ARK Invest and Glassnode have released white papers describing a proposed framework for analyzing Bitcoin on-chain metrics. The new method is called Cointime Economics and introduces a new measure – the coinblock – to represent the state of the Bitcoin (BTC) network.

Cointime Economics can be used to represent Bitcoin’s economic state in place of outstanding supply. The use of the new system may improve valuation metrics and provide a new analytical tool to measure Bitcoin activity, according to authors David Puell of ARK Invest and James Check of Glassnode. They said:

“The importance of a single bitcoin should vary based on the last time it moved. Upon its transfer, for example, the information value of a bitcoin that had been unmoved for 10 years is more important than one that had been unmoved for 1 week.”

The reasoning behind this supposition is found in a footnote:

“Coins held for a prolonged period of time suggest ownership by the market cohort with the longest time investment horizon and the most profitable cost basis. They therefore display the market behavior of the largest capitalized and historically most savvy market participants in Bitcoin’s history.”

Thus, when long-dormant Bitcoins are moved, it is likely to be the action of hodlers and whales, and so more significant than actions with more newly mined Bitcoin. Lost Bitcoins do not count at all.

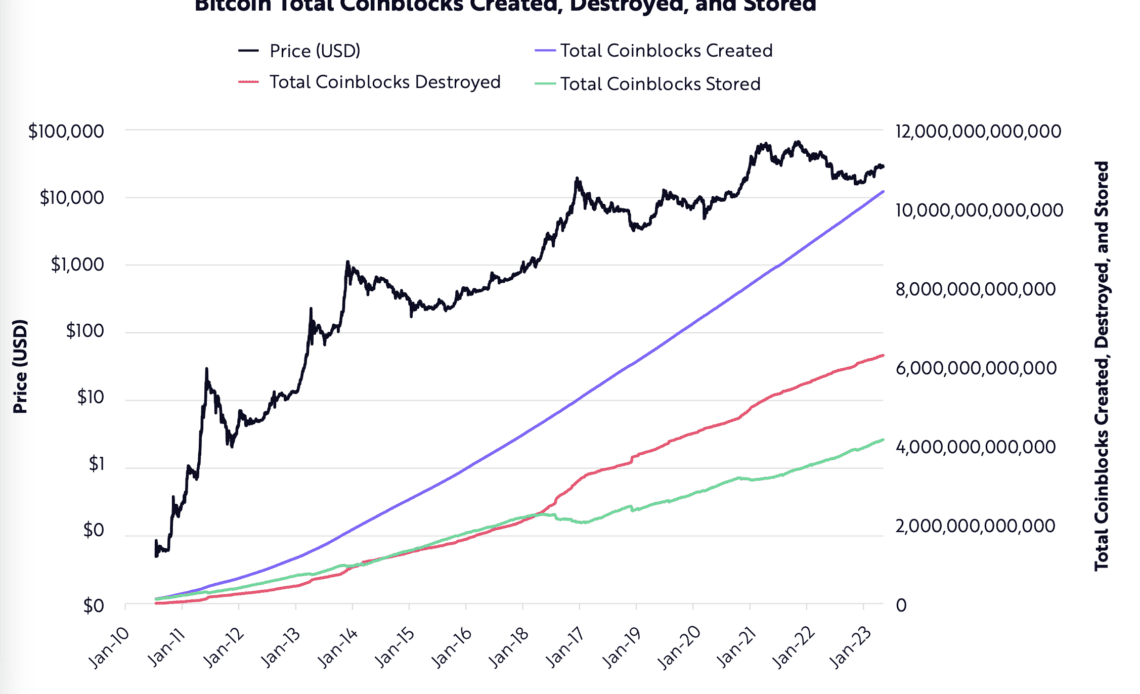

A coinblock is the basic unit used for calculation. It is determined by multiplying the number of Bitcoin by the number of blocks (the basic unit of mining) produced while the Bitcoin do not move. “Because the Bitcoin network produces a block every 10 minutes on average, one coin generates approximately 144 coinblocks per day: 6 blocks produced per hour multiplied by 24 hours,” the authors write.

Coinblocks are “destroyed” in line with the length of time the Bitcoin was held: “If two bitcoins had not moved in seven blocks and then transacted, for example, 14 coinblocks would have been destroyed.” Bitcoin that had been held longer thus produce a larger number of coinblocks destroyed, pointing to higher activity by hodlers. Coinblocks destroyed is a variation of coindays destroyed, a metric that Glassnode already employs.

In comparison, the traditional Unspent Transaction Output (UTXO) model, which is essential to many settlement systems, gives all Bitcoin equal weight. Because of this difference, the overall amount…

Click Here to Read the Full Original Article at Cointelegraph.com News…