On July 24, Bitcoin (BTC) experienced a flash crash, plummeting to $29,000 in a movement now attributed to significant BTC holders potentially liquidating their positions.

Amidst the crash and market uncertainty, Bitcoin’s three major trading metrics continue to project a bullish outlook, signifying that professional traders have not reduced their leverage longs through the use of margin and derivatives.

Analytics firm Glassnode reported a surge in whales’ inflow to exchanges, reaching its highest level in over three years at 41% of the total. This forceful sell-off from whales alarmed investors, especially in light of the absence of any significant negative events impacting Bitcoin in the past month.

Notably, a major concern stems from the ongoing court cases by the U.S. Securities and Exchange Commission (SEC) against leading exchanges, Binance and Coinbase. Still, there hasn’t been any major advancement on those cases, which will likely take years to settle.

Bitcoin’s price crash might have been related to the U.S. dollar reversion

Despite historical volatility, Bitcoin’s crash became more pronounced following 33 consecutive days of trading within a tight 5.7% daily range. The movement is further accentuated by the S&P 500 gaining 0.4%, crude oil rising by 2.4%, and the MSCI China stock market index surging by 2.2%.

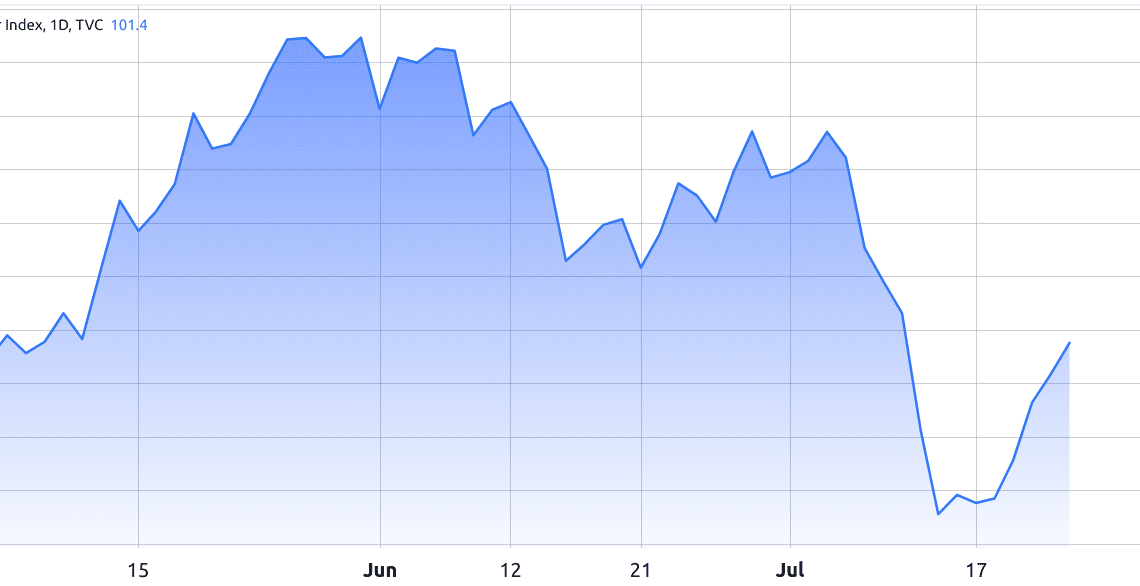

However, it is essential to consider that the world’s largest global reserve asset, gold, experienced a dip of 0.5% on July 24. Furthermore, the dollar strength index (DXY) reversed its two-month-long trend of devaluation against competing fiat currencies, climbing from 99.7 to 101.4 between July 18 and July 24.

The DXY index measures the strength of the U.S. dollar against a basket of foreign currencies, including the U.K. Pound, Euro, Japanese Yen, Swiss Franc and others. If investors believe that the U.S. Fed will manage a soft landing successfully, it makes sense to reduce exposure to gold and Bitcoin while increasing positions in the stock market. Lower odds of a recession can positively impact corporate earnings.

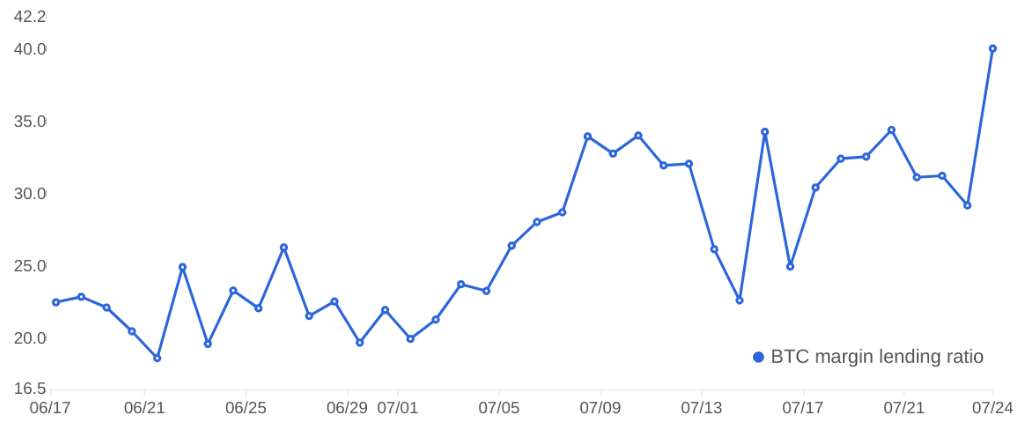

Margin and derivatives markets show resolute professional traders

To understand whether Bitcoin’s price move down to $29,000 has successfully ruptured the market structure, one should analyze margin and derivatives markets. Margin trading allows investors to leverage their positions by borrowing stablecoins and using the proceeds to buy more cryptocurrency.

Click Here to Read the Full Original Article at Cointelegraph.com News…