Bitcoin (BTC) eased volatility into Oct. 6 as BTC price downside preparations returned.

Bitcoin keeps liquidations limited amid long, sh “squeeze”

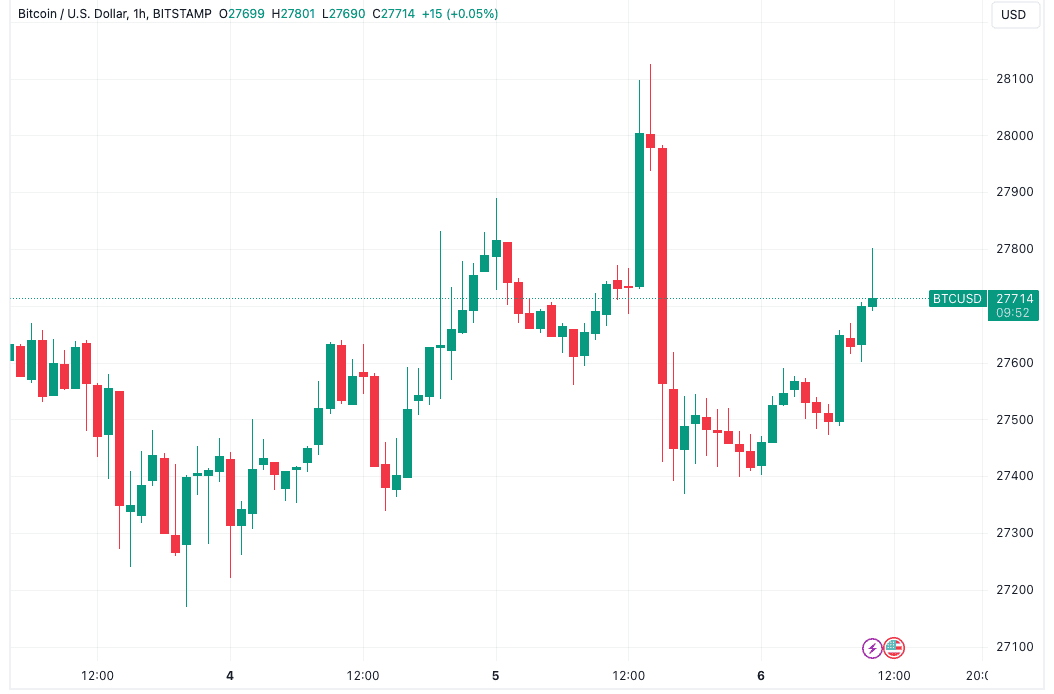

Data from Cointelegraph Markets Pro and TradingView covered a flatter 24 hours for BTC/USD after a failed retest of $28,000.

After lingering in a narrow range around 1.5% lower, the largest cryptocurrency was again pushing toward the $28,000 mark ahead of the Wall Street open, yet fielded fresh concerns from market participants over potential losses to come.

I remain just in my long from $26,000 for now, but will be closing that and entering a short if we lose $27,200 support below us. Alerts are set and i am on standby pic.twitter.com/mcS9Zcp5zN

— Crypto Tony (@CryptoTony__) October 6, 2023

Popular trader Daan Crypto Trades eyed an ongoing tussle between two key moving averages (MAs) on one-day timeframes.

“Whether the Daily 200MA (Purple) or the Daily 200EMA (Blue) gives in first, will likely determine the trend for the rest of October if I had to guess,” he wrote alongside a chart in an X post on Oct. 4.

“$27K & $28K. The battle continues.”

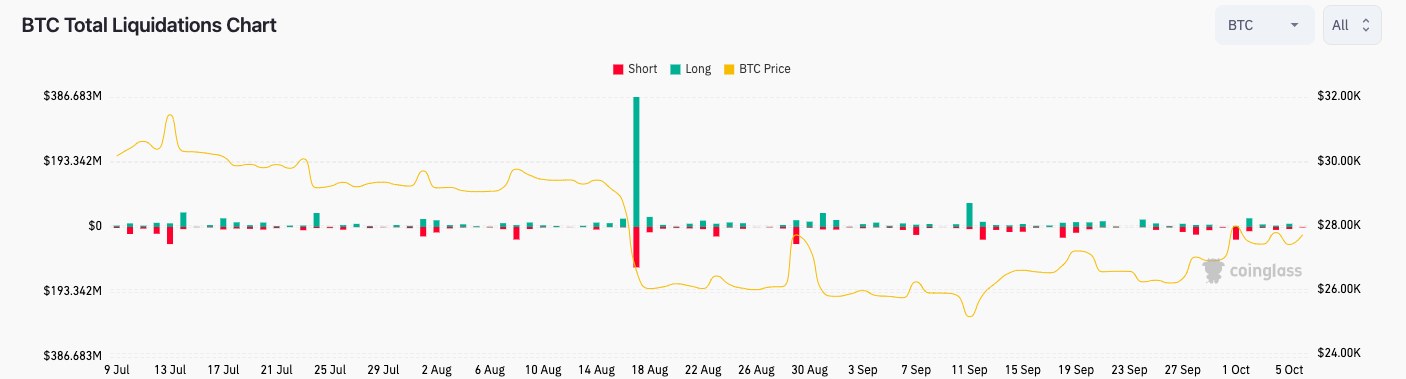

Daan Crypto Trades subsequently flagged increasing open interest (OI) across exchanges, this apt to cause a squeeze of shorts followed by longs, respectively.

“This has usually been a short squeeze (up) into long squeeze (back down). We saw this yesterday again. Good to keep an eye on this region,” he suggested.

#Bitcoin Open Interest hit the 8.7-9.1B region again where we’ve recently seen a lot of squeezes occur.

This has usually been a short squeeze (up) into long squeeze (back down).

We saw this yesterday again.

Good to keep an eye on this region. pic.twitter.com/yojcBHSGzk

— Daan Crypto Trades (@DaanCrypto) October 6, 2023

Data from montioring resource CoinGlass showed overall negligible liquidations across both long and short BTC positions through Oct. 6.

Lack of lower BTC price levels “surprise”

Monitoring resource Material Indicators meanwhile turned its attention to whale trading behavior over the course of the week.

Related: Bitcoin bull market awaits as US faces ‘bear steepener’ — Arthur Hayes

Dividing whales into volume-based cohorts, it showed different “classes” of whale making contradictory moves. Orders worth between $100,000 and $1 million — the class Material…

Click Here to Read the Full Original Article at Cointelegraph.com News…