Bitcoin (BTC) hit new October lows after the Oct. 11 Wall Street open as one analyst hailed the “final stage” of the cryptocurrency bear market.

Bitcoin traders stress importance of $26,800

Data from Cointelegraph Markets Pro and TradingView showed further BTC price weakness emerging, costing bulls $27,000 support.

At the time of writing, the largest cryptocurrency was headed toward $26,600 as downside gained momentum.

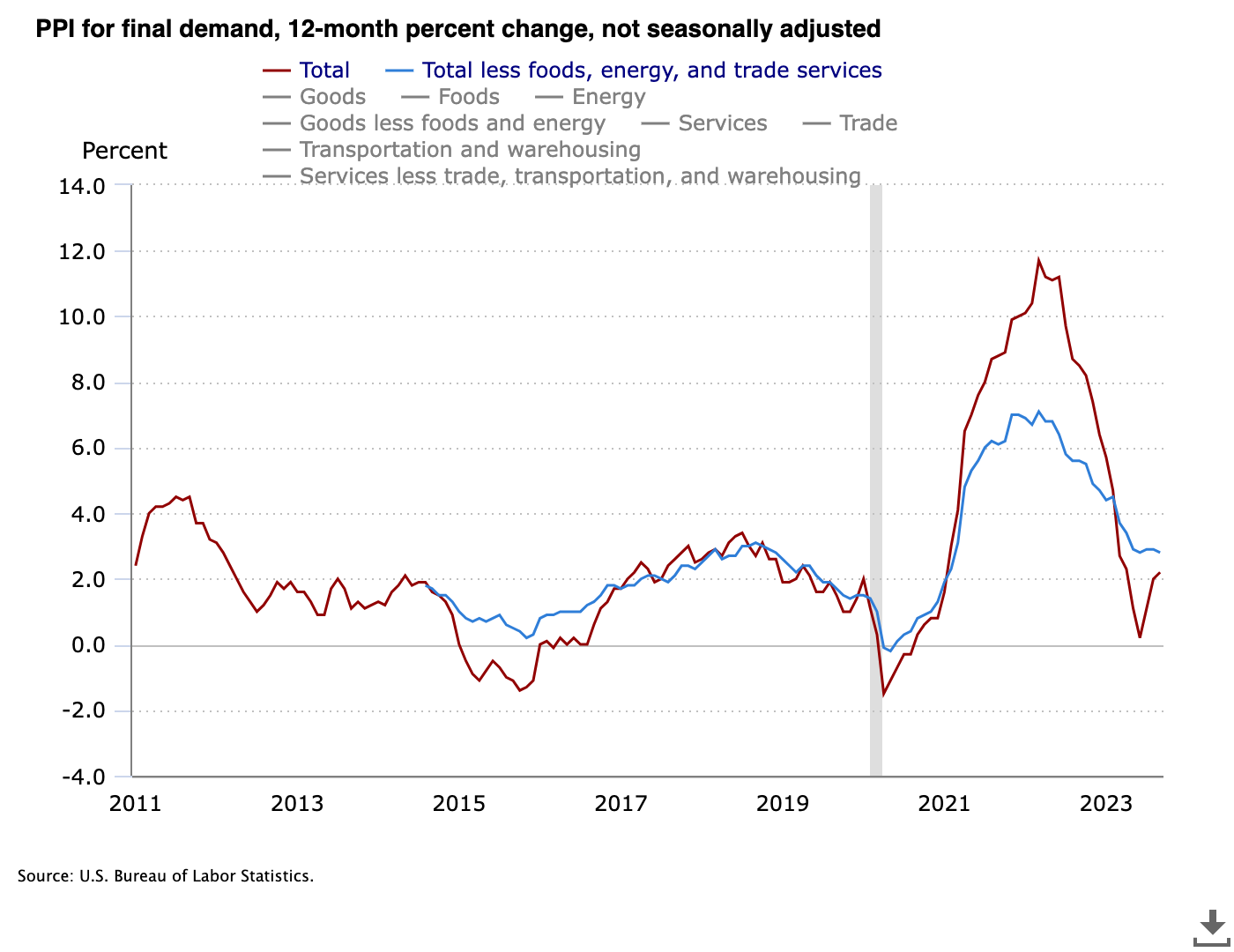

The move followed United States inflation data in the form of the Producer Price Index (PPI), the September print for which came in above expectations — 2.2% versus 1.6% year-on-year (YoY). This added to concerns about lingering U.S. inflation pressures, with dollar strength up and risk assets down.

“PPI coming in hotter than expected, meaning that the $DXY will probably have a bounce upwards and Bitcoin some corrections south. Still monitoring the lower boundaries here for potential entries,” Michaël van de Poppe, founder and CEO of MN Trading, commented on X.

Having already lost $1,000 since a “death cross” completed on the daily chart at the start of the week, Bitcoin thus hit its lowest levels since Sep. 29. In so doing, it canceled out its previous October gains, and with it removed the month’s status as a classic “Uptober.”

“The final stage of the bear market for Crypto,” Van de Poppe continued.

“We might be reversing here already in October, going into an uptrend in November (retesting the $26,800 area) or we might be reversing at the end of December for a pre-halving & ETF rally. Good times are ahead for Bitcoin.”

Following the action, popular trader Skew also highlighted $26,800 as a crucial level within the current range.

“Will wait for close but looking like a rejection so far also last area for bulls to do something imo ~ $26.8K,” he told X subscribers about the 4-hour chart.

At the same time, fellow trader Daan Crypto Trades noted multi-month highs in open interest, high levels having triggered the bouts of volatility, which characterized the first week of the month.

#Bitcoin At it’s highest Open Interest level since the August dump.

Usually this is met by some kind of squeeze from this point. pic.twitter.com/IZuhVbt6lt

— Daan Crypto Trades (@DaanCrypto) October 11, 2023

Binance order book shows thin bids

Prior to the PPI release, monitoring resource Material Indicators showed a lack of bid…

Click Here to Read the Full Original Article at Cointelegraph.com News…