In July, Bitcoin (BTC) mining stocks continued their positive run in 2023 with the top ten stocks by market cap gaining 23.10% over the month on average, with an year-to-date return of 277.34%.

In comparison, BTC price has lost 3.59% in July as it failed to build support above $30,000 for the sixth week since June 2023. Despite a difficult July, BTC price is still up 78.88% in 2023.

The decline in Bitcoin’s price reduced the profitability of miners. To make conditions more challenging for miners, the mining difficulty reached a new all-time high, reducing miner profitability.

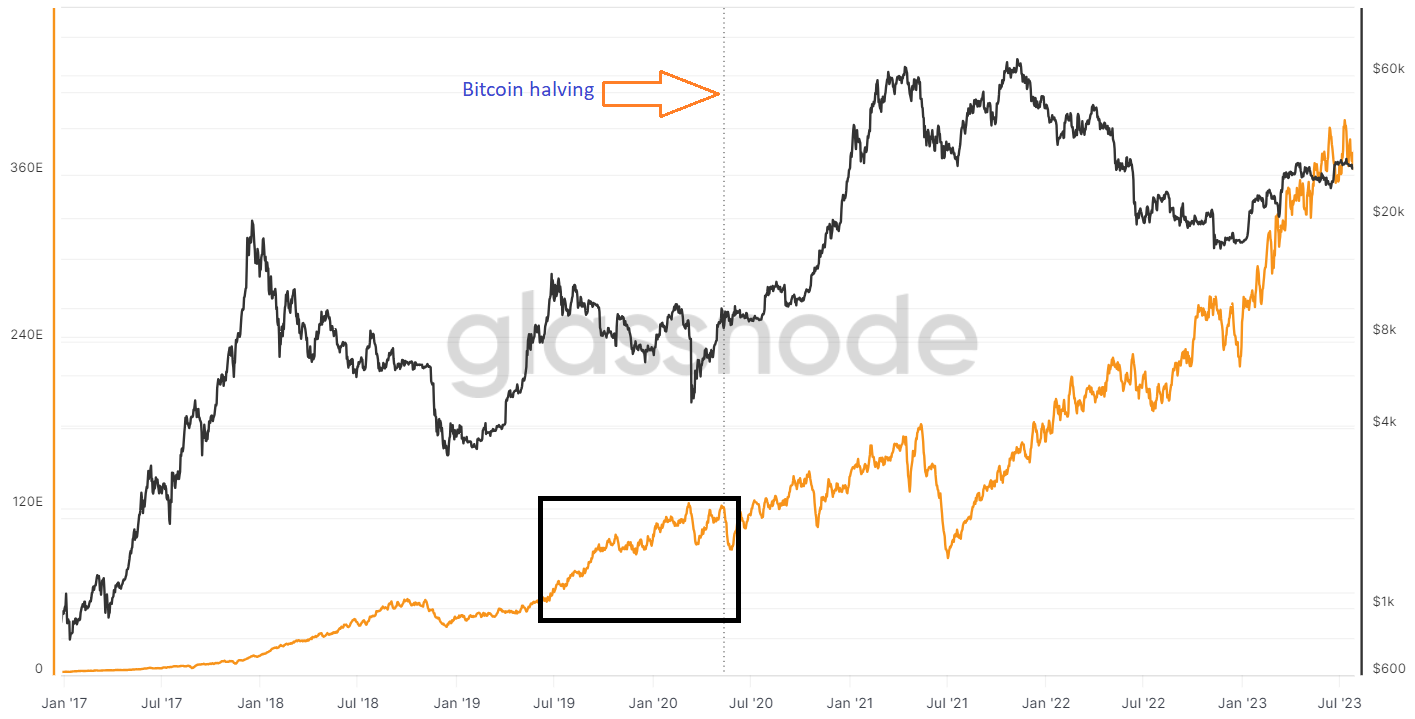

Historical trends show that the network’s hashrate could continue to rise leading up to the halving on April 26, 2024 as miners increase their hash power by installing new efficient machines.

Besides adding to their processing power, miners are also adopting other hedging techniques like selling Bitcoin futures to lock in current prices.

As the network’s hashrate is expected to increase through the year as miners reinvest in new machines and adopt other hedging techniques, miner profitability and stock valuations will continue to face pressure in the lead-up to the event.

Bitcoin hashrate projected to grow until halving

While BTC price has increased by around 80% year-to-date, the mining difficulty also increased by 51%, offsetting the rise in profitability due to price surge.

In mid-July, Bitcoin’s difficulty set a new all-time high of 53.91 trillion units. The increase in difficulty triggered a capitulation event in the sector, which was already reeling under pressure at the start of the month.

Bitcoin’s Hashprice index, a metric used to quantify the average daily miner earnings from 1 TH/s across the industry, dropped from $78.30 per TH/s on July 1 to $72 per TH/s by the end of July, per Hashrate Index data.

The network’s hashrate deflated in the second half of July, resulting in a 2% decline in its difficulty in the adjustment on July 26.

The adjustment will likely ease the pressure on miners, but only slightly. The total hashrate is still ranging above last month’s lows after rising consistently since the start of 2023.

Moreover, historical trends suggest that miners will likely continue adding to their fleet, which could cramp profitability further.

Before the previous halving Bitcoin’s…

Click Here to Read the Full Original Article at Cointelegraph.com News…