The market capitalization of stablecoins has hit the lowest level since August 2021 coming on the back of 16 consecutive months of decline, a new report says.

Cryptocurrency analytics platform CCData released a report on July 20 saying the stablecoin market cap fell 0.82% from the start of the month until July 17, taking the sector’s market cap to $127 billion.

Stablecoin market dominance took a slight fall and is currently at 10.3%, dropping from 10.5% in June.

Our latest Stablecoins & CBDCs Report is now live!

Key Highlights:

✔️16-month fall in stablecoin market cap, now at $127bn

✔️ $USDT at $0.73, $USDC at $0.82 on #Binance.US

✔️ $USDP‘s largest cap drop since 2020, now at $593mnFull Report https://t.co/A9rFx6pbJx

— CCData (@CCData_io) July 20, 2023

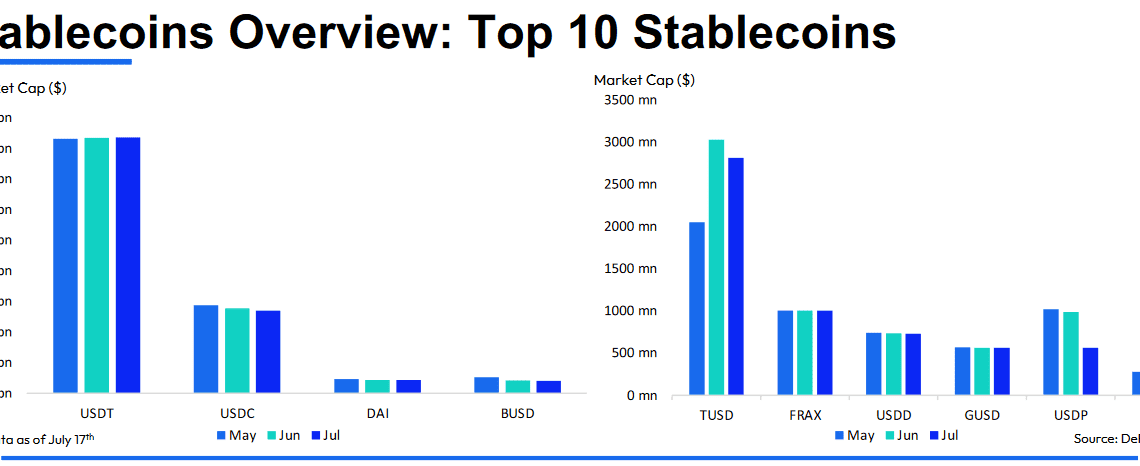

Of the top ten stablecoins, Pax Dollar (USDP) was hit hardest, falling 43.1% to $563 million in July — its lowest figure since December 2020.

CCData believes the fall was largely attributed to MakerDAO — a decentralized autonomous organization behind the Maker protocol — which elected to remove $500 million of USDP from its reserves because it failed to accrue additional revenue.

Tether (USDT), the largest stablecoin by market cap, managed to record its all-time high market cap of $83.8 billion as of July 17, increasing its stablecoin market cap dominance to 65.9%.

The market cap of USD Coin (USDC) and Binance USD (BUSD) fell 3.01% and 4.57% to $26.9 billion and $3.96 billion, respectively. For USDC, it is the seventh consecutive month of decline in its market cap and the lowest since June 2021.

Despite consecutive falls, stablecoin trading volumes increased 16.6% to about $483 billion in June, recording the first monthly increase since March.

CCData believes the lawsuits against Binance and Coinbase from the Securities and Exchange Commission (SEC) and the surge in spot Bitcoin (BTC) exchange-traded fund filings contributed to the increase in stablecoin trading volumes last month.

Related: Aave Protocol launches stablecoin GHO on Ethereum mainnet, $2M minted

Another major event in June was the suspension of fiat deposits on Binance.US due to the SEC’s lawsuit against the firm. CCData said this led USDT and USDC to depeg from the U.S. dollar on the exchange.

“The suspension of fiat deposits has led to a drastic decline in the liquidity of the [USDT and USDC]…

Click Here to Read the Full Original Article at Cointelegraph.com News…