The Cambridge Bitcoin Electricity Consumption Index (CBECI), which tracks global Bitcoin energy consumption, has undergone its first major update since 2019, influenced by evidence pointing to frequent overestimating Bitcoin’s electricity usage.

A new report is said to shed light on the evolution of Bitcoin mining and to clarify the rationale behind the changes in CBECI’s methodology, providing an in-depth analysis of the transition of Bitcoin mining hardware – from CPUs to GPUs, then FPGAs, and finally to the current state-of-the-art ASIC miners.

Mining efficiency evolution.

The CBECI noted that the efficiency of ASICs experienced a rapid surge initially but has since seen a tapering in growth as we reach the limitations of semiconductor technology. This slowdown has direct implications on the lifespan of miners, affecting the assumed replacement cycles, with estimates ranging from 1.5 years (academia) to 3-5+ years (industry).

Its methodology has been revised to account for this increased computing power of newer models, such as the Antminer S19 XP, which boasts a 140 TH/s capacity compared to the 11.5 TH/s of the 2016 Antminer S9.

CBECI further asserted that the introduction of ASICs triggered an exponential growth in Bitcoin’s hashrate, from less than 1 EH/s in 2010 to over 300 EH/s in early 2023, revolutionizing mining from a home computer activity to a professional endeavor.

Hashrate growth.

While a higher hashrate enhances Bitcoin’s security, it also escalates mining difficulty and the computing power necessary to earn block rewards. Comprehending these drivers of hashrate growth was reportedly crucial to reevaluating the CBECI methodology.

According to the report, investigations into hashrate growth factors revealed a strong correlation between the increase in imported mining hardware to the US and the overall network hashrate growth. Additionally, sales data from Canaan Creative indicated that their latest models accounted for nearly 45% of their hashrate sales in 2021, suggesting that these more efficient models likely contribute more to hashrate growth than previously assumed by the CBECI methodology.

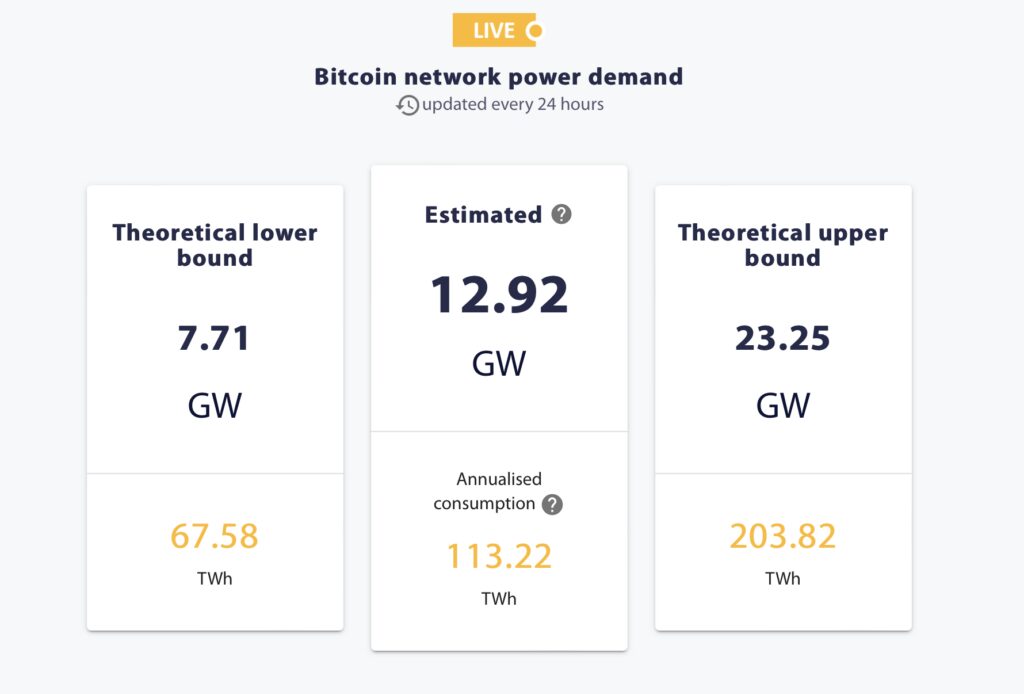

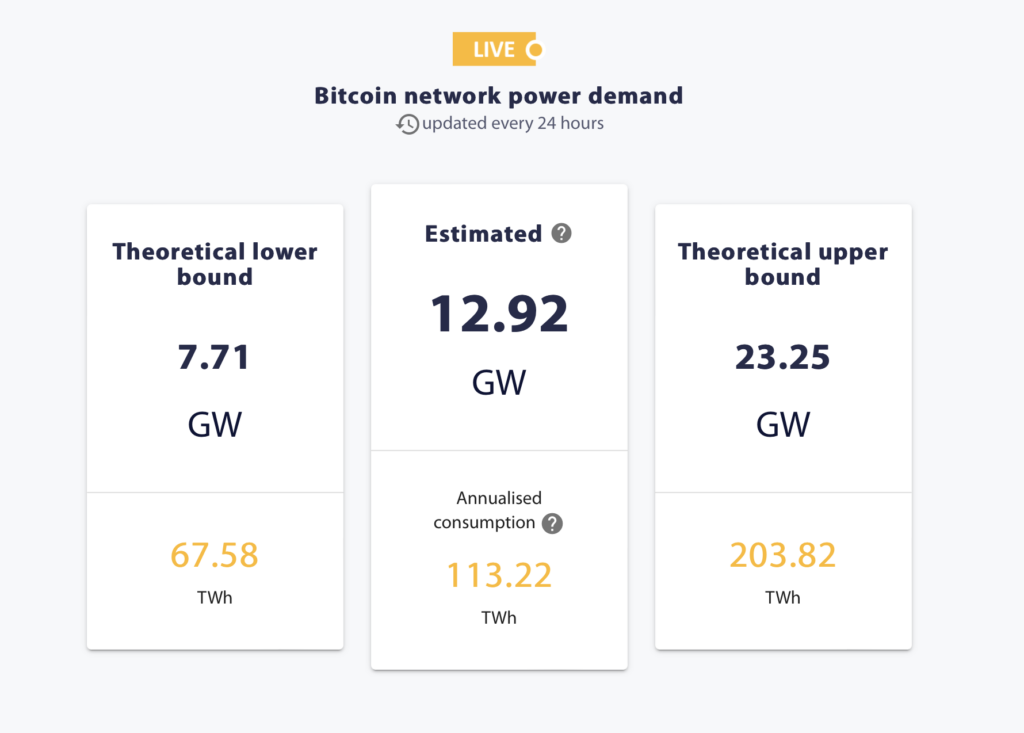

Upon applying the new CBECI methodology, the 2021 estimate was significantly reduced by 15 TWh, or 14% (from 104 TWh down to 89 TWh), and the 2022 estimate was cut by 9.8 TWh, or 9% (from 105.3 TWh down to 95.5 TWh).

These revised estimates presume higher average mining efficiency by considering the impact of newer models. Yet,…

Click Here to Read the Full Original Article at Cryptocurrency Mining News | CryptoSlate…