Since September, Chainlink (LINK) price has gained more than 25%, outperforming Bitcoin (BTC), Ethereum (ETH) and most altcoins. Currently, the project is the leading decentralized blockchain oracle solution and ranks 15th in terms of market capitalization when excluding stablecoins.

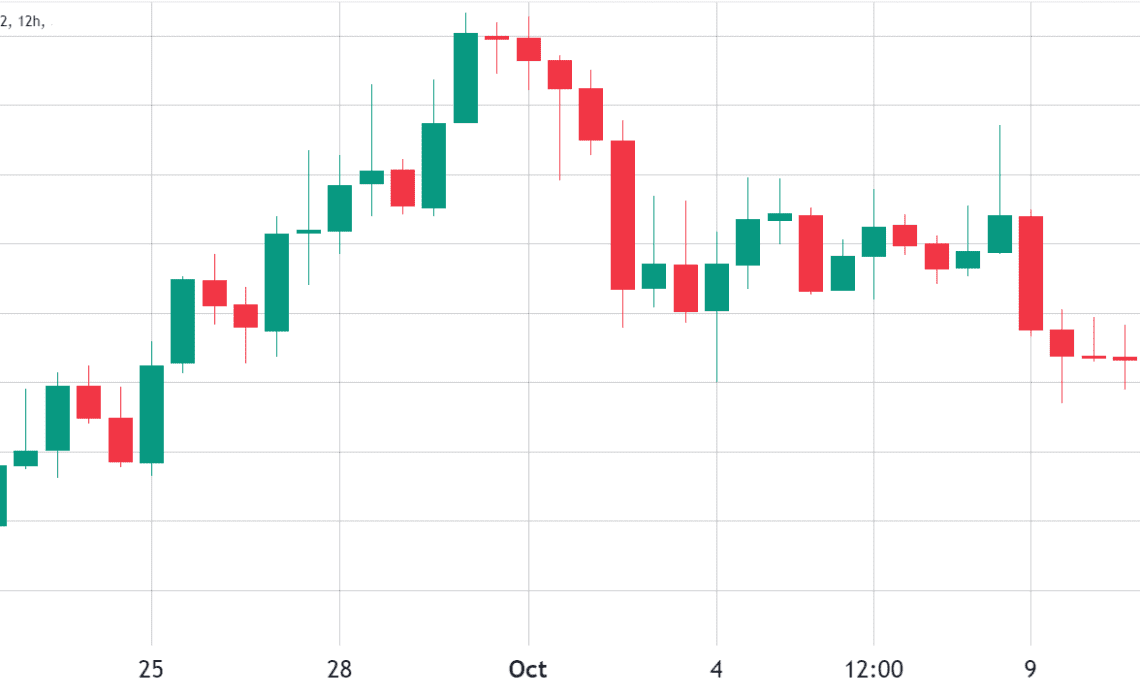

In September, LINK’s price surged by an impressive 35.5%, but in the month-to-date performance for October, LINK has faced a 10% correction. Investors are concerned that breaking the $7.20 support level may lead to further downward pressure, potentially erasing all the gains from the previous month.

It’s worth noting that the closing price of $8.21 on Sept. 30 marked the highest point in over 10 weeks, but when looking at the bigger picture, Chainlink’s price still remains 86% below its all-time high in May 2021. Moreover, over the past 12 months, LINK has shown little growth, while Ether (ETH) gained 21.5% in the same period.

LINK marines placed all their hope on the SWIFT experiment

The LINK bull run began after SWIFT, the leader in messaging for international financial transactions, released a report on Sept. 31 titled “Connecting Blockchains: Overcoming Fragmentation in Tokenized Assets,” suggesting that linking existing systems to blockchains is more feasible than unifying different central bank digital currencies (CBDC).

Following a series of tests, SWIFT reported its capability to provide a single access point to multiple networks using existing infrastructure. This system relied on Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and was said to significantly reduce operational costs and challenges for institutions supporting tokenized assets.

Part of the surge in Chainlink’s value can also be attributed to the successful testing of their Australian dollar stablecoin by the Australia and New Zealand Banking Group (ANZ) using Chainlink’s CCIP solution. In a statement dated Sept. 14, ANZ described the transaction as a “milestone” moment for the bank. Nigel Dobson, ANZ’s banking executive, noted that ANZ sees “real value” in tokenizing real-world assets, a move that could potentially revolutionize the banking industry.

On Sept. 21, Chainlink announced the mainnet launch of the CCIP protocol on the Ethereum layer-2 protocol Arbitrum One, aimed at driving cross-chain decentralized application development. This integration provides access to Arbitrum’s high-throughput, low-cost scaling solution. StarkWare,…

Click Here to Read the Full Original Article at Cointelegraph.com News…