The bears are trying to extend Bitcoin’s (BTC) record of nine consecutive red weekly candles to ten weeks, but the bulls are trying to avert this negative occurrence. Although sentiment remains negative, Arthur Hayes, former CEO of derivatives giant BitMEX, anticipates Bitcoin to bottom out in the range of $25,000 to $27,000.

On-chain data from Glassnode shows that thsmart money may have started accumulating Bitcoin. The net outflows from major cryptocurrency exchanges reached 23,286 Bitcoin on June 3, the highest since May 14.

Another positive sign of accumulation is that investment into Bitcoin exchange-traded products (ETPs) was strong in May and has only risen further in the first two days of June, according to an Arcane Research report. The ETPs hold 205,000 Bitcoin under management, which is a new record.

Could Bitcoin turn up and start a recovery? If that happens, could select altcoins follow the leader? Let’s study the charts of the top-5 cryptocurrencies that may lead the relief rally.

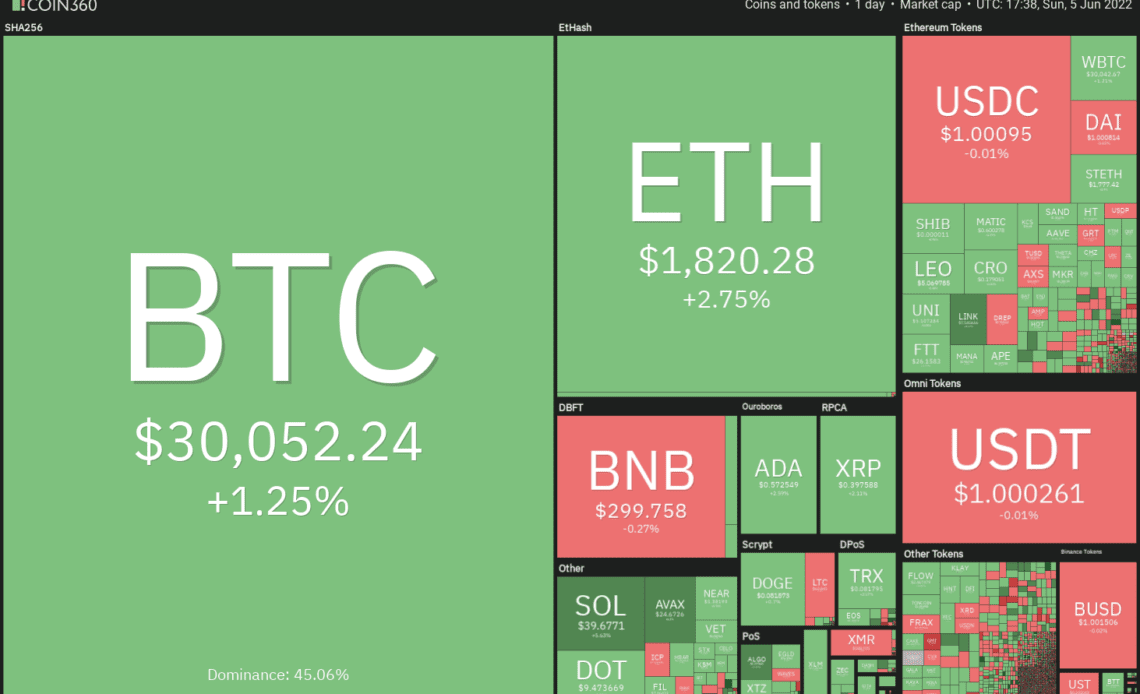

BTC/USDT

Bitcoin plunged below the 20-day exponential moving average (EMA) ($30,459) on June 1. The bulls attempted to push the price back above the 20-day EMA on June 2 and 3 but the bears did not relent.

The bears will try to pull the price below the strong support at $28,630. If they manage to do that, the BTC/USDT pair could drop to the vital support at $26,700. The buyers are expected to defend this support zone with all their might because if they fail to do that, the downtrend may resume.

On the upside, the bulls will have to push and sustain the price above $32,659 to suggest that a new uptrend could be starting. The bullish momentum could pick up on a break and close above the 50-day simple moving average (SMA) ($33,778). The pair could then rally to the pattern target of $36,688 and thereafter to $40,000.

The four-hour chart shows that the price action is getting squeezed. Although bulls pushed the price above the 20-EMA, they are facing stiff resistance at the 50-SMA. This suggests that bears are active at higher levels.

A minor positive in favor of the bulls is that they have not allowed the price to break below the support at $29,282.

If the price rises from the current level and breaks above the downtrend line, the bulls will attempt to push the pair to the 200-SMA. Conversely, if the price breaks below $29,282, the next stop…

Click Here to Read the Full Original Article at Cointelegraph.com News…