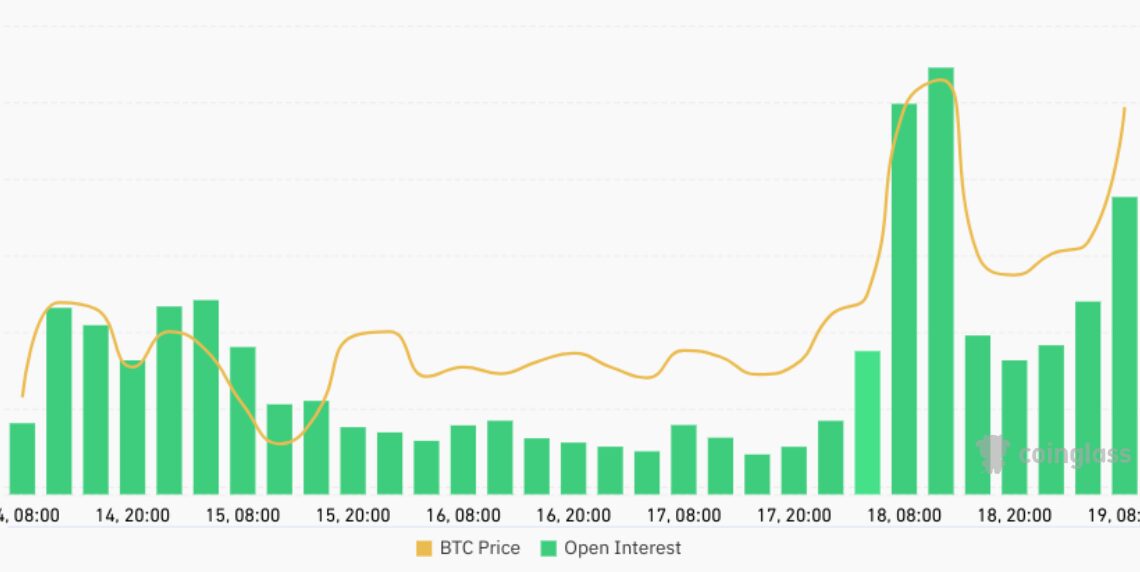

Bitcoin’s (BTC) open interest on derivatives exchanges experienced a sudden surge of $1 billion on Sep. 18, prompting investors to question whether whales were accumulating in anticipation of the unsealing of Binance’s court filings.

However, a closer look at derivatives metrics suggests a more nuanced picture, as the funding rate did not exhibit clear signs of excessive buying demand.

The decision to unseal these documents was granted to the U.S. Securities and Exchange Commission (SEC), which had accused Binance of non-cooperation despite previously agreeing to a consent order related to unregistered securities operations and other allegations.

The open interest spiked to $12.1 billion while Bitcoin’s price concurrently increased by 3.4%, the highest point in over two weeks at $27,430.

However, investors soon realized that, aside from a comment by the Binance.US auditor regarding the challenges of ensuring full collateralization, there was little concrete information revealed in the unsealed documents.

Later in the day, Federal Judge Zia Faruqui rejected the SEC’s request to inspect Binance.US’s technical infrastructure and share additional information. Nevertheless, the judge stipulated that Binance.US must furnish more details about its custody solution, casting doubt on whether Binance International ultimately controls these assets.

By the end of Sep. 18, Bitcoin’s open interest had receded to $11.3 billion as its price dropped by 2.4% to $26,770. This decline indicated that the entities behind the open interest surge were no longer inclined to maintain their positions.

These whales were likely disappointed with the court’s outcomes, or the price action may not have unfolded as expected. In any case, 80% of the open interest increase disappeared in less than 24 hours.

Futures’ buyers and sellers are matched at all times

It can be assumed that most of the demand for leverage was driven by bullish sentiment, as Bitcoin’s price climbed alongside the increase in open interest and subsequently plummeted as 80% of the contracts were closed. However, attributing cause and effect solely to Binance’s court rulings seems unwarranted for several reasons.

Firstly, no one anticipated that the unsealed documents would favor Binance or its CEO, Changpeng “CZ” Zhao, given that it was the SEC that had originally requested their release. Additionally, the Bitcoin futures contract funding rate,…

Click Here to Read the Full Original Article at Cointelegraph.com News…