keep hitting all-time highs.

The result is that Bitcoin mining is becoming increasingly competitive by the day and profit margins…

Click Here to Read the Full Original Article at Cointelegraph.com News…