Solana (SOL) investment products clocked $26 million worth of inflows since the start of 2023, outpacing all other altcoins including Ethereum, suggesting its the “most loved altcoin amongst investors” according to CoinShares.

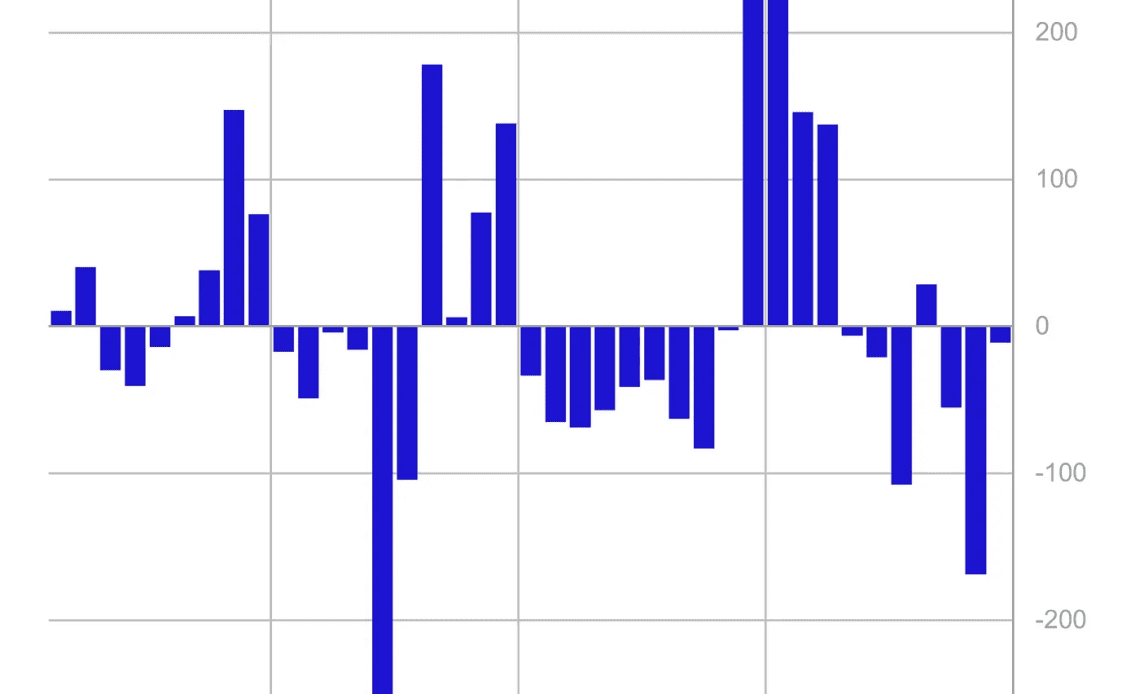

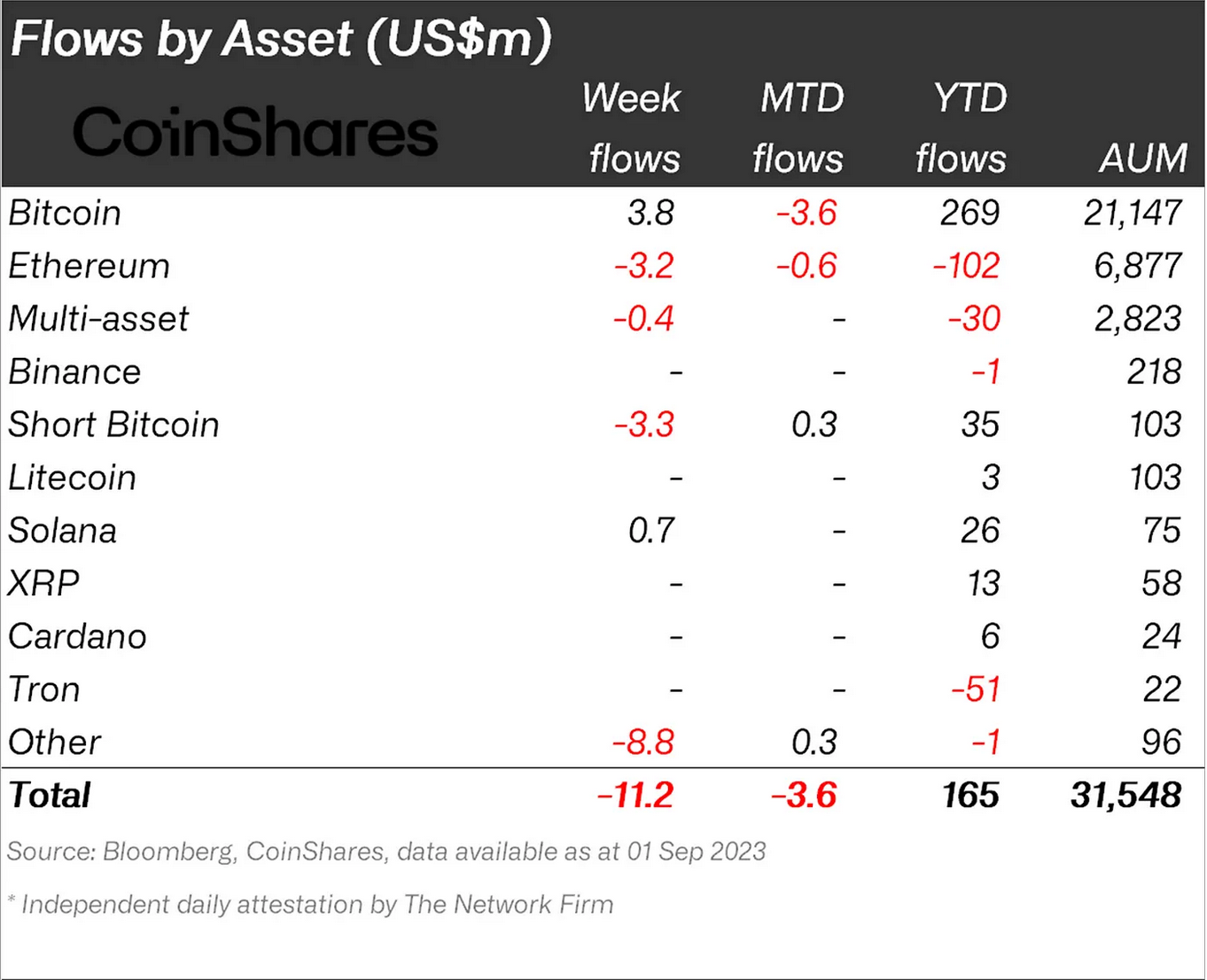

In a Sep. 4 Digital Asset Fund Flows weekly report, CoinShares’ head of research James Butterfill noted that trading volumes for crypto investment products for the week ending Sep. 1 were 90% above the year-to-date average — with crypto product outflows dropping to $11.2 million.

It marks a seven-week run of negative sentiment that’s seen $342 million leave crypto products over that time but YTD, investment products remain net inflow positive at $165 million.

The outflows haven’t affected Solana products however, which saw weekly inflows of $700,000 — the ninth straight week in a row with inflows of $14.1 million over that time and YTD inflows of $26 million.

Bitcoin (BTC) products were the only other asset to see weekly inflows, totaling $3.8 million, while Short BTC, Polygon (MATIC) and Ether (ETH) products all recorded weekly outflows.

Solana’s inflows come amid a streak of recent positive developments related to the network.

On Sep. 1, MakerDAO co-founder Rune Christensen submitted a proposal to build the project’s upcoming native chain off a fork of Solana’s codebase, despite its long-held ties to Ethereum.

On Aug. 23 it was reported that Shopify added the Solana-based payment network Solana Pay to its payment options — starting with the stablecoin USD Coin (USDC).

The Solana network has also seen some performance and reliability improvements, with only oe outage in 2023 so far.

Related: Bitcoin ETF applications: Who is filing and when the SEC may decide

SOL’s price is up around 95.5% YTD but has traded mostly sideways around $20 to $25 since mid-January. It was trading at around $19.5 as of 12 am UTC Sep. 5 according to Cointelegraph data.

However, SOL is down 92.5% from its November 2021 all-time high of nearly $260.

Magazine: BitCulture: Fine art on Solana, AI music, podcast + book reviews

Click Here to Read the Full Original Article at Cointelegraph.com News…